Norwegian Air Shuttle: A Challenging Outlook

European airlines have been facing their fair share of headwinds including Brexit, Boeing 737 Max delays and oil prices.

Ryanair Holdings CEO Michael O’Leary has been consistent in his outlook that the airline industry is going to face further consolidation while unprofitable airlines will go into bankruptcy. “I think inexorably the market is moving towards consolidation. The bankruptcy of Thomas Cook was the latest … we clearly think the next failure will be that of Norwegian.”

Looking at StarMine quantitative models and analytics, a challenging picture is painted for low-cost carrier Norwegian Air Shuttle: a secular decline in stock price (Price Momentum), out of favor by institutional investors (Smart Holdings), deteriorating fundamentals (Earnings Quality), in addition to having a high probability of credit default (Combined Credit Risk). Exhibit 1 shows the model scores for Norwegian Air Shuttle, which are 1 (worst) – 100 (best) percentile rankings compared to all companies in Developed Europe.

Exhibit 1: StarMine Model Scores for Norwegian Air Shuttle

Source: Eikon by Refinitiv

Credit Risk models are designed to detect credit default risk over a 12-month period. Our Combined Credit Risk model is a multi-pronged approach that combines our three stand-alone credit models: SmartRatios, Structural and Text Mining.

Looking at the Combined Credit Risk Model, Norwegian Air Shuttle has a model ranking of 1.Exhibit 2 highlights Norwegian Air Shuttle having the lowest decile scores across all three components: Structural Model, Text Mining Model, and SmartRatios Model.

The Combined Credit Risk model generates a probability of default of 2.04%, which is the fourth-highest among all European companies with a market cap greater than $500 million. The probability of default (%) is mapped to a StarMine Implied Rating of “CCC+”.The company had a StarMine Implied Rating of “B” one year ago, highlighting the deteriorating outlook. As there are no major rating agencies covering this company, the value of an implied rating generated by StarMine will be beneficial to active investors looking to manage risk.

Exhibit 2: StarMine Combined Credit Risk for Norwegian Air Shuttle

(Click on image to enlarge)

Source: Eikon by Refinitiv

We can also look at the Combined Credit Risk model rankings for industry peers as shown in Exhibit 3.Air France, Deutsche Lufthansa and International Consolidated Airlines Group also demonstrate weak model rankings. The peer average has a StarMine Implied Rating of “BB”.

Exhibit 3: Combined Credit Risk Rankings for Industry Peers

Source: Eikon by Refinitiv.

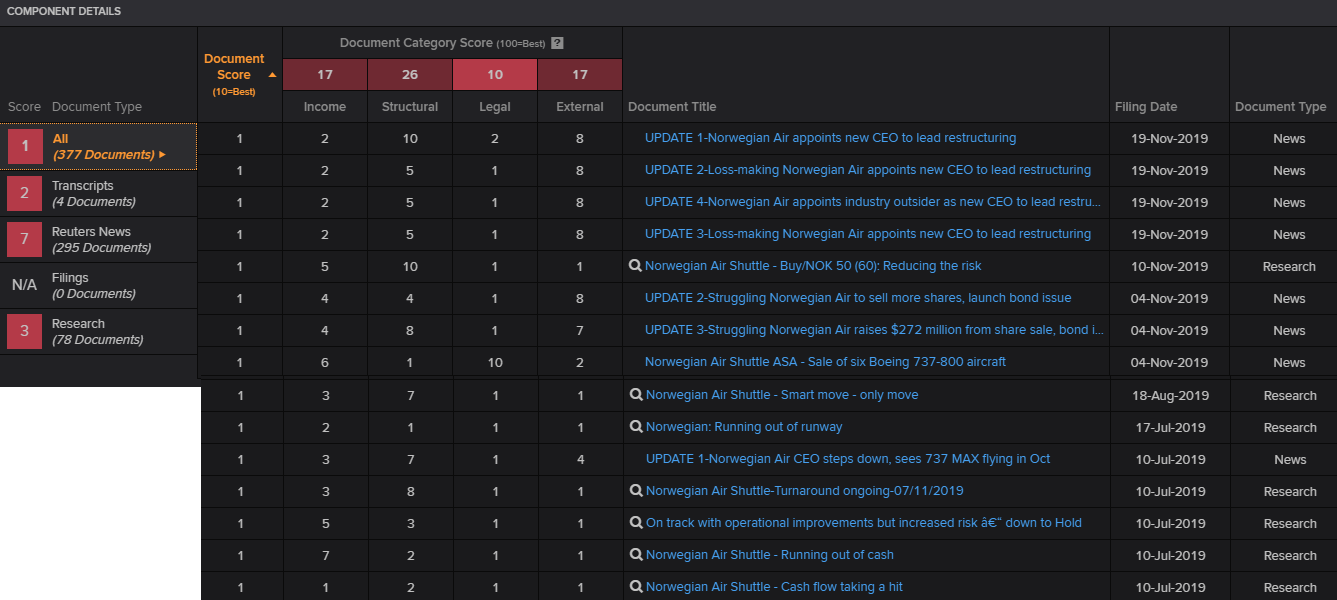

The Text Mining model, a text-based algorithm analysis of company risk, scans thousands of documents across news, StreetEvents, filings and research to detect words and “bag of words” which indicate credit risk. For companies outside of the United States, filings data is not currently an active component in the model. Exhibit 4 highlights themes picked up in the last six months including the CEO departing, internal restructuring, bond issuances, and cash flow concerns. For human portfolio managers and analysts, machines are of clear benefit to help signal both investment opportunities and red flags.

Exhibit 4: StarMine Text Mining Model for Norwegian Air Shuttle

(Click on image to enlarge)

Source: Eikon by Refinitiv

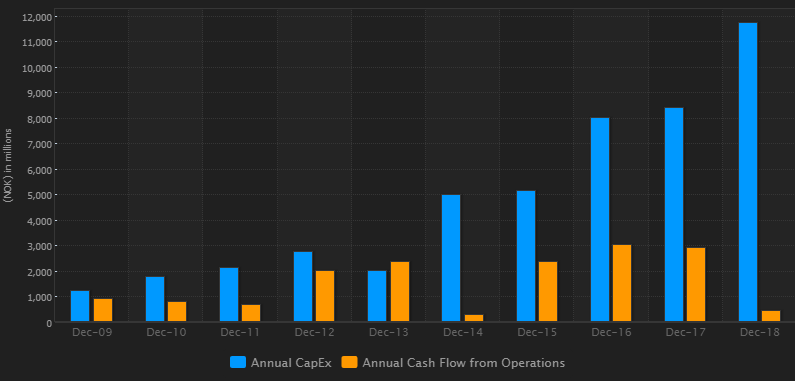

Deteriorating fundamentals are demonstrated by low profitability and liquidity, negative profit margins, high degree of leverage, and significant capital expenditures. Exhibit 5 highlights Norwegian Air Shuttle’s aggressive expansion into the long-haul market with large increases in fixed assets such as property, plant, and equipment. According to the Earnings Quality model, capital expenditures accounted for 94% of average adjusted net operating assets (ANOA), while cash flow from operations was only 3.7% of ANOA, resulting in a negative free cash flow of 11.3 billion NOK in 2018.

Exhibit 5: Earnings Quality Model for Norwegian Air Shuttle

(Click on image to enlarge)

Source: Eikon by Refinitiv

Estimates revised downwards

According to analysts polled by I/B/E/S from Refinitiv, FY20 EPS estimates have declined by 121.0%, resulting in a consensus value of -0.73 NOK. FY20 revenue is forecasted at 41.6 billion NOK, down 23% from a year ago when consensus was 54.4 billion. Key performance indicator (KPI) estimates have also declined for next year. Passenger load factor consensus has dropped from 88.2% to 87.2%, Available seat kilometers have declined from 130.0 billion to 96.2 billion, and revenue passenger kilometers have declined from 113.2 billion to 86.1 billion.

Norwegian Air Shuttle has appointed a new CEO in January 2020 who will look to turnaround the low-cost carrier back to profitability.

All names and marks owned by Thomson Reuters, including "Thomson", "Reuters" and the Kinesis logo are used under license from Thomson Reuters and its affiliated companies.