WeWork, Office Space Worth More Than $47 Billion?

-

WeWork allows start-ups and companies to rent office space.

-

Members get access to office space and amenities like wifi and coffee.

-

Tenants don't sign a lease, but they rent space with agreements averaging 15 months.

-

The company signs leases up to 20 years in length.

WeWork (WE) is getting ready to IPO and my first thought was "What does this company actually do?" So, I invested some time trying to figure that out. I read several news articles about the company's IPO and came up with nothing valuable. I even watched this video.

Uh... What do they do again.

I found this page which appears to show some people on laptops drinking coffee and surfing the internet in a sterile cafe-like setting. According to the page, you can pay for a flexible space that changes every day and get access to free wifi.

This rings a bell. The word cybercafe is a close proxy. For those of you that are millennials, a cybercafe is a cafe where customers would sit at computer terminals and log on to the internet while they eat and drink. Before wifi, people actually paid to access the internet through a terminal. The cyber cafe was soon replaced by chains like Starbucks and the fact that people could get high-speed internet at home through their local cable company.

What amenities do you get with your Hot Desk? Micro-brewed coffee and tea, 24/7 building access, free wifi, and unlimited guests. The company basically rents out office space.

As a one-time entrepreneur, my interest is peaked. So, I start looking at the pricing. There isn't much available to me nearby, but a city like Charlotte, NC has a few options, including a $260/month Hot Desk.

What's the average membership term?

Luckily, this is disclosed in the S-1 filing.

We monetize our platform through a variety of means, including selling memberships, providing ancillary value-added products and services to our members and extending our global platform beyond work. Today, we are signing more multi-year membership agreements for various space solutions across our global platform: the average commitment term of our membership agreements has nearly doubled from approximately eight months as of December 1, 2017 to more than 15 months as of June 1, 2019.

So, on average members have committed to lease space from the company for 15 months. This seems a little short for the average office lease.

Can tenants cancel? (membership terms)

You can cancel your account at any time, by submitting a request at weworkcm.zendesk.com. Please note that if your individual account was created by a Company, (A) an authorized representative of such Company may at any time terminate your individual account by contacting us, and (B) we may terminate your account, even if the Company’s account remains active, and even if you continue to be employed or engaged by such Company. Cancellation will be effective immediately upon our receipt of notice of cancellation. We do not provide refunds upon termination or cancellation of your account with respect to amounts already paid.

This sounds great. As an entrepreneur, you could rent a space and if your business fails, you can easily get out of your office lease because you don't have one! It is unclear from this whether there are early termination fees.

Does WeWork make a profit?

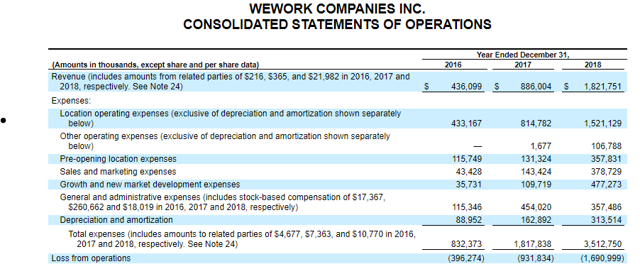

Source: S-1 Filing

The answer is a resounding NO. This isn't even the full income statement. The Operating Loss has been nearly as large as the companies revenue in each of the past three years. What's more scary is that despite the rapid growth, the operating margin hasn't really improved.

How does the company secure real estate locations?

Long-term leases are our primary means of securing real estate to deliver space-as-a-service to our members. Source: S-1 Filing

If you search the S-1 filing for the word "lease", you get 939 results, including this paragraph.

Properties Leased to The We Company

We are party to lease agreements for four commercial properties with landlord entities in which Adam has an ownership interest. These leases, individually and in the aggregate, are not material to our operations and represent only four of our 528 locations as of June 1, 2019. For one of these four properties, we entered into a lease agreement with the landlord/partnership entity within one year following Adam acquiring his ownership interest, and in the other three cases we entered into a lease agreement with the landlord/partnership entity on the same day that Adam acquired his ownership interest

Adam Neumann is the company's Co-Founder and CEO. If you are thinking of investing in this company, I encourage you to read the Related Party Transactions, Note 24.

Further, the company has a $47.2 billion lease liability related to future contractual obligations to their landlords.

In addition, as of June 30, 2019, we had future undiscounted minimum lease cost payment obligations under signed operating and finance leases of $47.2 billion, and if we are unable to service our obligations under the lease agreements for particular properties, we may be forced to vacate those properties or pay compensatory or consequential damages to the landlord.

What I really want to know is how long the company is locked into long-term lease agreements. The only thing I could really find was a reference to a 20-year lease term.

So far, we know that WeWork leases billions of dollars worth of office space for terms up to 20 years and the average tenant has a 15-month contract.

What's the org structure look like?

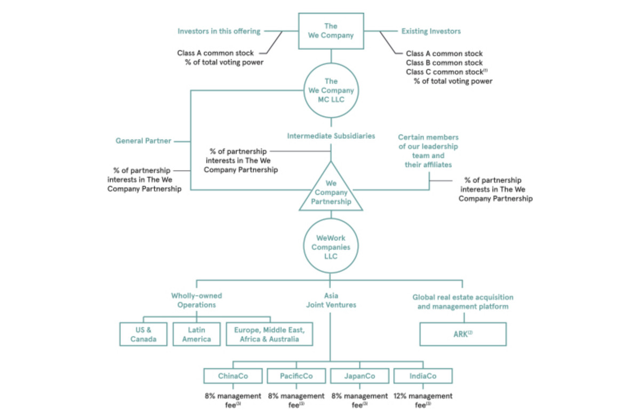

Here's a graphic.

Here's what one author had to say about it,

This is the planned structure for The We Company after its IPO, as it appears in its S-1 form. I’d try to explain it, but I don’t understand what the f*** is happening.

What's the state of the U.S. Commercial Real Estate market?

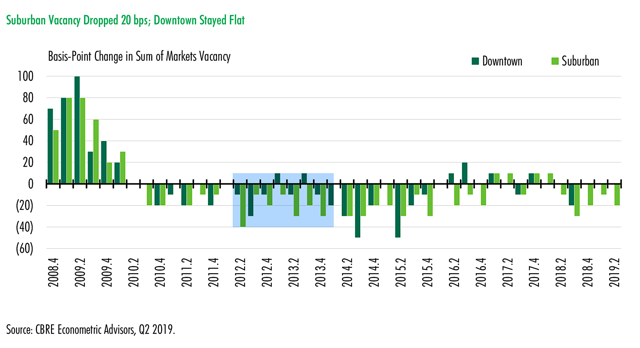

During the last recession, commercial office vacancy skyrocketed, as employees were laid off and businesses cut costs. Since 2010, though, the vacancy rate has improved (along with the employment picture). A reasonable investor might conclude that this is the very top of the commercial real estate cycle, especially if the economy was to head into a recession.

The really scary part for me is that this is the height of the commercial real estate cycle and the company is hemorrhaging cash.

Concluding thoughts...

Take a very hard look at this company's financial statements and related party transaction notes. The cash flows are coming from companies that have chosen not to invest in space of their own.

During a recession, commercial office space can quickly become vacant and the cost of leasing space can collapse. This company appears to be betting that businesses, entrepreneurs, and individuals will choose their loose contract terms and short minimum lease agreements, but this could come back to haunt them. In a downturn, start-ups could lose funding and cheap lease options with competitors could entice them to abandon their "memberships." They have long lease agreements with their properties, it appears and that is a red flag for potential liabilities.

Disclaimer: No position. The ticker symbol will be "WE" if it IPOs.