Russia: Local Growth Drivers Stronger Than Expected

The GDP structure for 2Q19 suggests that a sharp drop in exports was the main drag on growth, while local demand strengthened. Yet the pressure on exports may continue, while a material improvement in local investment and consumption is still a remote prospect.

Source: Shutterstock

GDP growth in 2Q19 was constrained by external and temporary factors

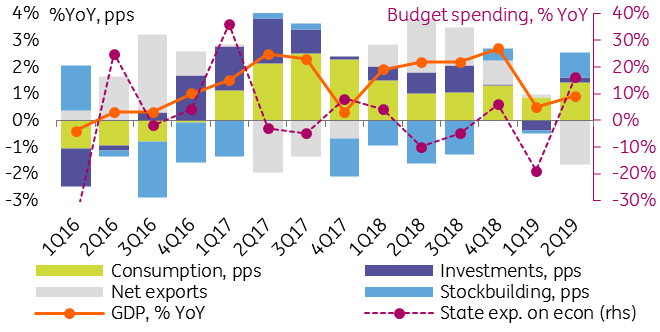

The Russian State Statistics Service (Rosstat) confirmed a modest acceleration of GDP growth from 0.5% year-on-year in 1Q19 to 0.9% YoY in 2Q19 and provided the structure of growth by usage. The story told by the fresh numbers is slightly different from the narrative of 'tight budget/monetary policy, limiting the growth rate' popular among some market participants and members of the government. Here are the key observations:

- Consumption growth accelerated from 1.2% YoY in 1Q19 to 2.1% YoY in 2Q19, suggesting a recovery to the levels seen before the VAT hike from 18% to 20% that took place at the beginning of this year. This acceleration is somewhat surprising given that the monthly retail trade data suggested a 0.3 percentage point deceleration amid the slowdown in the retail loan growth after the 24% YoY peak seen in April. This indicates that the deceleration of traditional retail trade was offset by outperformance in online trade, meaning bargain hunting by the lower-income groups. In the meantime, a likely pick-up in services growth may possibly reflect the development of car-sharing, taxi, food delivery, and other services in the large cities, leading to higher consumption from the higher-income households.

- Fixed investments after showing a 2.6% YoY drop in 1Q19 showed a small 1.0% YoY growth in 2Q19. In addition, the contribution of stock building-to-GDP growth increased from zero to 0.4 pps amid targeted support from the budget. While the overall budget spending indeed tightened from +6% YoY in 1Q19 to -1% YoY in 2Q19, the state spending on the national economy switched from -19% YoY to +16% YoY, respectively. To remind, the overall industrial output growth accelerated from 2.1% YoY in 1Q19 to 3.0% in 2Q19 mainly due to the manufacturing sector.

- Exports were the main drag on the GDP growth, as its drop deepened from -0.4% YoY in 1Q19 to -4.9% YoY in 2Q19 as a result of a softening of global demand for metals, Russia's OPEC+ commitments and the temporary halt in oil exports via the Druzhba (Friendship) pipeline, accounting for 20% of Russia's oil exports. Deterioration of net exports caused by external or temporary factors (not fiscal or monetary policies), knocked off 1.7 pps from the 2Q19 GDP growth rate.

GDP growth by component, and budget spending, % YoY

(Click on image to enlarge)

Source: State Statistics Service, Finance Ministry, ING

Global slowdown and limited room for local stimulus to keep constraining growth in the mid-term

Even though the pressure of one-off constraints such as the incident on the Druzhba pipeline is set to ease, we remain cautious on Russia's growth prospects in the mid-term.

- Consumption growth should be limited due to the expected further slowdown in consumer lending, which may intensify after the tightening in the consumer lending regulation since 1 October. From now on consumer loans for households with a high payment-to-income ratio will be assigned with higher risk weights, which according to the Bank of Russia should result in deceleration of the retail lending growth from the current 21% YoY to 10-15% in 2020. According to our earlier estimates, already in this year, the contribution of retail lending (minus interest payments) to consumption should be around zero.

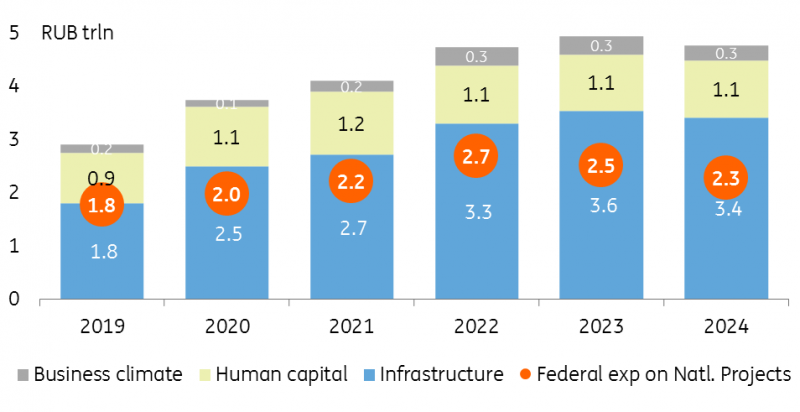

- Investment growth should continue to accelerate, as the state spending on the national economy is supposed to accelerate from 1% YoY in 1H19 to 19% YoY in 2H19, according to the updated 2019 spending plan. However, there are risks that the actual spending execution might be lower than planned this year, which might affect the confidence in the real sector. The recent sharp drop in the PMI index for Russia can be one illustration. Going beyond 2019, it would be premature to expect the realization of the National Projects, which are co-financed by the government are 70% infrastructure CAPEX, to have an immediate impact on the construction volumes, as the projects will go full-speed only in the 2022-2024 period, as suggested by the timeline (see the chart below). In any case, with fixed investments accounting for 22% of the Russian GDP, investment growth is unlikely to materially affect overall GDP growth rate in the near term.

- Exports may benefit from the Druzhba pipeline recovery, however, the global trade tensions and particularly the economic slowdown in the EU, which accounts for 40% of Russian exports of goods and services, suggest that the external demand is not a reliable source of support in the medium term. Diversification of Russia's product and export destination mix could be a positive factor to watch.

Expected timeline of National Projects

(Click on image to enlarge)

Source: Finance Ministry, media, ING

The structure of 2Q19 GDP paints a slightly more positive picture of local demand and supports expectations of an acceleration of GDP growth going forward. However, minding the risks related to external demand, the long waiting period before National Projects gain traction, and uncertain prospects of consumption, we maintain our cautious expectations of 1.0% GDP growth this year followed by 1.5-2.0% growth in the following years. Outperformance is possible in case of easing in fiscal policy (so far the 2020-22 draft remains tight) and/or improvement in the private sector confidence and diversification of exports.

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more