Buy Intuit Inc.: Strong Reversal Last Quarter

Overall, corporate growth fell as reported by second quarter 2020 financial statements submissions and extending a declining trend that began in the last quarter of 2018. The gross profit margin has dropped for the fourth consecutive quarter both on average and more frequently. This is a highly correlated factor that has been a reliable predictor of the direction of share prices. With shares now broadly extended and with the indexes at all-time highs its Sell Sell Sell.

Corporate sales growth fell to 6% for the annual period ended with the second quarter of 2020 while the frequency of improvement fell to 41% (down from 50% in the prior period). Average sales growth was up only in the technology sector. The industrial and energy improvement in the first quarter evaporated in the most recent numbers suggesting that recovery is not imminent.

Here’s where Harlan Korenvaes invests his charitable dollars

Like many hedge fund managers, Harlan Korenvaes of HBK Capital Management donates quite a bit of money to charity every year through his own foundation. We can get an idea of his favorite hedge funds by looking at where the Harlan and Amy Korenvaes Family Foundation invests its money. The 2019 filing isn't available yet Read More

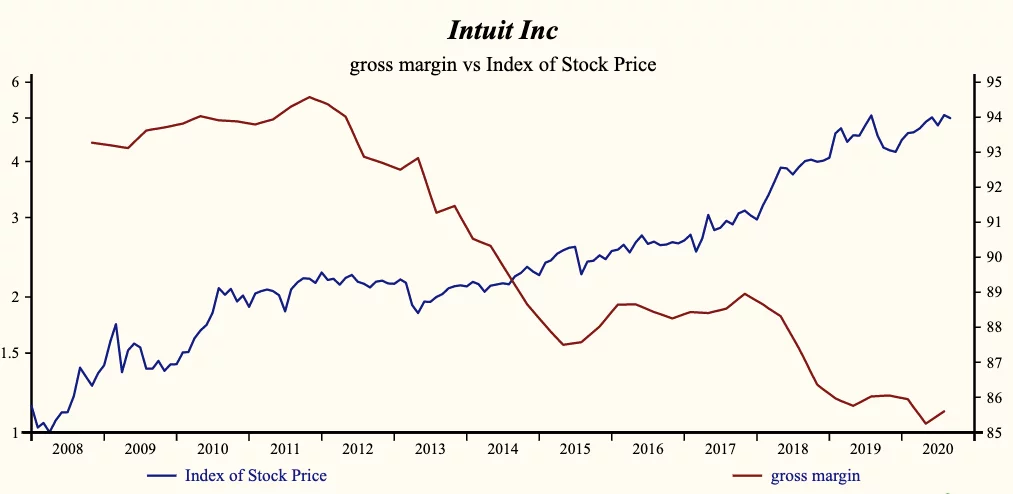

With the recent strong rebound in share prices, the broad market index price is now extended and still in a downtrend. The bottom of that downtrend historically has been marked by an improvement in the gross profit margin and, so far, that is not apparent. The gross profit margin is still unusually high and falling on average and more frequently.

Sell your falling growth companies with shares trading at premium prices and only buy Winners! or stocks of companies with exceptional attributes. Maintain a defensive cash position (20% to 30%) and take advantage of the higher share price volatility ahead.

Intuit Inc. (Nasdaq: INTU) has reversed course and is now exhibiting a fundamental buy pattern.

How to Spot a Winner!

A quality buy pattern requires:

- Low & flat to rising gross margin

- High & flat to falling SG&A and interest costs

- Higher sales growth

- Falling inventories & receivables

- Depressed share price

- Depressed valuation

Intuit Inc (INTU) $333.110 BUY this rich company getting better

Intuit Inc. (Nasdaq: INTU) has been an exceptionally profitable company with persistently high cash return on total capital of 29.9% on average over the past 21 years. Over the long term the shares of INTU have advanced by 425% relative to the broad market index.

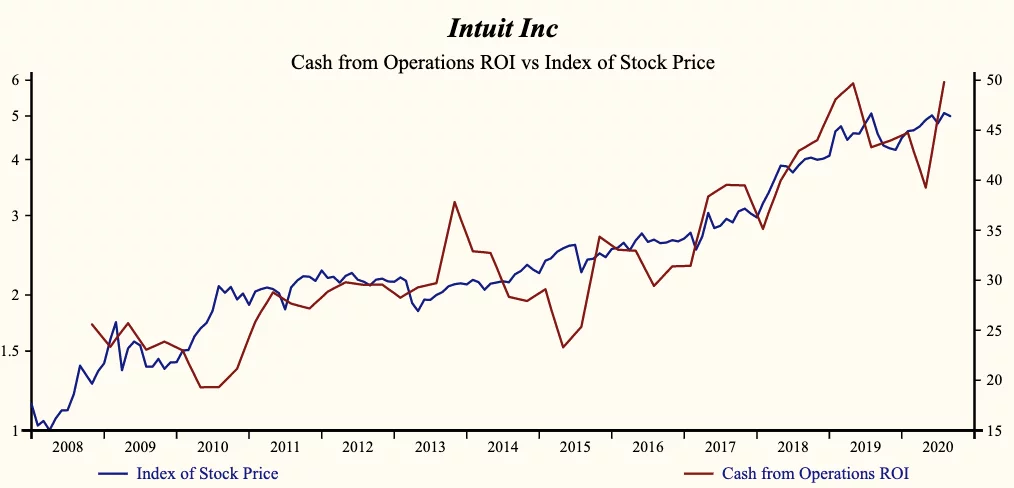

The shares have been very highly correlated with trends in Growth Factors. A dominant factor in the Growth group is Cash Flow from Operations which has been 90% correlated with the share price.

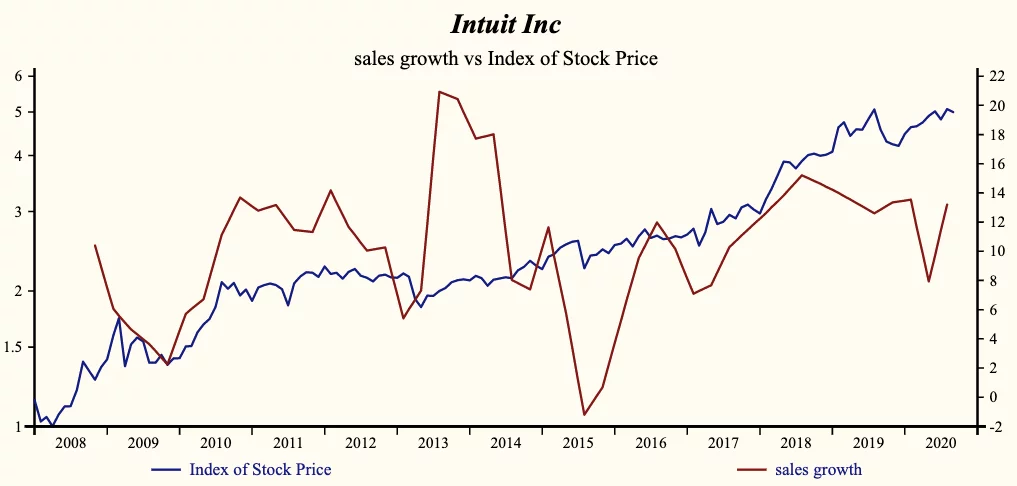

Currently, sales growth is 13.2% which is higher than the long-term growth record and higher than last quarter. Receivable turnover has remained stable which improves the quality of recorded sales. Higher sales growth has been correlated with the share price with a two-quarter lead.

After trending downwards since 2011 the company is recording a low but finally rising gross profit margin. Costs have been falling steadily for the past 2 years as seen by continuous reductions in SG&A Expenses. This reversal is significant since reducing cost has been key in supporting the bottom line. SG&A expenses reductions are not limitless however INTU managed further cost containment last quarter. The reversal on profit margins made an immediate impact with a sudden jump last quarter in the EBITDA growth rate relative to sales. Interest costs increased slightly but relative to sales remains around the lowest point in the record of the company. This continuous reduction in costs has also been supporting cash flow and EBITDA growth and ultimately Free Cash Flow growth which are all up last quarter.

Intuit Refunded

The current indicated annual dividend produces a yield of 0.6%. Five-year average dividend growth is 17.3%. The current trailing operating cash-flow coverage of the dividend is 4.7 times. More recently, the shares of INTU have advanced by 156% since the May 2013 low. The shares are trading at the upper-end of the volatility range in an 88-month rising relative share price trend.

Despite the recently extended share price, the broad improvement in fundamentals forces a reversal of Otos May 2020 sell decision.

Imagine the stock market as a large greenhouse. Each stock is a plant in a pot. At the front of the greenhouse is a small group of very tall plants with large green globes and all in full bloom. These plants look healthy and sit in solid golden pots. Those are the pick of the crop!

Pierre Raymond is a 25-year veteran of the Financial Services industry. Driven by his passion for financial technology he has transitioned from being a quantitative stock picker to an award-winning hedge fund manager, credit risk manager to currently a multipurpose risk IT banking consultant. Pierre is the co-founder of Global Equity Analytics & Research Services LLC (GEARS) and a current partner at OTOS Wealth Systems Inc.