Two Investing Habits Losing You Money – And How To Fix Them

I have the opportunities to talk to a lot of individual investors. I am a regular, invited presenter at various investor conferences, and I frequently answer email questions from my newsletter subscribers. From these interactions, I have learned that the two hardest things for investors to do is to buy shares when the market is down, and sell when profits are running. With an income focused approach, it becomes more automatic to buy low and sell high, rather than follow the herd and lock in losses when the market is down.

I continue to talk about how income-focused investors need to be able to buy shares when prices are dropping, therefore locking in higher yields. To buy when everyone is selling and when the financial news media is predicting some sort of meltdown takes two factors and some intestinal fortitude. First, you need to be very familiar with the income stocks you want to buy. You need to have a strong understanding that even if the market is dropping like a rock, the company’s business can and will continue to operate as it has in the past. Second, you need to understand that if you buy in at a great share price, the price may continue to fall. At that point, you are focused on earning dividends at the yield your entry point allowed.

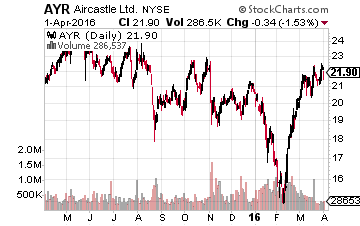

For example, I have been following aircraft leasing company Aircastle Limited (NYSE: AYR) for a decade. I know that this is a very well-run company that generates free cash flow of three to four times the dividend payments. I also know that management will continue to increase the dividend by 8% to 10% each year. In the mid $20’s, AYR yields under 4%, and that yield plus the growth potential is not a compelling value.

However, when the stock drops under $20, the yield approaches or exceeds 5%, and I am a willing buyer. Back in mid-February, during the market correction, AYR declined below $16 per share and I made the stock the recommended buy of the week for my Dividend Hunter newsletter subscribers. The market has recovered, and AYR has soared. Those who bought on my recommendation are now sitting on a 44% gain and hold shares with a yield on cost of 6.2%.

The other side of buying low is implementing a system to sell high. The market never keeps going in the same direction, whether that is up or down or sideways, forever. Again, I recommend a different strategy for investors focused on dividend income. As the share price of a stock rises, the yield goes down. It’s a mathematical inverse relationship between share price and yield.

When one of the stocks I have recommended has had a nice run-up, I look at the current yield and dividend growth potential to determine if it is best to continue holding the stock for the future dividend stream or whether it is better to sell, lock in the profits, and reinvest the proceeds into another stock. Here is an example that illustrates the thought process.

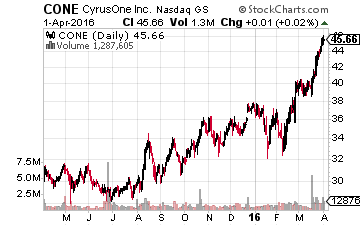

I made CyrusOne Inc. (NASDAQ: CONE) a newsletter recommendation in July 2015. At that time, the stock was yielding 4.2% and my dividend growth forecasts were at 20% per year. A 4% yield and 20% dividend growth gives a mathematical total return prediction of 24% per year. However, the CONE share price has taken off over the last six months and my subscribers are sitting on a 58% total return since the stock was first recommended. The company did increase the dividend by 20.6% in February, right in line with my expectations. However now, even with the higher dividend rate, CONE yields just 3.3%.

The total return generated in the last nine months equals almost 2.5 years of total return as predicted by my dividend growth mathematical model. From this point, my expectations are either much lower total returns not justified by a 3% yield, or even a significant share price decline. So I have recommended that my subscribers sell CONE to lock in the nice gains.

CyrusOne is a great company with tremendous growth. But, my yield driven approach tells me that with the current low yield it’s time to lock in the total return profits. If, at some point in the future, CONE again yields above 4% I will take a close look at again making it a Dividend Hunter recommendation.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term.

The combination of a high yield and regular dividend growth is what has given me the most consistent gains out of any strategy that I have tried over my decades-long investing career.

You probably already know there are about 3,000 U.S. stocks that pay dividends, with some yielding 12%+ per year. But it’s not the size of the dividend that counts, it’s whether those dividends are sustainable and rise over time, like the ones mentioned above.

Rising dividends propel share price returns and rapidly increases the cash income you earn on your investments.

Disclosure: There are currently over twenty of these stocks to choose from in my more