Retail Sales Make It Two Toward The Second Act

One monthly result does not make a trend. Two? Still not a trend, but edging closer to one and more solid analysis. If making a claim based off the potential for one high-frequency result is going out on a limb, then a second result confirming the first while not yet solid ground is at least a bit thicker of a limb.

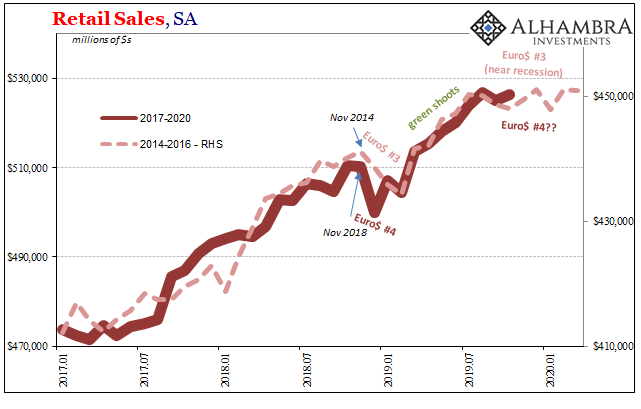

Last month, we talked about patterns and how there were distinct ones when it came to certain aspects of these eurodollar problems. One example is the bond market and how it gives into very distinct phases, these midpoints. Another is consumer spending, specifically retail sales which was our major topic in the middle of October.

The Census Bureau had reported at that time a stumble in spending during the month of September 2019. It was characterized as “unexpected” largely because everyone still listens to Jay Powell rather than believing their own lying eyes (on bonds). The Fed’s Chairman continues to claim that the economy is very strong and doing quite well, largely because the unemployment rate tells him that the labor market remains awesome.

And if the labor market is doing well, how can there be a serious setback when it comes to consumers?

What I wrote instead was how September’s negative month (seasonally-adjusted) was actually right on schedule.

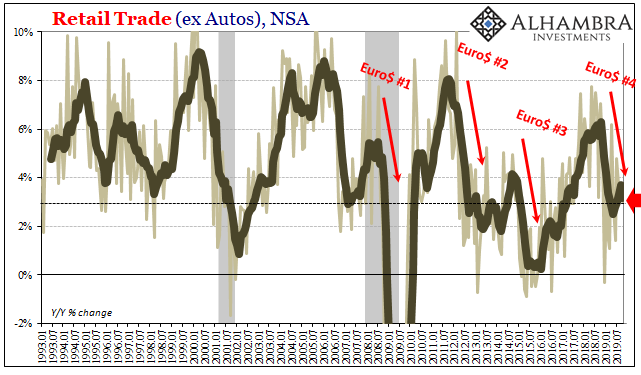

It is a pattern that repeats – a little too exactly to be anything other than legitimate. We have been made to think of our hyper-modern world as a product of randomness. The idea that there might be calendar points embedded within deeply complex systems seems almost incompatible with how we think about the state of the world.

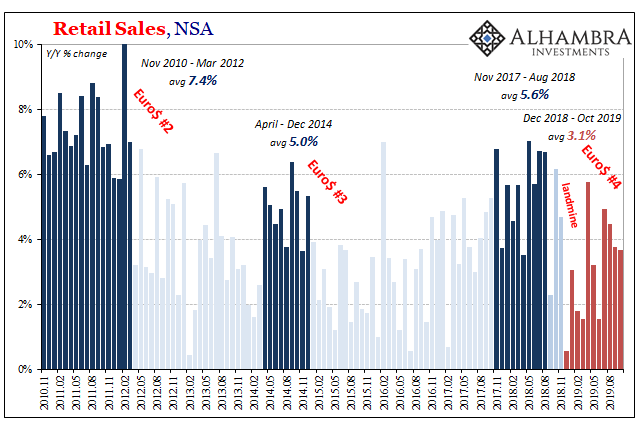

Yet, here we can observe the same said pattern repeating; and not just in one instance, but four times. It happens the same way, or very nearly the same way, in each.

Toward the end of any year experiencing growing eurodollar pressures, like 2018 or 2014, there’s an “unexpected” misstep in consumer spending (retail sales). It typically lasts several months perplexing our nothing-to-see-here officials and troubling every other reasonably honest observer. Then it goes away, everyone gets happy and puts it out of mind…for a little while.

Only to see the same thing show up again right around September. That’s what happened with last month’s data – a negative in retail sales right where we’d thought there’d be one. But it was only a single monthly data point, hardly conclusive.

With today’s Census Bureau’s retail trade update for the month of October 2019, make it two monthly data points. Though total retail sales were up last month when compared to the month before, not by much. As a result, retail sales in October remain lower than they were in the month of August. Two months, still negative.

Our limb got just a little thicker.

Consumers might rebound more strongly in the months ahead, but there is more than enough to more strongly suggest the possibility they might not. There aren’t yet enough more frequent indications of much worse.

In terms of retail sales, the numbers remain on the edge of recessionary, completely contradicting Powell’s notion of a strong anything. Unadjusted, retail sales gained just 3.68% year-over-year in October. Excluding autos (which remain on relative upswing, at least compared to late 2018 and early 2019) and food sales, overall retail trade increased right at the mark: 3.00% year-over-year last month.

With only two months left in the second half, there is no second-half rebound. There isn’t much of any second-half anything. It isn’t unmistakably recessionary, either.

But the predictable eurodollar pattern does suggest much more on that downside risk. It is, as we noted last month, this second stumble in the cycle which equates to the more consequential part of the affair.

All the Census Bureau’s update reminds us is that the economy is already in a critical state with regard to uncertainty and weakness. That’s the predicate for the more serious second half of each “cycle.” The first part knocks the global system down enough so that it is no longer really growth. And then after some time in the middle, the second part comes along and that’s when the havoc is really wreaked.

One month isn’t proof of a second part, and two months isn’t, either. But two months is taking it a little bit beyond the realm of randomness, and thus closer to the possibility. Just as that possibility edges closer in terms of the calendar, too.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more