September Is Not 'The Cruelest Month' - Despite Thursday

Analysts spend volumes debating why, oh, why is September such a poor month to get through? Wrong question. Ask first if there is any validity to this oft-repeated fable. It has been told so many times that many people believe it. Here is a recent headline from Mark Hulbert, a MarketWatch contributor, who handily debunks this notion:

"Opinion: The stock market is on a tear, but now comes September, the worst month of the year"

Who says it is the worst month of the year? US markets in September may rise or they may fall, just as is the case every month. But if they fall, it will not be preordained because it is at a certain moment in the calendar. There is no reason to be any more cautious than we always are.

First of all, this is yet another of those academic exercises based upon apples-and-oranges data. The stories you might read elsewhere take the tale as fact. After all, isn’t it true that since the Dow Jones Industrial Average (The “DJI” or the “Dow”) was created, it has fallen an average of 1% in September, and the Dow’s gain in all other months has averaged a positive 0.7%?

Garbage in, garbage out.

The first DJIA, created in 1896, comprised of only 12 stocks, nine of which are no longer in business (though some sort of survive as being part of some other company, none of which are Dow components). None of the remaining three are components of the Dow. Anything that happened back then, with 12 different companies, is in no way related to the Dow today - so why count the 31 Septembers between 1896 and 1927?

In 1928, the DJI added 18 new companies, making a total of 30 just as we have today. Except, most of these are not the same companies either. Is it possible that some of the companies from back in the 1900's might have experienced a rough September for reasons no longer valid?

Who knows? In a recent article, Mark Hulbert noted that, “The Dow’s average September loss prior to 1990 was four times worse than it’s been since then - minus 1.2% versus minus 0.3%.” Already, we see a rather major disconnect; for the past 30 years, the September disparity has been a decline of 0.3%, not 0.7%.

0.3% is not exactly decimal dust, but it is darn close to it. If your portfolio is worth $100,000 and it falls 0.3% in September, that comes to $300. Wait a minute - $300 is a normal day’s up or down for a portfolio that size. For this you are supposed to worry about September?

(Now, a single day when a market falls 5% - as the Nasdaq did on Thursday, September 3 - that is something to maybe find a bit more disconcerting. Of course, there may be many a slip twixt cup and lip between the 3rd and the 30th.)

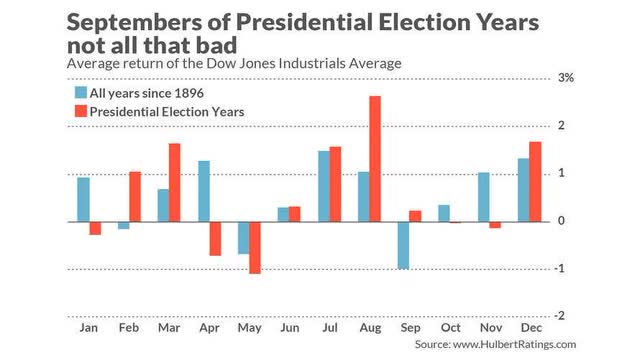

Please be advised that there is yet another reason to stop fearing September. Here is a little more granularity into that old maxim: the average move in September of most presidential election years is up. The following chart from Mr. Hulbert's article illustrates this quite well:

The only thing to fear about the stock market in September is fear itself. This month is most likely to be influenced by the election run-up, COVID-19 case load and death toll, corporate over-dependence upon debt, and investor overreaction in either direction. You know, just like any other month so far this year.

Buy the dip in early September, or place tighter trailing stops (I have), or go to cash. But do whatever you do based upon your analysis, or that of the advisers you most trust, of the coming months and years, not because you have heard September is the cruelest month of all.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own ...

more