Services Slowing

Just like the reading on manufacturing earlier this week, the ISM’s Non-Manufacturing survey showed overall growth in November, albeit at a slower rate. The headline reading for the services index beat expectations (55.9 vs 55.8 expected) but still came in below last month’s level of 56.6. That is a sixth consecutive month of expansionary readings (readings above 50 indicate growth/below 50 indicate contraction) although the reading for November was the lowest of those six months. The same applies to the composite of the manufacturing and services which fell from 56.9 to 56.1.

Looking across each of the individual indices of the report also resembled the manufacturing report. While most components continue to be consistent with further growth, November did see some slowing across a range of indicators.

The improvements in business activity have considerably moderated over the past few months. After a near-record high reading back in July, this index has fallen every month except for in September. At 58, the index is around levels similar to just before the pandemic began earlier this year. A slowdown in orders likely plays a role in this as the index for New Orders similarly sits in the middle of its historical range following a 1.6 point decline to 57.2 in November. While that is still indicative of new orders growth, it would be the slowest growth since August.

Export order growth slowed in November as that index fell to a barely expansionary reading of 50.4. While orders from outside the US were a bit weak, the index for imports rose to 55 which is the strongest level since January of this year (55.1). One important thing to note with these indices, though, is less than half of survey respondents report that they do not use or track imports/exports (only 29% for exports and 37% for imports). In other words, these readings only apply to a smaller sample of responding firms.

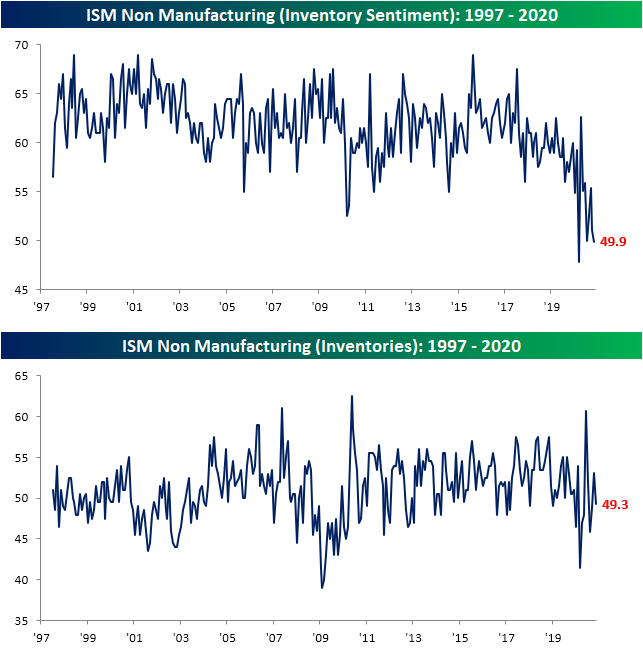

The continued growth in new orders has resulted in smaller inventories. For only the second time in the index’s history (the other instance being March of this year), the index for Inventory Sentiment came in below 50. That indicates a larger share of companies are reporting that inventories are too low rather than too high. As a result, the index for Inventories showed a contractionary reading of 49.3. That is not any sort of extreme reading but again points to declining inventories.

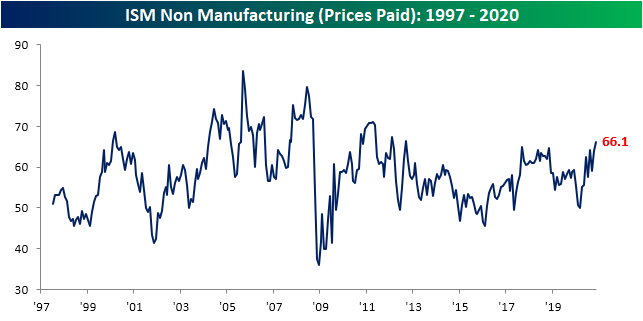

Stronger demand has filtered through to lower inventories which has, in turn, resulted in higher prices. The index for prices paid rose to 66.1 from 63.9 in October. That points to prices growing at their fastest pace since February of 2013.

Staying on the topic of prices, with housing flying high, prices for construction contractors and construction supplies like lumber, PVC, and steel have all been on the rise as they remain in short supply. Outside of construction contractors, labor, in general, was cited as in short supply. That is consistent with some commentary concerning employment in Monday’s manufacturing release. But unlike Monday’s report in which the employment component fell to a contractionary reading, the services employment index showed a third straight expansionary reading at 51.5. Additionally, as COVID has made a resurgence in the past few months, PPE and other related products continue to be cited as some of the commodities seeing price increases. For PPE this month saw the 10th month in a row that these products were in short supply with higher prices.

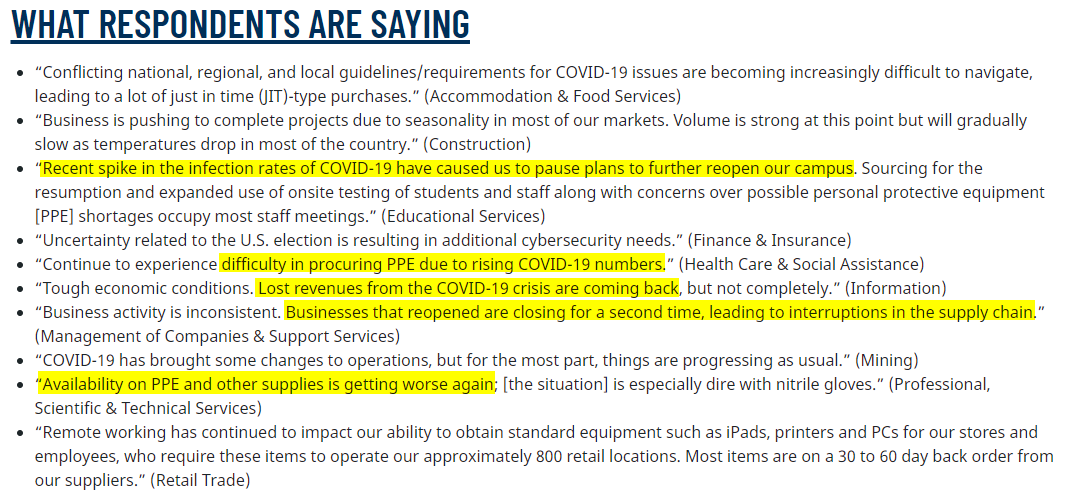

The commentary section reaffirms the COVID resurgence impact. Quotes from various industries stated how higher infection rates have had negative impacts.

Click here to view Bespoke’s premium membership options for our best research ...

more