Real Personal Income Remains On Trend…Higher

“Davidson” submits:

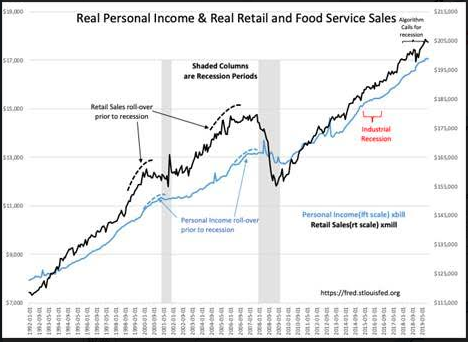

Real Personal Income is correlated to 3Q19 GDP (revised higher this morning), to Real Retail Sales and employment levels. Monthly and quarterly reports always have some volatility due to data collection. The fact remains that it is impossible for economic activity of ~330mil US individuals to surge/accelerate activity at the pace of the rises and falls that are reported monthly. Despite these well-known measurement flaws, traders and the media respond with commentary as if economic activity had suddenly slowed or accelerated by a surprising margin. While it provides media headlines, the true story lays in the 6mos-12mos trend as it relates to the overall trend of the cycle.

(Click on image to enlarge)

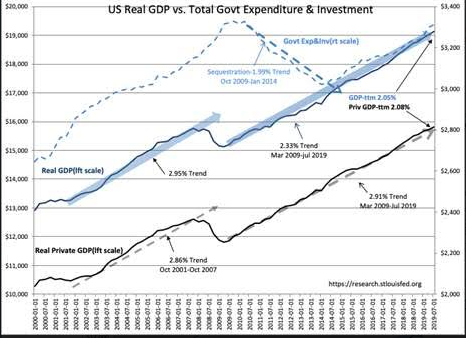

(Click on image to enlarge)

Just as the employment trend remains intact, so do trends in Real Personal Income, Retail Sales and Real GDP. Real Private GDP measures the economic activity without government spending. It is a more fundamental indicator in my opinion without the artificial impact of government spending. At 2.91% since 2009, this cycle trend remains on trend even though the ttm (trailing twelve mos) of 2.08% shows we are coming off the 2018 spurt from the tax reduction.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more