S&P 500 Hits Intraday Record Ahead Of Fed Decision

Stocks are mostly lower at midday, as investors digest Big Tech earnings and the Federal Reserve wraps up its two-day policy meeting, with comments from Fed Chair Jerome Powell scheduled for 2:30 p.m. The central bank is not expected to make major moves -- rather, it is more likely to back up its current stance on inflation. At last check, the Dow Jones Industrial Average (DJI) is off around 122 points. The S&P 500 Index (SPX) is only marginally higher, after earlier hitting an intraday high, while the Nasdaq Composite (IXIC) is in the red. Looking ahead, U.S. President Joe Biden will give an update on his $1.8 trillion families and children plan later today.

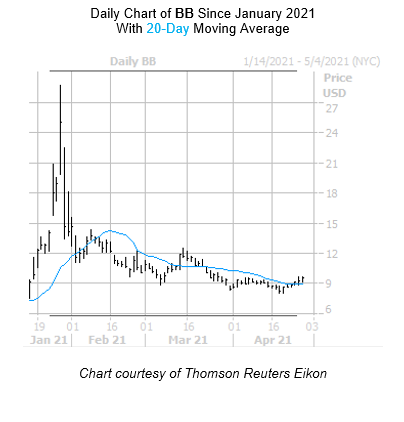

One stock seeing an unusual amount of call activity today is BlackBerry Ltd (NYSE: BB) after the company announced steps to strengthen its management team in an effort to increase focus on cybersecurity and IoT (Internet of Things) growth. So far, 47,000 calls have exchanged hands, which is nearly double the intraday average, and more than six times the number of puts traded. Most popular are the weekly 4/30 9.50- and 10-strike calls, meaning options traders are speculating on plenty of upside for BB by the time these options expire on Friday. The equity was last up 2.2% to trade at $9.49, with newfound support at the 20-day moving average. Though that is a far cry from its Jan. 27, 10-year high of $28.77, BlackBerry stock is up 41.6% year-to-date.

Hovering near the top of the Nasdaq today is Microvision, Inc. (Nasdaq: MVIS). Reddit's newest target was last seen up 22.2% at $24.63, after announcing it completed its long-range Lidar Sensor A-Sample hardware and development platform. The security yesterday notched another record high of $28, though it did end up closing just below the $25 level. Longer term, MVIS is up a jaw-dropping 9,717.3% year-over-year.

Meanwhile, sinking towards the bottom of the Nasdaq is BioVie Inc (Nasdaq: BIVI), last seen down 17.9% at $17.65, after the company acquired assets from Neurmedix, agreeing to pay 8.4 million newly issued shares, as well as roughly $3 million in cash. After notching two consecutive closes above the 200-day moving average, BIVI is trading below the trendline again. Year-over-year, though, it remains up 364.1%.