Your Retirement Plan Will Likely Run Out Of Money Before You Run Out Of Life

I recently ran across a special retirement report that included some shocking data. The report used historical investment results to help retirees project how long their savings will last. Of course, the hope is that your retirement savings last for the full length of your retirement. The scary news is that by using traditional investment strategies, that goal is less than 100% attainable.

I have regular contact with hundreds of savers, investors, and retirees who are part of my Dividend Hunter group. It keeps me constantly aware of the challenges we face in retirement, especially if someone retires with a lump sum of capital and has to make sure that money covers expenses and lasts for the rest of their life.

The traditional approach involves investing in a 60/40 mix of stock and bond ETFs. Financial advisors would tell their clients that they could withdraw 4% to 5% per year, adjusting for inflation, and the odds were their retirement assets would last. The 4% to 5% was viewed as a “safe” withdrawal rate that would keep going for up to 30 years.

However, in the current investment climate, retirees face many challenges with the traditional retirement approach, including:

- Originally, the 30-year number was picked for planning because, at that time, very few retirees lived that long after leaving the workforce.

- Meager interest rates mean that you cannot count on safe and secure income from the bond portion of a portfolio. Investment-grade bond ETFs currently yield about 3%, falling short of the targeted withdrawal rates. The safest U.S. Treasury securities pay less than one percent.

- Historical stock market results show that investing now in the broader stock market indicates a 50-50 chance that you could run out of money in as few as 22 years.

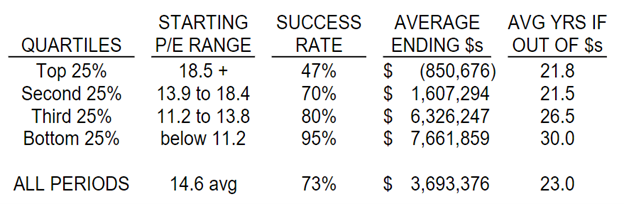

This table from the above-linked report shows the success rate when drawing 5% per year, adjusted for inflation, based on the stock market P/E ratio in effect when withdrawals for retirement started.

Note that top line, when the stock market P/E at the start of retirement is greater than 18.5, with 5% withdrawals, the investment account lasted for 30 years only 47% of the time. Currently, stock market P/E ratios are near record levels. The Dow Jones Industrial Average is priced at 29 times earnings. Even worse, the broad market S&P 500 trades for 40 times earnings. If you live for 40 years after retiring, under this scenario, you will run out of money halfway through.

If you are approaching or just beginning your retirement, this data should scare the heck out of you. It does me, especially on behalf of the subscribers to my income focused services.

The good news is that you can build a portfolio that throws off 7% to 9% cash income, letting you withdraw 5% per year and reinvest the remainder to ensure your income keeps up with inflation.I’m starting a class on this, click here for details.

Preferred stocks are one asset class that I have been recommending to my Dividend Hunter subscribers. One example is Chimera Investment Corp. Preferred Series B (CIM-PB).

Preferred shares have priority for dividends over common stock shares.

I like the stability of the CIM.PB 9.1% yield over the more at-risk dividends of the common shares currently yielding 11%.

If you are working with a financial advisor that recommends a portfolio of mainstream ETFs, with regular withdrawals that could deplete your principal, I want you to know other investment strategies will produce a great income and preserve the retirement money you worked so hard to accumulate.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more