S&P/Case-Shiller Home Price Index: January

With today's release of the January S&P/Case-Shiller Home Price Index, we learned that seasonally adjusted home prices for the benchmark 20-city index were up 0.31% month over month which is cut to -0.04% with inflation adjustment.

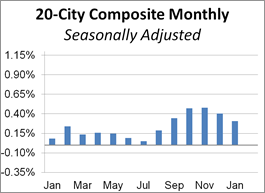

The adjacent column chart illustrates the month-over-month change in the seasonally adjusted 20-city index, which tends to be the most closely watched of the Case-Shiller series. It was up 0.31% from the previous month. The nonseasonally adjusted index was up 3.1% year-over-year.

Investing.com had forecast a 0.4% MoM seasonally adjusted increase and 3.2% YoY nonseasonally adjusted for the 20-city series.

Here is an excerpt from the analysis in today's Standard & Poor's press release.

"The trend of stable growth established in 2019 continued into the first month of the new year,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index rose by 3.9% in January 2020, and the 10- and 20-City Composites also advanced (by 2.6% and 3.1% respectively). Results for the month were broad-based, with gains in every city in our 20-City Composite; 14 of the 20 cities saw accelerating prices. As has been the case since mid-2019, after a long period of decelerating price increases, the National, 10-City, and 20-City Composites all rose at a faster rate in January than they had done in December."

"At a regional level, Phoenix retains the top spot for the eighth consecutive month, with a gain of 6.9% for January. Seattle, Tampa, and San Diego all rose by 5.1%. Housing prices were particularly strong in the West and South, and comparatively weak in the Midwest and Northeast."

"It is important to bear in mind that today’s report covers real estate transactions closed during the month of January. The COVID-19 pandemic did not begin to take hold in the U.S. until late February, and thus whatever impact it will have on housing prices is not reflected in today’s data." [Link to download]

The chart below is an overlay of the Case-Shiller 10- and 20-City Composite Indexes along with the national index since 1987, the first year that the 10-City Composite was tracked. Note that the 20-City, which is probably the most closely watched of the three, dates from 2000. We've used the seasonally adjusted data for this illustration.

The next chart shows the year-over-year Case-Shiller series, again using the seasonally adjusted data.

Here is the same year-over-year overlay adjusted for inflation with the Consumer Price Index owners' equivalent rent of residences.

For a long-term perspective on home prices, here is a look at the seasonally and inflation-adjusted Case-Shiller price index from 1953, the first year that monthly data is available. Because the CPI owners' equivalent rent of residences didn't start until 1983, we've used the broader seasonally adjusted Consumer Price Index.

To get an even better idea of the trend in housing prices over long time periods, we compare the change in the seasonally-adjusted Case-Shiller Home Price Index and the Consumer Price Index since 1953.