Sell These Stocks That Will Take A Long Time To Recover After This Crisis

For over a month now, I’ve been providing you with predictions about who will come out on top of the new normal that is quickly being established by the novel coronavirus.

I’ve told you about stay-at-home stocks, work-from-home stocks, and stocks that will benefit from an acceleration in the move to do business online. The new normal will have clear winners, many of which, like Zoom (ZM), Docusign (DOCU), and Netflix (NFLX). have already made massive moves to the upside.

But, there is a flip side to winners like ZM, DOCU, and NFLX. Some companies will struggle, possibly for many years to come, to execute business models that will not be negatively impacted by the fallout from the pandemic.

You already know some of these companies. They’re on business television and in business news articles constantly, most often begging for some form of bailout money from the federal government. The airline, hotel, and restaurant industries are in for a rough road ahead, and a very slow recovery.

While I love telling you about companies that will come out of this crisis as winners, I also think it’s important to identify some specific industries, and companies, that could be dead money for your portfolio.

These are stocks I would avoid short term, and, unless they can innovate their business models in a new direction, they will likely remain hard to invest in for the long term.

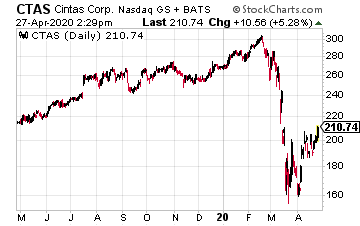

The first of these is Cintas (CTAS). Cintas is in the business of providing “corporate identity uniform programs.” Think of all the people you see working in the service industry that wear clothes with their company’s name. Flight attendants, the counter clerk at Marriott (MAR), the servers at your favorite casual chain restaurant. See a pattern?

A large portion of CTAS’ customers interact directly with the public. And we know exactly what that means. These customers will be some of the slowest to come back, and even when they do, there is a high likelihood there will be less demand for these types of businesses for years to come.

Going into the “coronacrisis,” CTAS was performing exactly as you would expect a broad-based service provider would in a good economy. In its latest quarter, the company reported revenue of $1.8 billion, a 7.6% year-over-year increase. Cintas increased its dividend in the quarter to an annual rate of $2.55 per share, or a 24% increase over the same quarter the previous year.

Clearly that will not be increasing further, and current circumstances may result in a negative driver for the stock if that dividend is cut in the future. As with many other companies, CEO Scott Farmer has withdrawn both next quarter and full year 2020 guidance for Cintas.

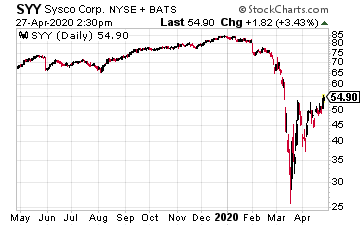

Sysco (SYY) is in a similar situation to Cintas. The food service supplier has suddenly seen a massive drop in demand from its customers, as restaurants across the U.S. either close or reduce service to carry-out only.

Now, some will argue that the demand has shifted from restaurants to grocery stores. That’s true. And, SYY and other restaurant food providers, like U.S. Foods (USD), have tried to shift business to provide for the uptick in demand from grocery stores.

While this may blunt some of the fall off in revenue, it definitely won’t replace it. And, grocery is a much lower margin business than the restaurant model.

SYY has fallen to $50, from the mid $80s it was at prior to the crisis. It currently has a 3.67% dividend yield. But like Cintas, I think that may not be sustainable moving forward.

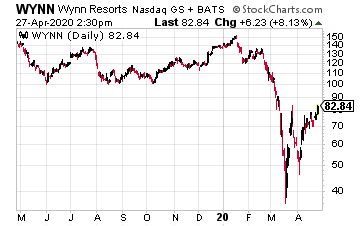

The last stock I want to look at is Wynn Resorts (WYNN). As a casino company, WYNN faces many of the same headwinds as the airline and hotel companies, but with an added burden.

Even today, airline travel continues, and hotels are gathering what little business there is from essential travelers. As the economy comes back, the first green sprouts for the airlines and hotels will most likely come from business travellers forced to hit the road—even if there remains a reluctance to do so.

I believe the casinos, like WYNN, are facing a different scenario for two reasons. First, no one has to go to a casino the way they may have to travel for business. Customers will need to want to travel for pleasure in order to visit casinos, and that will just take longer.

Second, online gambling was already growing pre COVID-19, and as states need to refill their depleted coffers, there is a high likelihood that more and more will approve online gambling. This will increase competition for live gambling casinos like Wynn.

The company also carries a heavy debt load, with long-term debt close to six times equity, and like both CTAS and SYY, continuing to pay the dividend, now at 5.68% could quickly become a heavy burden. The stock traded over $150 earlier this year, and currently trades just over $70.

Disclosure: None.