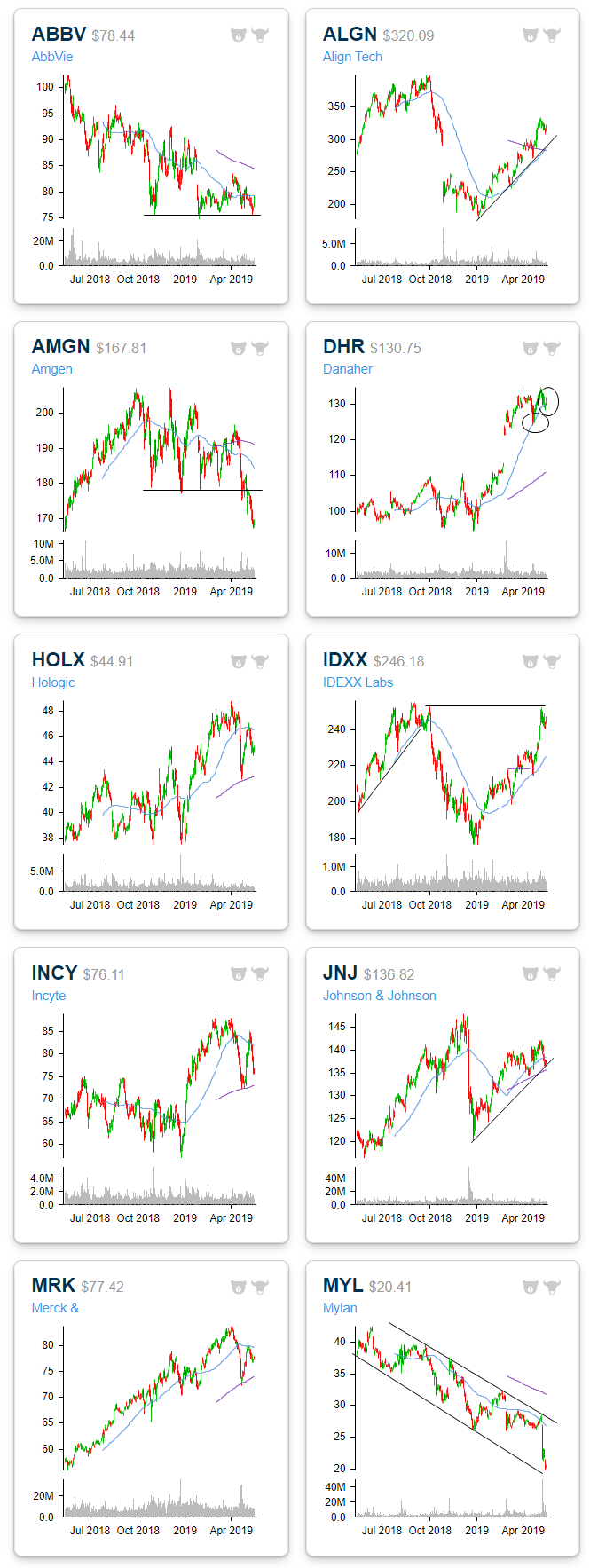

Sector Charts – Health Care

While the past couple weeks of declines have eaten into YTD gains, a majority of the S&P 500 sector ETFs are still seeing double-digit or at least high single-digit returns. That is not the case for Health Care (XLV). Health Care has been and continues to be a drastic underperformer this year, now only up 1.35% since the start of the year.

Align Tech (ALGN) has been in a solid uptrend all year, avoiding the more substantial declines that the rest of the sector has seen. Currently, it boasts the greatest YTD performance of the Health Care stocks in the S&P 500 with a 52.84% gain. Along with the broader market, in the past couple of weeks, ALGN has pulled back providing a good chance to buy the dip. Similarly, Danaher (DHR) and Johnson & Johnson (JNJ) are also seeing pullbacks in their uptrends along with constructive trading in regards to their moving averages. In late April DHR pulled back to the 50-DMA before breaking out to new highs, and it has just bounced off of the moving average again. JNJ similarly has pulled back recently in this year’s uptrend but is finding support at the 200-day.In today’s trading, the stock has fallen to and rallied off of the 200-DMA. This happened two other times earlier this year, once about a month ago and again in mid-February, in which JNJ saw a solid rally afterward.

A few other names are seeing interesting trading in regards to moving averages. Hologic (HOLX), Incyte (INCY), and Merck (MRK) all collapsed right through the 50-DMA in early April when the sector fell sharply. All three found support at the 200-DMA before rallying back up to the 50-DMA. But this time around, the 50-DMA has been a bit more meaningful as it has been tough resistance. After running up to it, all three stocks have fallen and are now in the middle of the range between the two moving averages. Each will be interesting to watch as they re-approach either average to the up or downside.

Some other Health Care names are at interesting points of resistance and support. For starters, AbbVie (ABBV) just reported a triple play at the end of April. In spite of this more optimistic fundamental point, the stock is still forming a descending triangle pattern, reaching the floor of support around $75 for the third time this year in the past few days. Going forward either a break higher through its downtrend line or a break down below support would be two things to watch for, and right now it appears it could do either. Conversely, IDEXX Labs (IDXX) has been skyrocketing since its earnings report. It is now re-approaching last year’s highs. Over the past few weeks, it stopped short of these levels pulling back slightly and now it has begun to move back up to these prior highs.IDXX now has the potential to break out higher in a cup and handle pattern.

Some of the less promising looking setups include Mylan (MYL) and Amgen (AMGN). Both of these stocks have seen the rug get pulled out from under them recently in the time leading up to and in response to their earnings reports. Regardless of the fundamental pictures seen in these reports, investors have not been acting kindly. For the fifth time in the past year, AMGN ran into support around the upper $ 170s. This time around it was not able to hold onto these levels. MYL meanwhile has been in a solid long term downtrend for multiple years now. This most recent drop has brought it to its lowest levels since 2011 and to the bottom of its downtrend channel.

(Click on image to enlarge)

The charts from within the sector come from our Chart Scanner tool.

Disclaimer: To begin receiving both ...

more