Want Good Grades? Buy This Student Housing REIT

While American Campus Communities (NYSE:ACC) is the biggest and arguably the best of the student housing specialty REITs, this pitch is "high and outside." It's had a nice run of late, which makes it a little high-priced and outside the value range in which I prefer to buy. So in addition to nibbling now, I will add on any correction to the low 40s and be a buyer in size in the 30s - if that opportunity presents itself.

ACC is the largest developer, owner and manager of high-quality student housing communities in the country. Since 1996, they have developed more than $3.8 billion in properties for their own account and their university clients, and they have acquired in excess of $3.7 billion in student housing assets. They've also been awarded the development of more than 60 on-campus projects.

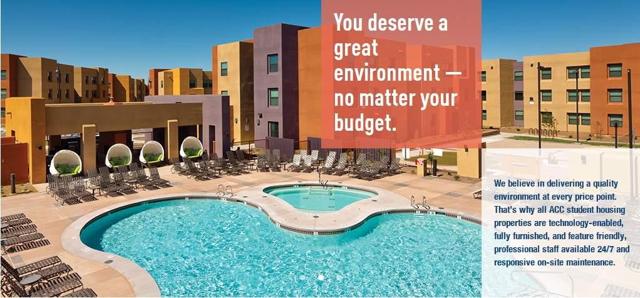

I couldn't afford to live in student housing when in college. But I understand from others who did, and who are now parents of college kids, that things have changed! Swimming pools, fitness centers, volleyball courts, walk-in closets and private baths and, of course, constant access to super-fast broadband, now seem to be the norm at upscale facilities like those offered by ACC.

Because colleges and universities are often non-profit (at least for tax reporting purposes) they can sometimes build housing at a better price than a REIT could. But most of them long ago ran out of room, so student housing adjacent to colleges, or if the university decides it is too low-margin a project, replacing student housing on campus, is now a superb niche business.

ACC is the big dog and it targets the bigger universities, typically those with 15,000 or more students. That's where they can achieve the best economies of scale. Its real competition is not another deep-pocketed REIT but rather the plethora of smaller units , some fine and others of dubious quality, often with absentee landlords, that currently dot the just-off-campus landscape. It pays a lower dividend than our other REITs (just 3.7%) but I believe it offers the probability of better long term growth than most REITs. (Of course, if online universities rule 10 years from now or no one goes to college or no one offers student loans, all these apartments will need to be repurposed and rented to young couples and singles.)

Until relatively recently, there was no such thing as purpose-built student housing, but when you think about it there are different needs in terms of social centers, fitness, and proximity to campus that make this a pretty smart idea. Even so, only 20% of the old-style cinder-block, shared-bath dormitory-type student housing has been replaced. The size of the remaining conversion market is huge.

And it turns out that many students actually want to go to school to study. Who knew?!! But as ACC's CEO Bill Bayless recounts, "We took over an apartment at Arizona State University in Tempe that had a party reputation and told the residents that we were developing an academically oriented community with no tolerance for rowdy behavior. The building had a 70 percent occupancy rate before we took it over. Most of the previous residents left, and yet we quickly reached 100 percent occupancy."

ACC will do well as long as enrollments stay roughly the same and old properties need replacing. If enrollments increase, so much the better. If more moms and dads are paying (rather than the student,) as seems the trend, better yet. Parents tend to pay up for secure, well-maintained, academically oriented housing and they are not nearly as price sensitive. When you're laying out $20,000 or more for a year's tuition, an extra thousand or two for the peace of mind of knowing the kids are in a cleaner, newer, safer place barely enters the equation.

American Campus Communities is basically a residential REIT with a twist: most apartment REITs would find the high turnover impossible to deal with. But ACC has learned to handle it, and handle it well. They keep the occupancy high and enjoy a year of stability unless students drop out of school and the apartment can't be re-rented. While the former may happen, they do have a contract in case it can't be re-rented. But that is seldom a problem.

The student housing niche in the residential housing sector is just in its first years. Even in areas where ACC and its competitors have a number of facilities, the total number of students in their complexes run just about 40% of the total number of students in need of such housing.

One thing to keep in mind, as well: this niche may be one of the more recession-resistant areas of real estate. As we saw in the past few years, if people are losing jobs or having trouble finding one, they tend to consider higher education to beef up their resume. For those already in school, they may continue to do graduate work, knowing it increases their chances of getting a job. No one knows if we are due (or overdue) for another recession, but if we do I want to be in sectors and companies whose revenue and earnings keep rising even in bad times. American Campus Communities fills the bill.

Disclaimer: As a Registered Investment Advisor, I believe it is essential to ...

more