What Will It Take To Turn This Bull Market Euphoria?

Investing is all psychological.

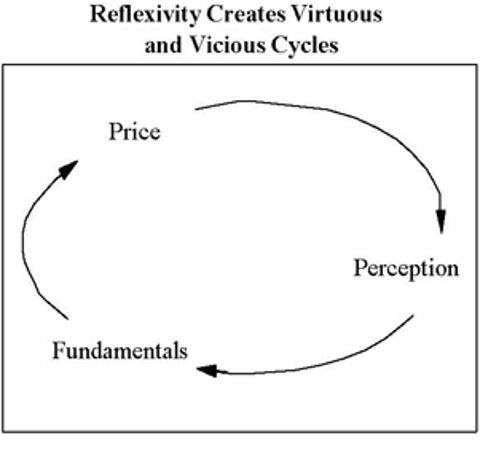

I learned from George Soros how important his Theory of Reflexivity is. The crowd's prevailing perception is what moves prices up or down, which further reinforce fundamentals, then proving the perception correct.

People will believe what they want to see. If the crowd is expecting a bear market and catastrophe, they will sell everything. And if they are expecting a bull market with bailouts protecting them, they will buy no matter how high the price.

Financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality. This is the principle of fallibility. The degree of distortion may vary from time to time. Sometimes it’s quite insignificant, at other times it is quite pronounced.

Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception, a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced. - George Soros

Since 2008, investors witnessed the extraordinary lengths that the central banks and governments went to, through zero-to-negative interest rates and straight-up printing money via quantitative easing.

They did all this to maintain confidence in the monetary system.

Because without confidence, investors will just sit idle and hoard cash and probably gold. This is what happened during the 1930s Great Depression. The persistent fear is what made it the decade-long GREAT depression.

Ben Bernanke, the former Federal Reserve Chairman, knew this. After-all, he was a self-proclaimed expert on the Great Depression.

So he did whatever was necessary to persuade investors that confidence was stable. So that consumers would keep borrowing and buying.

At some point someone must have said to themselves, "the world is in this mess from too much debt and overspending. And their solution? Pile on even more debt and spend even more out of our means?"

I know I sure did. . .

But regardless, here we are. It's June 2017 and markets are at all-time highs. Confidence is more than euphoric. It doesn't matter what the catalyst is - good or bad - just keeping buying stocks higher. Just like the 1990s had Alan Greenspan to reassure investor confidence (the infamous Greenspan Put), today it is the "Central Bank Puts".

Derived from the concept of a put option, these terms refer to central bank policies that encourage risk-taking and force equities higher. For instance, Alan Greenspan was known for lowering the Fed Funds rate whenever the stock market dropped below a certain value, which resulted in a negative yield and encouraged movement into equities.

Investors have realized it's a win-win. If GDP and credit markets fall, the Fed will simply slash rates and print more money, which will help our assets. If GDP and credit markets strengthen, then that will justify the even higher prices.

Janet Yellen, the current Fed chairwoman, will always give us a rosy outlook.

Think about it ... Imagine what markets would do if she came out and said, "things are out of control. Growth is collapsing. And stocks are in a huge bubble."

We can't get the whole truth or even an honest view of what the Central Banks think. Because remember, they can't shake confidence. Where does that leave markets going forward? If it is truly a win-win regardless of economic data, will markets just continue upwards forever?

If you're reading this and thinking "yes" - beware. History is littered with the corpses of investors who thought the same.

But, honestly, what will it take now to shake confidence?

I have thought long and hard. I have read countless books. And I have spoken with numerous investors. I came to the conclusion that the market needs action, not words, to collapse.

For example, last month the Canadian alternative mortgage lender Home Capital Group's (CN:HCG) stock plummeted roughly 75% over two days.

Home Capital Group basically had a bank-run. Their liquidity was drying up as depositors were pulling money out. Therefore it needed an immediate emergency injection of capital to keep the lights on. And it's going to cost them as the deal they got was very expensive.

The C$2 billion ($1.5 billion) loan is coming from an institutional investor that Home Capital did not identify, and the lender’s agreement is non-binding. With a 10 percent interest rate plus other fees and charges, the company is effectively paying 22.5 percent on the first C$1 billion it borrows, which falls to 15 percent if it uses the full C$2 billion available to it, according to Jaeme Gloyn, an analyst at National Bank of Canada (Source:Bloomberg)

A couple days later the mystery "institutional investor" was exposed. The good pensioners of the Healthcare of Ontario Pension Plan (HOOPP).

How did the 321,000 retired health workers of Ontario get on the hook for this? Well, the CEO of the HOOPP, Jim Keohane, was also a director for Home Capital Group. He recused himself from the board of Home Capital Group the night before the deal was announced.

But it gets better. . .

The chairman of Home Capital Group, Kevin Smith, was on the board of HOPP. Because of the clear conflict of interest, he also recused himself from HOPP's board.

HOOPP confirmed in a separate statement late Thursday that it has agreed, along with a syndicate of lenders, to provide the C$2 billion credit line.

And just like that, somehow an unlikely lender came to the rescue.

Of course many stocks of Canadian mortgage lenders suffered because of this. Especially Equitable Group Inc (CN:EQB) being brought down as a side-effect of Home Capital's own problems. It's eerily similar to how things began to unfold pre-2008.

Yet look at Home Capital Group today. The company is under pressure from the Ontario Securities Exchange (OSE) for falsifying income on loan applications. And the Canadian housing bubble has already peaked. Still, the stock is recovering and the alarming news was as good as ignored.

That's what I am getting at in writing this article. Talks of a catastrophe were just that - talks. For this market to actually shake confidence, it will need more than simple jawboning of a crisis. Sudden action will be needed.

Instead of Home Capital Group talking about needing liquidity, they need to suddenly bankrupt. . .

Instead of China talking about devaluing their currency, they need to actually do it. . .

Instead of the Fed talking about unwinding their balance sheet, they need to surprise markets and do it. . .

Until investors are plagued with sudden changes that leave them speechless, I don't believe the market confidence will falter.

What made 2008 frightening? It was how fast the steadily declining financial markets suddenly imploded.

As long as investors believe something will pass over, their confidence won't be shaken.

But once that fine line is crossed - watch out.

Disclosure: None.