Rebounding Euro Triggers Sharp Equity Rally

Early Movers

Higher: CLDX +7%, GLUU +7%, DSW +7%, AAL +5%, JBLU +2%, LUV +2%

Lower: WTW -9%, CRZO -4%, MU -3%, QGEN -2%

Chaikin S&P 500 Signals

Overbought Sell: IRM

Momentum Breakout: ANTM, BBY, EW, UNH, WBA

Money Flow Buy: AVGO, CTSH, MCK, MDT, PFE, TEL, VLO

Relative Strength Buy: FIS, HAR, MCK, WYN, CELG, DHR, EQR, HON, IPG, JNPR, LM, LO, MDT, NWSA, PFE, TMO

Relative Strength Breakout: CHRW, RSG, RTN

Groups/Stocks

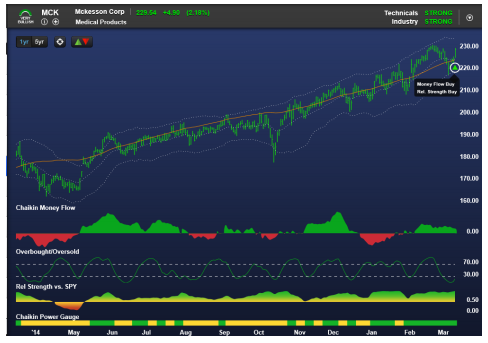

Medical Products (Rank: Strong) / McKesson – MCK (PGR: Very Bullish)

MCK is in the Medical Products Industry Group, which has been a strong performer for many months. Despite hefty gains the group continues to sport a strong Power Bar Ratio (61 Bullish, 21 Bearish). The group has pulled back recently with the market, but the Chaikin Credentials for most of the stocks have remained positive. These are the type of stocks investors should be focusing on (in pullbacks) when market uncertainty/volatility is increasing. MCK registered both a Money-Flow Buy Signal and a Relative Strength Buy signal yesterday. While two signals don’t double the odds for success, they do favor MCK outperforming the market over the next 1-3 months.

(c) Chaikin Analytics, 2015

Overnight/Pre-Market

China extends Monday’s breakout to new 52-week highs by another +1.5% (6th gain in 7 sessions), Hong Kong continues to struggle (-0.20%) after sliding -5% in the previous two weeks and Japan gains +1%, as demand persists following February’s breakout to new 15-year highs.

In Europe the FTSE is flat (+0.13%), but the DAX is backtracking -1.4% after hitting another record yesterday (reaching +46% above the December low and +24% YTD). That’s obviously affecting the S&P futures, which are down -5 points net. Also pressuring the futures is another -2.5% decline in Crude Oil (which has moved under yesterday’s low) and a +3 bp increase in the 10-year yield.

Looking Back

Monday Overview

The SPX jumped the most in six weeks yesterday, boosted by weaker than expected economic data, merger news and stability in the Euro. The +1.35% gain, together with last Thursday’s +1.26% jump, has repaired half of the recent -3.77% decline. The DJIA advanced a similar amount (+1.29%), while small-caps (which outperformed last week), lagged by 50% as the pullback in the Dollar redirected demand towards those stocks sporting exchange-rate sensitivity.

Crude Oil fell another -2.1%, which was actually a mid-range finish after being as low as -4.25% at 11:00 a.m. The rebound allowed the S&P Energy sector (XLF) to recover an equal amount off its intraday low (to +1.35% net), with heavyweights like XOM (+1.06%) and CVX (+1.49%) having the biggest impact on the sector (although breadth was also very positive, with 41 stocks advancing and just 2 declining).

Weaker than expected Industrial Production data, along with a downtick in Homebuilder sentiment, were the most often mentioned catalysts for the equity-demand surge. However, with the 10-year yield down just -4 bps, we think that’s a bit of a stretch. The bigger positive was probably the +0.8% rebound in the Euro, which wasn’t a big deal on its own, but it was the fourth consecutive day where the currency has found support near 1.05. It may not hold there, but with the Dollar in such a hyper-extended state, any semblance of stability, especially with the FOMC meeting tomorrow, could continue to help equity Bulls.

Finally, it was no coincidence that yesterday’s rebound coincided with an equity market that was deeply oversold (short-term), had retraced 50% of the prior rally and had stabilized near key moving average support late last week. That configuration puts pressure on the shorts, especially with an event as important as tomorrow’s FOMC release lurking just around the corner.

Sector Performance

Healthcare (+2.2%), Utilities (+1.6%) and Industrials (+1.5%) led yesterday, while Materials (-0.11%) was the only negative sector. The rest of the pack all closed about +1.1% higher, but volume for seven sectors still fell short of the 5-day average and total exchange volume fell -8%. New highs in the SPX jumped to 11% (vs 2% making new lows) and SPX breadth was better than 10:1 positive, although the NYSE ratio was just 2:1 positive, which continues to indicate that the bull’s shopping list isn’t as broad as the closing gains would suggest. (Being selective in the initial stages of a rebound is normal. The key for sustainability, however, is for demand to eventually radiate out to other areas, something the Bulls were unable to do in the back-half of February).

Looking Ahead

With the DAX slipping -1.2%, with Crude Oil off another -2.5% (and at new lows) and with the 10-year yield backtracking -3 bps, volatility appears to be back for this morning’s opening. With the SPX having hit the 50% retracement mark yesterday (of the prior decline) it’s a natural place for traders to take some money off the table, especially with the FED meeting tomorrow. At 8:00 a.m. the S&P futures were down -5 points net, but actually -9 points under FV. An uptick in the Euro (+0.5%) has helped pull the S&P futures off the lows (the low was -12 under FV), although the Dollar is off just -0.2% vs. the basket of currencies. Initial support for the SPX is near 2073, followed by 2065 and then the 50-day MA near 2060.

Have a nice day.

Disclosure: None.