Residential Construction Improves: Housing Set To Have A Great Q4

Strong Redbook Growth

The order of importance in terms of measurements of consumer spending from least important to most important are the following: Redbook, consumer confidence, retail sales, and PCE. However, the Redbook report is the most updated, so I follow it. Redbook results show sales growth from the last week of September, while the August PCE report only came out last Friday.

If you’re curious, the PCE report includes services while the retail sales report doesn’t. That’s why retail sales growth is more cyclical. The fact that real retail sales growth was above real PCE growth in August is actually a good sign. Retail sales growth falls way below PCE growth in recessions.

Redbook and retail sales reports have shown the tariffs causing no impact on consumer spending growth, while consumer sentiment and PCE seem to show an impact. Savings rate increased 0.3% in August, the University of Michigan index fell sharply in August, and the Conference Board index fell sharply in September. Redbook same-store sales growth continued its strength in the week of September 28th as growth increased from 5.2% to 5.8%. Redbook’s results in September point to solid retail sales growth.

September retail sales report will come out on October 16th. The control group had very strong growth in the prior 3 months. Let’s see if that run continues. If retail sales growth is strong, its divergence from PCE growth will be more apparent. Weakness in the August PCE report doesn’t mean retail sales growth will be weak this fall. Labor reports this Friday will determine how optimistic I am about retail sales.

Residential Construction Growth Shows Improvement

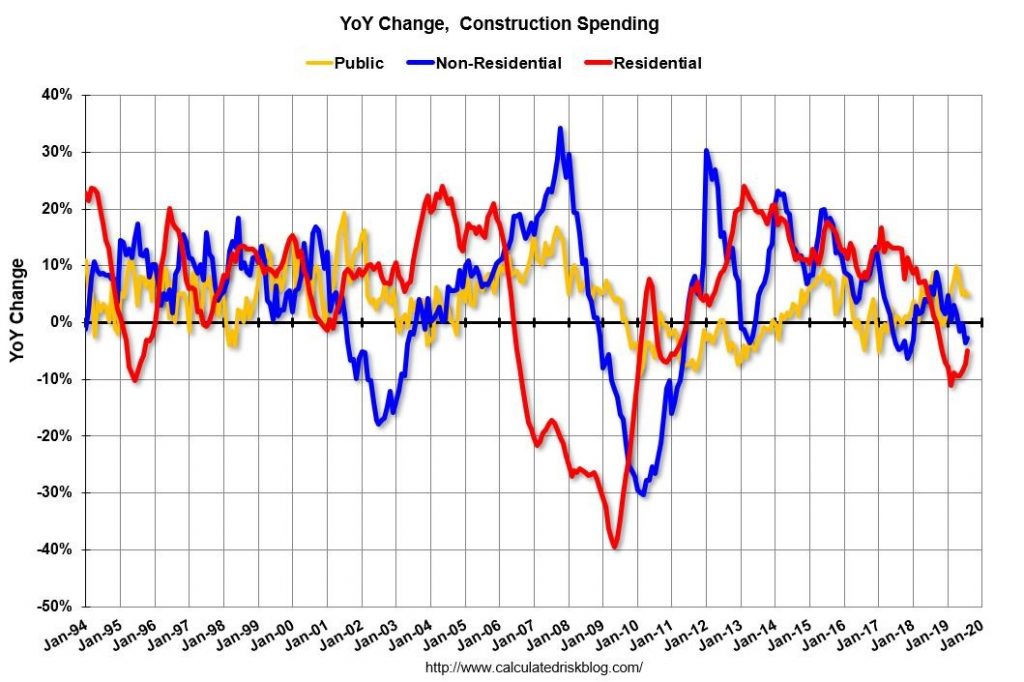

The housing market is set to drive Q3 GDP growth modestly higher according to the August construction spending report. Unlike late 2018 and early 2019, the housing market will soon become one of the strongest aspects of the economy. Specifically, monthly construction spending growth was 0.1% which missed estimates for 0.3% and was above July’s 0% growth. Yearly growth improved from -3% to -1.9%. Monthly residential construction growth was 0.9%. Spending on single-family homes was up 1.4%, spending on multi-family homes fell 0.9%, and spending on home improvements was up 0.9%.

As you can see from the chart below, yearly private residential spending growth was -5%. Overall, yearly residential construction spending growth was -6.4%. As housing starts rebound and comps get easier, growth will turn positive for both measurements. I expect it to do so in Q4.

Non-residential spending fell 0.4% monthly because of healthcare which was down 6.8%. That being said, yearly growth was 4.8%. Yearly healthcare spending actually had the highest growth as it was 23.6%. Sewage and waste disposal spending was up 19.3%. Public spending was up 4.6% yearly.

(Click on image to enlarge)

Divergent ISM Reports

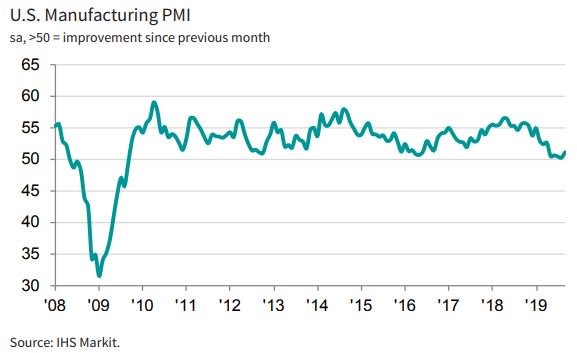

Tuesday’s big story was the big divergence between the two September manufacturing PMIs. It’s not as if the Markit PMI was very strong, but it was the highest reading in 5 months, while the ISM PMI was the worst in 10 years. I trust the Markit PMI more because it is closer to the average of the regional Fed readings and the recent industrial production report. That being said, it’s clear the manufacturing sector is in a slowdown even if you believe the Markit report.

As you can see from the chart below, the Markit PMI increased from 50.3 to 51.1 as it was 0.1 above its flash reading. As I mentioned, the Markit report signals the sector is in a slowdown as the quarterly average in Q3 was the weakest since Q3 2009. In other words, September showed a slight improvement in an otherwise weak quarter.

(Click on image to enlarge)

The comment section stated "News of the PMI hitting a five-month high brings a sigh of relief, but manufacturing is not out of the woods yet. September improvement fails to prevent US goods producers from having endured their worst quarter for a decade.

Given these PMI numbers, the manufacturing recession appears to have extended into its third quarter.” When the better reading tells you the sector is in a recession, the situation isn’t great. The slightly good news is the 1-year output expectations index hit a 3 month high.

Very Weak ISM Manufacturing PMI

ISM manufacturing PMI hit its lowest level since June 2009 as it fell from 49.1 to 47.8. This report sent stocks falling since it missed estimates for 50 and the low end of the estimate range which was 49.1. Before I review the details of this report, note that the ISM reading is an equal-weighted composite of new orders, production, deliveries, inventories, and employment. Markit has about twice the sample size, which makes it potentially more accurate. It also overweights production and new orders while giving a lower weight to inventories and deliveries.

This PMI was much below the 12 month average of 53.5. New orders index actually increased 0.1 to 47.3. Production index fell 2.2 points to 47.3 which was the lowest reading since April 2009. An index above 51.7 signals positive growth in industrial production. That means there will be negative growth again in September. Employment reading fell 1.1 to 46.3 which was the weakest reading since January 2016.

One key takeaway is that this doesn’t mean a recession is coming. A PMI above 42.9 is consistent with an overall economic expansion. As you can see in the chart below, this report increased the odds of a recession to 23% which is the highest of this cycle by a small amount. According to Pictet Asset Management, a PMI below 44.5 is indicative of a recession. Personally, I think the PMI was way too optimistic in 2018 and is slightly too pessimistic now which is why I don’t see a recession coming.

(Click on image to enlarge)

Conclusion

The Redbook report showed solid retail sales growth. Construction report was weak, but monthly residential construction improved. Markit manufacturing PMI showed slight improvement, but it was still a weak report. ISM PMI was worse as it was the lowest reading since June 2009.

Disclosure: None.