160 Billion Reasons To Buy Square

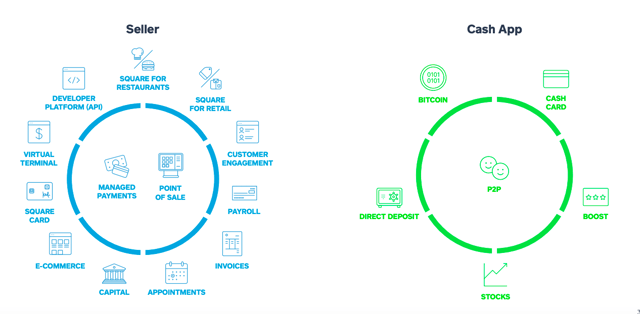

Square (SQ) has a remarkably smart business model. The company provides the hardware at low prices, and this is a customer acquisition tool that allows Square to expand into far more profitable businesses such as software and services. In addition to this, the company is building new growth engines with credit services and its digital wallet Cash App.

With an estimated addressable market worth $160 billion and growing, the company is well-positioned for sustained expansion in the years ahead. Macroeconomic risk is a key factor to consider. However, at current prices, Square is offering abundant upside potential for long-term investors.

An Outstanding Growth Business

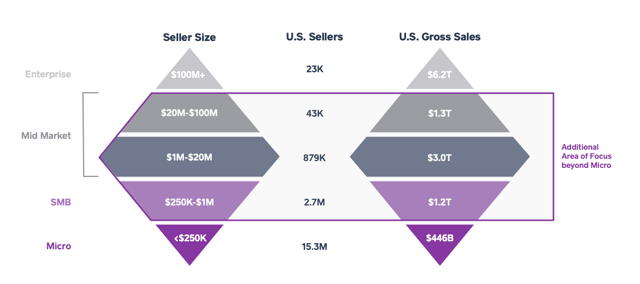

Square started by providing access to debit cards, credit cards, and digital payments to small businesses and micro-merchants. The company provides the hardware at aggressively low prices, and then it makes big profit margins on payments processing.

Even better, Square is leveraging on the opportunity to provide all kinds of software and services to an underserviced customer base. The software segment tends to be very sticky, generating recurrent revenue and attractive profit margins for Square.

In addition to this, Square is expanding into credit services, and it has an enormously valuable source of competitive advantage in this market due to its access to all kinds of sales and inventory data from small merchants, which allows it make better decisions regarding credit risk and to provide a superior customer experience in comparison to other sources of credit such as banks.

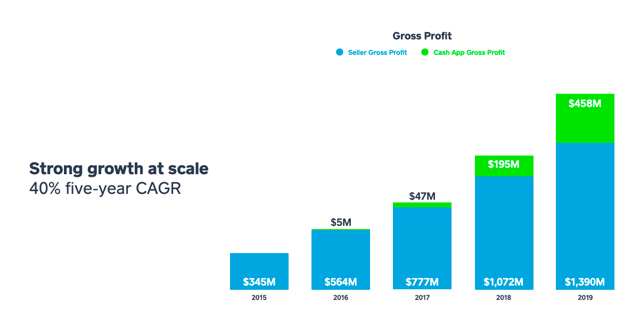

The Cash App digital wallet is also growing at full speed and with enormous potential going forward. Cash App gross profit grew 115% year over year last quarter, and the company is expanding into new functionalities such as investing in fractional shares of stocks and Bitcoin trading.

Source: Square

Based on management estimates, Square has only penetrated less than 3% of its market opportunity in the seller segment and less than 2% of the market opportunity in Cash App. The company calculates that the total addressable market could be worth as much as $160 billion and with multiple growth avenues for the two segments combined.

Source: Square

Corporate management is always an interested party in these discussions, so the size of the addressable market as estimated by management should always be taken with a big grain of salt. Nevertheless, it is easy to see that Square has enormous room for further growth in the years ahead.

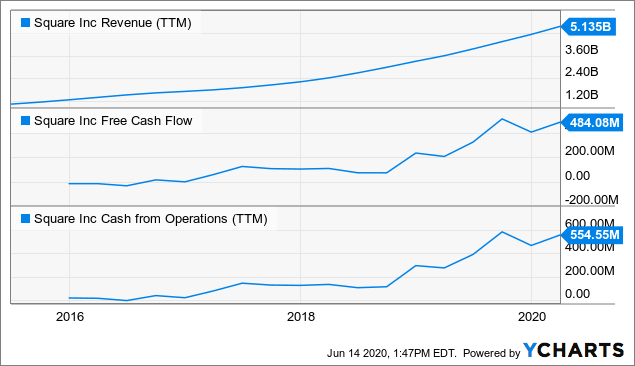

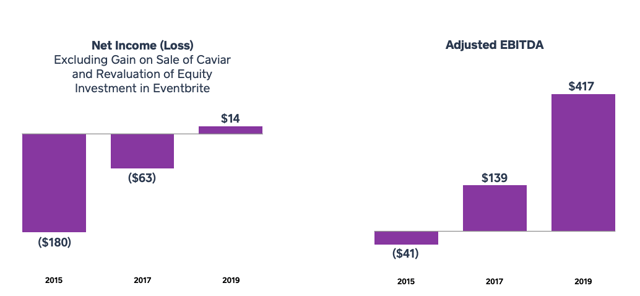

Square has delivered outstanding revenue growth over the years. Due to heavy investments for growth, the company has thin profitability on a GAAP basis, but it generates positive cash flows both at the operating level and at the free cash flow level.

Data by YCharts

Importantly, profit margins have been moving in the right direction over time, and the business model should allow for huge margins at the core business level. Payments processing, software, and digital wallets tend to have relatively fixed costs in comparison to revenue. For this reason, margins tend to expand as revenue grows over the years.

Source: Square

Source: Square

Moving forward, sustained revenue growth in combination with a larger share of revenue being retained as earnings should provide a double boost to earnings growth in the years ahead.

Valuation And Timing

Square's stock is currently trading at a price to sales ratio around 7.3 times revenue estimates for the current year. This valuation is more than reasonable when considering the company's long-term growth opportunities.

For comparison purposes, the table below shows some key growth and valuation metrics for Square versus PayPal (PYPL), Mastercard (MA) and Visa (V). There are many differences to consider, and the comparison is not completely straightforward.

PayPal, Mastercard, and Visa are bigger and more established than Square, and they also have much larger profit margins. This could justify a higher valuation for these companies in comparison to Square. On the other hand, Square is far superior to the other names in terms of current growth and future growth potential, which would arguably merit a higher price tag for Square.

In any case, it is fair to say that Square's stock is very reasonably priced by industry standards.

| SQ | PYPL | MA | V | |

| Market Capitalization | 38,050 | 182,120 | 298,981 | 410,283 |

| Sales Growth 5Y | 40.85% | 17.24% | 12.33% | 12.59% |

| Sales Growth TTM | 43.09% | 14.90% | 11.43% | 10.20% |

| Sales Growth Projected | 25.19% | 17.08% | 20.13% | 10.36% |

| Enterprise Value to Sales | 7.34 | 9.89 | 17.66 | 17.52 |

Data from S&P Global via Portfolio123

On a forward-looking basis, the table below shows revenue estimates, expected growth rates, and the implied price to sales ratio for Square in the years ahead. Valuation levels in relationship to growth expectations are not excessive at all.

| Fiscal Period Ending | Revenue Estimate | YoY Growth | FWD Price/Sales |

| Dec 2020 | 5.21B | 129.02% | 7.31 |

| Dec 2021 | 6.52B | 25.19% | 5.84 |

| Dec 2022 | 8.35B | 27.98% | 4.56 |

| Dec 2023 | 10.11B | 21.10% | 3.77 |

| Dec 2024 | 13.71B | 35.64% | 2.78 |

Source: Seeking Alpha

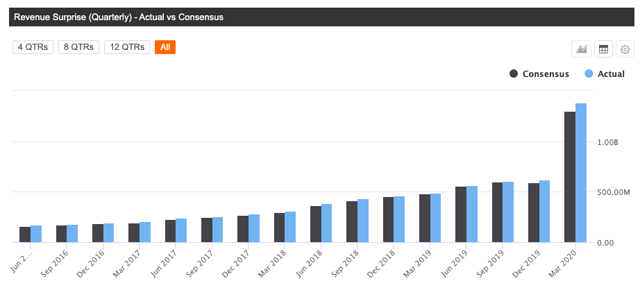

Even better, Square has consistently delivered revenue growth rates above Wall Street expectations in each of the past 12 quarters. If the company continues outperforming expectations in the future, such as it has done in the past, the stock would be even more undervalued than what current estimates are implying.

Source: Seeking Alpha

Management has proven its ability to consistently execute and to build new growth drivers for the business by expanding its ecosystem. Optionality should provide plenty of opportunities for Square to continue outperforming expectations as long as management keeps leading the company on the right track.

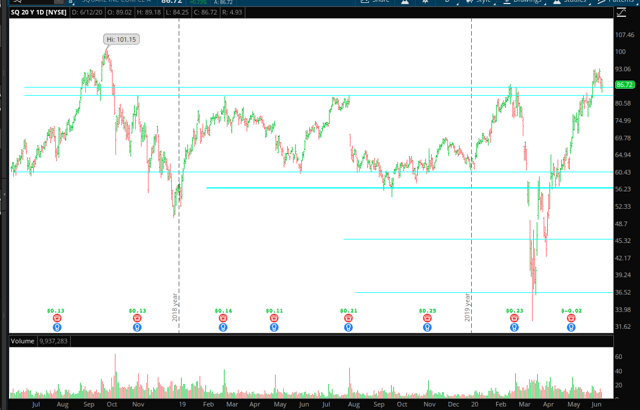

Square's stock has appreciated significantly from the March lows, but from a long-term perspective, the stock is still trading at levels it reached in August of 2018. This long sideways consolidation has allowed the company's growth rates to grow into its valuation, and now Square looks fairly reasonably priced in comparison to the company's growth prospects.

Source: TOS

When considering the risks, it is important to note that Square has big exposure to small businesses and restaurants in particular, and this is a particularly relevant uncertainty driver in the current environment.

Economic uncertainty can also provide the proverbial wall of worry for the stock to climb higher as the economy goes back to something more similar to normal in the coming months, but it is still a major uncertainty cloud weighting on the stock in the near term.

The sector is also very competitive, and Square will face growing competitive pressure from both financial services companies and technology players in the future. The company has solid competitive advantages, and the market opportunity is big enough for different competitors to do well over time. But investors in Square still need to keep a close eye on the competitive landscape going forward.

Those risk factors being acknowledged, Square is a high growth business with enormous potential for further expansion. At these prices, the stock is well-positioned for attractive returns over the long term.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more