Retail Sales Trend Continues…

“Davidson” submits:

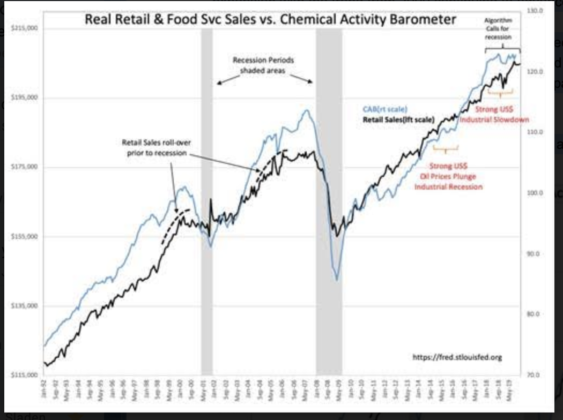

Since 2014, there have been 2 periods of US$ (US Dollar) strength which have impacted exports and US manufacturing of high-value products. This was reflected in pauses in the Chemical Activity Barometer (CAB) trend. The US$ is relatively high currently with an influx of global capital forcing 10yr Treasury rates back towards historical lows. Low 10yr Treasury rates is the outcome of global investors seeking a safe haven on fears with US actions to curb terrorism and rebalance tariff regimes. Expectations that an economic correction would occur has proven to have been mostly a period of pessimism. al Retail Sales show no impact on economic expansion with the trend from 2009 continuing to advance.

(Click on image to enlarge)

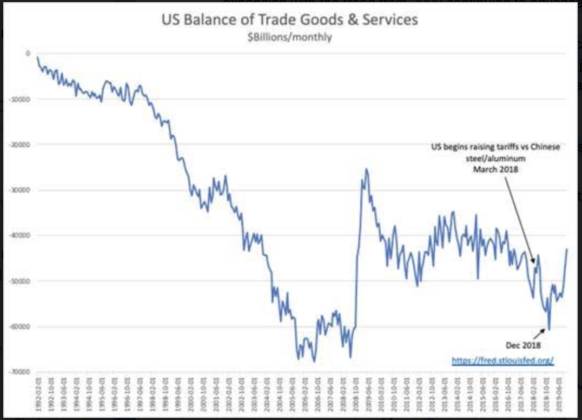

(Click on image to enlarge)

Persistent efforts to readjust global tariff regimes have recently proven fruitful. New trade agreements with So. Korea, Japan, Mexico, Canada and just yesterday China should continue to improve the US Balance of Trade with global trading partners. Improvement in the US Balance of Trade benefits the US economy.

Equity prices should continue to rise in the next few years as tariff regimes adjust.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more