Single Family Housing Permits Hit A Cycle High - No Bubble This Time

Redbook Recovers

Obviously, each Redbook same store sales report is just one week of data, but some readings are very interesting. In the week of October 17th, same store sales growth rose from 1.2% to 2.5% which is a good sign because it seemed like the economy was falling back quickly.

This isn’t a good reading, but it signals the economy is bumping along the bottom rather than free falling. The main way consumer spending could freefall is if pandemic continuing claims don’t get extended by the end of the year. In that case, we could see millions go off benefits at the start of 2021.

We only say the word ‘could’ because it’s possible, albeit unlikely, that some sort of vaccine or treatment comes out and is widely administered within the next 2 months, allowing the economy to fully reopen. Government shouldn’t play with fire. It’s very easy to just extend this program another 3 months.

And it makes sense to extend it now rather than wait until the last minute. However, the government loves to wait. Dems are hoping for a win where it will be tough to do anything after the election due to a lame duck Congress and new President in charge. Those chances are becoming less likely as Donald Trump surges in the polls; it's looking more like a repeat of the 2016 election.

Another Great Housing Report

We had a great October homebuilder confidence report on Monday; on Tuesday we got a great permits number. The housing market is so hot that any bad number is either a temporary blip or shocking. We haven’t had any shocking numbers recently.

Obviously, these numbers will cool off a bit, but the long term trend is intact. Long term trend is based on millennials reaching their lower 30s which is when many people buy their first home. Young millennials are in their upper 20s.

(Click on image to enlarge)

Specifically, there were 1.415 million housing starts in September which rose from 1.388 million. It fell from the original August reading of 1.416 million before the revision. This report mildly missed estimates for 1.463 million. As you can see from the chart above, single-family housing permits rose from 1.476 million to 1.553 million which beat estimates for 1.52 million. This is a new cycle high. It matches the burst in construction spending.

Why Housing Is So Strong

It’s notable that permits aren’t as high as the previous cycle because some people might be getting nervous about the record optimism in housing. We aren’t seeing excess supply being built like the last cycle. Builders can be optimistic all they want, but if they don’t actually build record new homes, there won’t be an oversupply.

The worst thing for the housing market would be a spike in rates. Homeowners would be fine because mortgage rates are fixed, but new buyers wouldn’t be able to afford current prices.

The chart below shows the monthly carrying cost of a new home is near a 45 year low. This assumes a 20% down payment which is harder now that housing prices are higher because interest rates are so low. Most down payments are actually in the high single digits. Because down payments end up being below 20%, PMI insurance is paid. When you include that, the deal isn’t as great.

(Click on image to enlarge)

Record low rates have boosted home prices which has helped American’s net worth hit a record high (obviously stocks and bonds have helped). The good news is unlike the last cycle, homeowners aren’t taking money from their homes (HELOC). That’s because they don’t need the money.

Plus, some people remember the disaster HELOC loans were in the housing bubble. To be clear, if rates rise significantly, home prices will fall. The good news is there won’t be a bubble burst like the last cycle in the 2000s.

Pandemic Causes Desire For Government Help

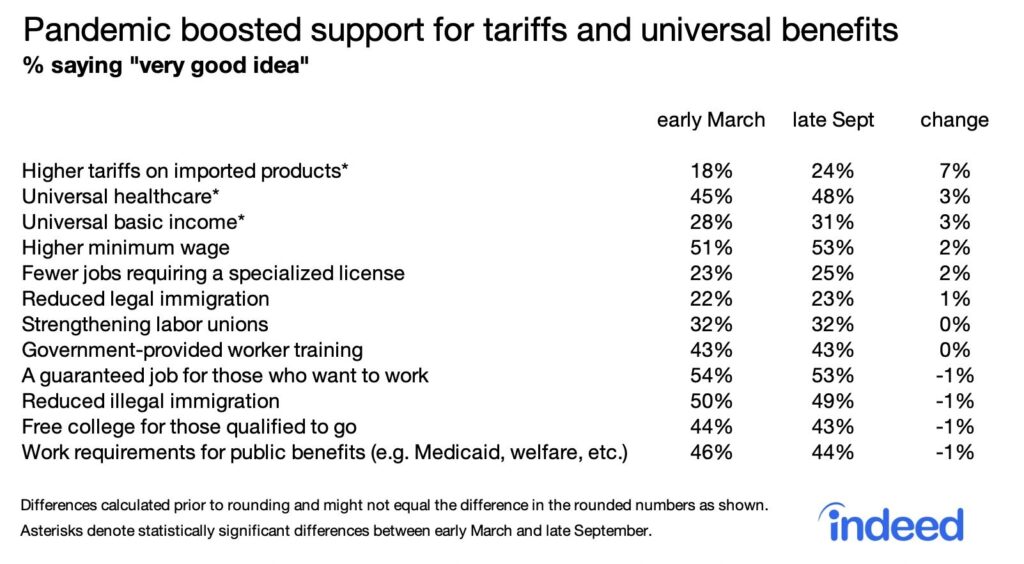

This pandemic shifted desires for certain government programs. As you can see from the Indeed table below, from early March to late September there was a 3% increase in those who said universal basic income is a very good idea. There appears to be a long term trend towards this which could mean it will happen at some future point. That theory has become more popular recently. When you add in the positive impact of the stimulus, you get more support.

(Click on image to enlarge)

We shouldn’t be surprised if something like this becomes law in the next decade. It could give the lower class more purchasing power which would be good for certain stocks. Furthermore, 48% now support universal healthcare which would be bad for the health insurance companies.

This won’t become law in a Trump or Biden presidency, but it’s another trend to look out for. Interestingly, the increase in support for universal benefits came from Republicans. If both parties support this, it will be enacted.

These Are The Hottest Of Hotspots

COVID-19 results appear to be getting worse by the day. The stock market is clearly relying on the hope of a treatment or vaccine soon because cases and hospitalizations are starting to explode. Just looking at the data; it’s not looking good anymore.

On Tuesday, there were 60,582 new cases and 39,230 new hospitalizations. The latter is up from 37,744 on Monday. There were 832 deaths which pushed up the 7-day average by 20 to 731. As you can see from the chart below, the hotspots are all in the Midwest.

The worst state on a population adjusted basis is North Dakota. Wisconsin is still seeing a spike in cases even though it’s not headlining these results. There were 4,591 new cases in the state on Tuesday.

(Click on image to enlarge)

Conclusion

Same store sales growth and housing permits data were strong. Housing is helped by low rates obviously. People are more supportive of government benefit programs due to the recession. COVID-19 is starting to get out of control in a few midwestern states.

Some believed that the Dakotas wouldn’t see a lot of cases because people live far apart there. That was wrong as they are in trouble. Stocks aren’t responding to this. That’s probably because of optimism on a potential vaccine or treatment.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more