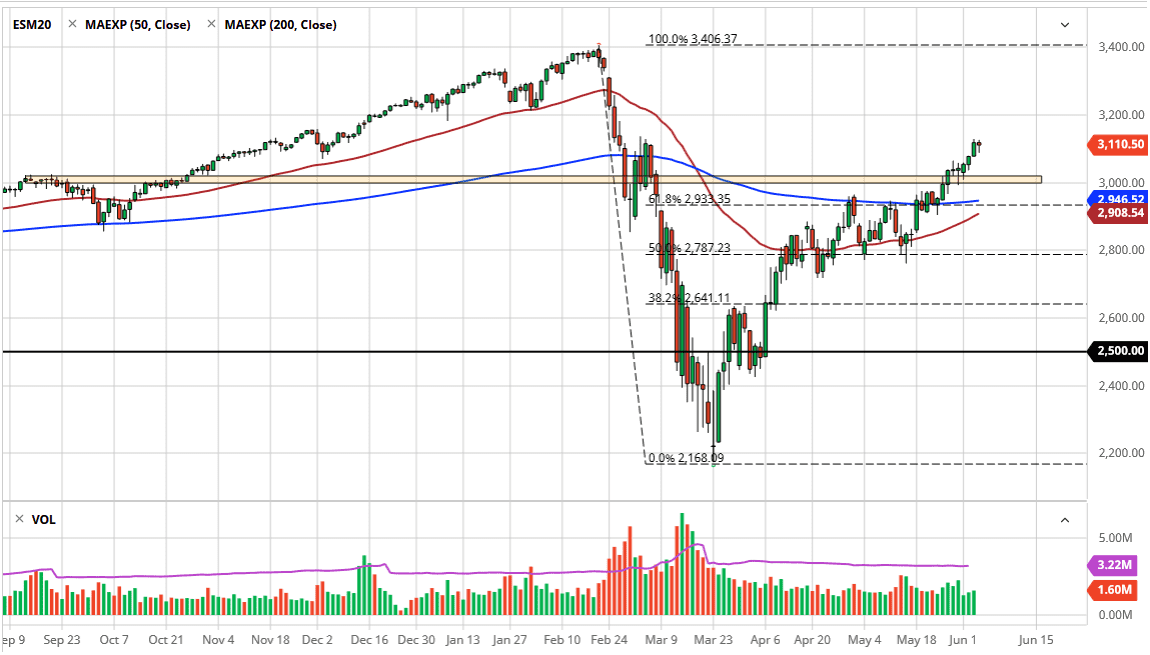

S&P 500 Forecast: Knocking On The Door Of Major Breakout

The S&P 500 has initially pulled back during the trading session on Thursday, but at the end of the bell we saw the Plunge Protection Team come out and push the markets back to the upside. That being said, it looks like the market is trying to break above the resistance that sits just above this candlestick, and I suspect that the Non-Farm Payrolls figures coming out during the day on Friday is probably one of the main reasons why this has happened. After all, nobody wanted to be short of the market going into that, but at the same time most people probably do not want to be too heavily invested.

I anticipate that the number will come out horrifically bad, because some type of knee-jerk reaction, followed by the FOMO traders getting in and picking up the S&P 500 at lower levels. The 3000 level underneath is obvious psychological support, and I think once we break over the last couple of days, the market probably goes looking towards the 3200 level. Eventually, the S&P 500 will probably go looking towards the top that we had recently made before the meltdown. The biggest problem of course is that these are not normal acting markets, and I think this type of volatility is going to be a simple function of how markets behave going forward. We will have grinding markets to the upside, and then explosive breakdowns. That is the nature of having a market that has far too much leverage in it.

In the short term, if we do break down below the 200 day EMA, then it is likely that the market goes down to the 2800 level. The 2800 level has been supportive in the past, and quite frankly even though I can give you a million reasons, or maybe even better yet, 40 million reasons (jobs lost in the United States) as to why this market should be falling, the reality is that the FOMO traders are completely in control. This normally ends poorly, but you cannot fight it, because quite frankly price is price. I believe this is a market that will continue to cause headaches for a lot of people, but really at this point you need to suspend disbelief and simply look at it as a potential buying opportunity every time it drops a bit.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more