Short Selling 101

With the markets recently incredibly volatile, and now that we are solidly into the high risk, low return time of the year, I thought it’s time to review how to make money when prices are falling.

There is nothing worse than closing the barn door after the horses have bolted.

No doubt, you will receive a wealth of short selling and hedging ideas from your other research sources and the media right at the next market bottom.

That is always how it seems to play out.

So I am going to get you out ahead of the curve, putting you through a refresher course on how to best trade falling markets now while stock prices are still rich.

Markets could be down 10% by the time this is all over.

THAT IS MY LINE IN THE SAND!

There is nothing worse than fumbling around in the dark looking for the matches and candles after a storm has knocked the power out.

I’m not saying that you should sell short the market right here. But there will come a time when you will need to do so. Watch my Trade Alerts for the best market timing. So here are the best ways to profit from declining stock prices, broken down by security type:

Bear ETFs

Of course, the granddaddy of them all is the ProShares Short S&P 500 Fund (SH), a non-leveraged bear ETF that is supposed to match the fall in the S&P 500 point for point on the downside. Hence, a 10% decline in the (SPY) is supposed to generate a 10% gain in the (SH).

In actual practice, it doesn’t work out like that. The ITF has to pay management operating fees and expenses which can be substantial. After all, nobody works for free.

There is also the “cost of carry” whereby owners have to pay the price for borrowing and selling short shares. They are also liable for paying the quarterly dividends for the shares they have borrowed, around 2% a year. And then you have to pay the commissions and spread for buying the ETF.

Still, individuals can protect themselves from downside exposure in their core portfolios through buying the (SH) against it (click here for the prospectus). Short selling is not cheap. But it’s better than watching your gains of the past seven years go up in smoke.

Virtually, all equity indexes now have bear ETFs. Some of the favorites include the (PSQ), a short play on the NASDAQ (click here for the prospectus), and the (DOG) which profits from a plunging Dow Average (click here for the prospectus).

My favorite is the (RWM), a short play on the Russell 2000 which falls 1.5X faster than the big cap indexes in bear markets (click here for the prospectus).

Leveraged Bear ETFs

My favorite is the ProShares Ultra Short S&P 500 (SDS), a 2X leveraged ETF (click here for the prospectus). A 10% decline in the (SPY) generates a 20% profit, maybe.

Keep in mind that by shorting double the market, you are liable for double the cost of shorting which can total 5% a year or more. This shows up over time in the tracking error against the underlying index. Therefore, you should date, not marry this ETF, or you might be disappointed.

3X Leveraged Bear ETF

The 3X bear ETFs, like the UltraPro Short S&P 500 (SPXU), are to be avoided like the plague (click here for the prospectus).

First, you have to be pretty good to cover the 8% cost of carry embedded in this fund. They also reset the amount of index they are short at the end of each day, creating an enormous tracking error.

Eventually, they all go to zero and have to be periodically redenominated to keep from doing so. Dealing spreads can be very wide, further added to costs.

Yes, I know the charts can be tempting. Leave these for the professional hedge fund intraday traders for which they are meant.

Buying Put Options

For a small amount of capital, you can buy a ton of downside protection.For example, some time ago, I bought (SPY) $182 puts for $4,872 allowed me to sell short $145,600 worth of large-cap stocks at $182 (8 X 100 X $6.09).

Go for distant maturities out several months to minimize time decay and damp down daily price volatility. Your market timing better be good with these because when the market goes against you, put options can go poof and disappear pretty quickly.

That’s why you read this newsletter.

Selling Call Options

One of the lowest risk ways to coin it in a market heading south is to engage in “buy writes.” This involves selling short call options against stocks you already own but may not want to sell for tax or other reasons.

If the market goes sideways, or falls, and the options expire worthless, then the average cost of your shares is effectively lowered. If the shares rise substantially, they get called away but at a higher price so you make more money. Then you just buy them back on the next dip. It is a win-win-win.

Selling Futures

This is what the pros do as futures contracts trade on countless exchanges around the world for every conceivable stock index or commodity. It is easy to hedge out all of the risk for an entire portfolio of shares by simply selling short futures contracts for a stock index.

For example, let’s say you have a portfolio of predominantly large-cap stocks worth $100,000. If you sell short 1 June 2019 contract for the S&P 500 against it, you will eliminate most of the potential losses for your portfolio in a falling market.

The margin requirement for one contract is only $5,000. However, if you are short the futures and the market rises, then you have a big problem and the losses can prove ruinous.

But most individuals are not set up to trade futures. The educational, financial, and disclosure requirements are beyond mom-and-pop investing for their retirement fund.

Most 401Ks and IRAs don’t permit the inclusion of futures contracts. Only 25% of the readers of this letter trade the futures market. Regulators do whatever they can to keep the uninitiated and untrained away from this instrument.

That said, get the futures markets right, and it is the quickest way to make a fortune, if your market direction is correct.

Buying Volatility

Volatility (VIX) is a mathematical construct derived from how much the S&P 500 moves over the next 30 days. You can gain exposure to it through buying the iPath S&P 500 VIX Short-Term Futures ETN (VXX) or buying call and put options on the (VIX) itself.

If markets fall, volatility rises, and if markets rise, then volatility falls. You can therefore protect a stock portfolio from losses through buying the (VIX).

I have written endlessly about the (VIX) and its implications over the years. For my latest in-depth piece with all the bells and whistles, please read “Buy Flood Insurance With the (VIX)” by clicking here.

Selling Short IPOs

Another way to make money in a down market is to sell short recent initial public offerings. These tend to go down much faster than the main market. That’s because many are held by hot hands known as “flippers” and don’t have a broad institutional shareholder base.

Many of the recent ones don’t make money and are based on an, as yet, unproven business model. These are the ones that take the biggest hits.

Individual IPO stocks can be tough to follow to sell short. But one ETF has done the heavy lifting for you. This is the Renaissance IPO ETF (click here for the prospectus). As you can tell from the chart below, (IPO) was warning that trouble was headed our way since the beginning of March. So far, a 6% drop in the main indexes has generated a 20% fall in (IPO).

Buying Momentum

This is another mathematical creation based on the number of rising days over falling days. Rising markets bring increasing momentum while falling markets produce falling momentum.

So, selling short momentum produces additional protection during the early stages of a bear market. Blackrock has issued a tailor-made ETF to capture just this kind of move through its iShares MSCI Momentum Factor ETF (MTUM). To learn more, please read the prospectus by clicking here.

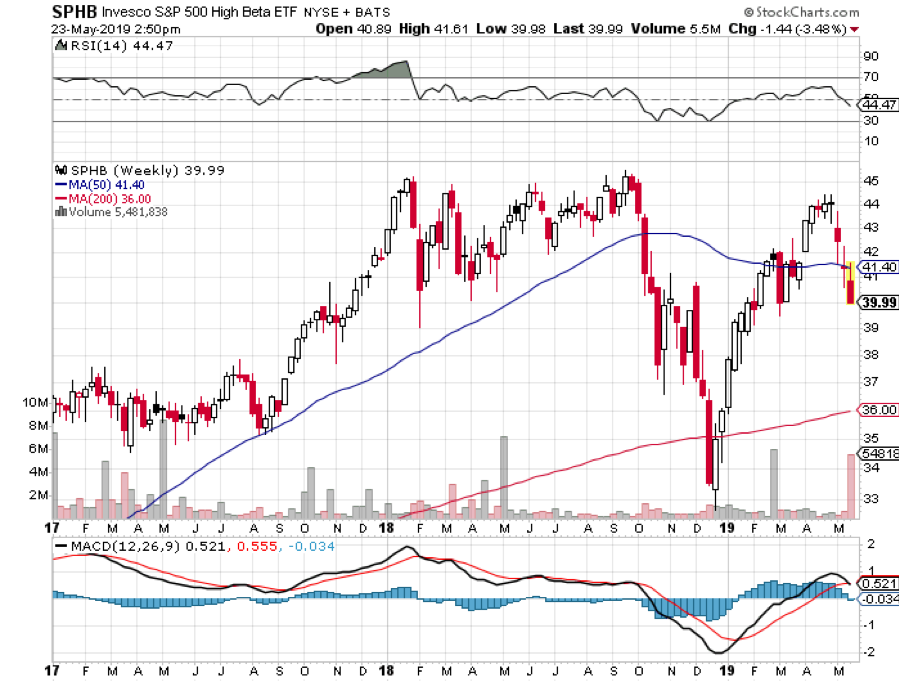

Buying Beta

Beta, or the magnitude of share price movements, also declines in down markets. So, selling short beta provides yet another form of indirect insurance. The PowerShares S&P 500 High Beta Portfolio ETF (SPHB) is another niche product that captures this relationship.

The Index is compiled, maintained and calculated by Standard & Poor’s and consists of the 100 stocks from the (SPX) with the highest sensitivity to market movements, or beta, over the past 12 months.

The Fund and the Index are rebalanced and reconstituted quarterly in February, May, August, and November. To learn more, read the prospectus by clicking here.

Buying Bearish Hedge Funds

Another sub-sector that does well in plunging markets is publicly listed bearish hedge funds. There are a couple of these that are publicly listed and have already started to move.

One is the Advisor Shares Active Bear ETF (HDGE) (click here for the prospectus). Keep in mind that this is an actively managed fund, not an index or mathematical relationship, so the volatility could be large.

Oops, Forgot to Hedge

The Diary of a Mad Hedge Fund Trader, published since 2008, has become the top performing trade mentoring and research service in the industry, averaging a 34.84% annual return for ...

more