Shelter Inflation Stays High Despite Decline In Home Price Growth

Modest April CPI Report

The April CPI report was weak even though technically core CPI increased from March. Monthly headline CPI was 0.3% which missed estimates and last month’s reading of 0.4%. Yearly CPI was 2% which increased from 1.9% but missed estimates for 2.1%. Monthly core CPI was 0.1% which was the same as March but missed estimates for 0.2%. Yearly core CPI was 2.1% which met estimates and was up from 2%. However, this is all about rounding. Core CPI only increased from 2.04% to 2.07%. That’s hardly a big deal even for the Fed which likes to focus on getting core inflation to 2%. This slight increase won’t make the Fed hike rates in June. The Fed is far from hiking according to the Fed funds futures market. There is a 10% chance the Fed cuts rates in June and a 71% chance the Fed cuts rates at least once by the end of the year.

Shelter Inflation Stays High

As per usual, inflation was driven by medical costs and shelter. Those make up about half of CPI. The fact that housing is the most important component of inflation and is above overall inflation makes it the number one category to follow. Specifically, on a non-seasonally adjusted basis, shelter inflation was 3.4% and medical care services inflation was 2.3%. Rent of primary residence inflation was 3.8% and owners’ equivalent rent of primary residence inflation was 3.4%.

It’s a surprise to those who aren’t experienced with shelter inflation that it is hasn’t fallen recently because home price growth has cratered. As you can see from the chart below, the national home price index’s growth rate has fallen from 6.47% last February to 4% this February. That’s while shelter inflation hasn’t moved much. In that period, it went from 3.13% to 3.37%. Shelter inflation actually increased while home price growth fell. If the recent trend in home price growth continues, it will fall below shelter inflation for the first time since August 2012.

(Click on image to enlarge)

Further Details On The CPI Report

As you can see from the chart below, commodities inflation has perked up slightly as it is now at 0.9%. It still lags services inflation which is 2.7%. Commodities are 37.3% of CPI and services are 62.7%.

Commodities, Services Inflation pic.twitter.com/9iZ2uCOFIf

— J. Brett Freeze, CFA (@Techs_Global) May 10, 2019

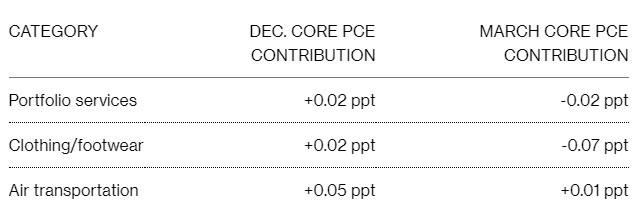

Core inflation is in a similar position as core commodities inflation was -0.2% and services less energy services inflation was 2.8%. Core commodities inflation was pushed lower by apparel which saw prices fall 3%. At the May press conference, Jerome Powell mentioned that apparel price inflation was low in March because of a change in methodology and transitory issues. However, apparel is a small portion of core inflation so it would need to spike significantly to matter. Prices fell sharply in the April CPI reading.

Similarly, he mentioned airfare prices hurting core PCE inflation. In the CPI report, airfare prices fell 1.8%. These “transitory” negative impacts to inflation continued in April. He also mentioned how portfolio services inflation was weak because stocks fell. He said there is a lag between stock price performance and inflation. Therefore, he said this component will see increased inflation in the future.

(Click on image to enlarge)

Energy commodities prices were up 2.9% yearly. This increase was caused by gas which had a 3.1% increase. Fuel oil prices fell 0.9%. Food inflation, which made a multi-year high last month, fell from 2.1% to 1.8%. The crash in soybean prices caused by the trade war hurt food inflation. New vehicle inflation was only 1.2%; used car and truck inflation was just 0.8%. With the recent weak auto sales report, it’s no surprise inflation wasn’t elevated.

Conclusion

Rising jobless claims need to be monitored closely. You can look at weekly claims, yearly growth in claims, unadjusted claims, and the 4-week average to get the full picture. CPI wasn’t strong as core CPI only increased 4 basis points. The Fed won’t be hiking rates anytime soon. The April CPI report showed Powell was wrong to expect airfare and apparel inflation to increase. Shelter inflation is steady, unlike national home price growth which is crashing.

Disclaimer: Please familiarize yourself with our full disclaimer here.