Trends Point To Rents Edging Higher In The Future

You Can Count On Death, Taxes, And Higher Rents

Several trends point to the reality we should expect rents to edge higher in the future. While many economy watchers tout the line that any economic crisis will result in massive defaults and deflation, hidden forces may prove them very wrong. Over the last few decades, a great amount of wealth flowing into paper promises rather than tangible assets has masked true inflation, but it is everywhere. One place it is most obvious is in the replacement cost of buildings and infrastructure destroyed or damaged by nature's fury.

Local, state and national governments need revenue and this translates into higher taxes, plus a slew of new fees are about to be unleashed upon their citizens. These will take many forms but it is clear that we will see more taxes assessed upon wealth, income, and property as well as soaring utility cost often driven by government mandates. When push comes to shove, we can expect the government to suck wealth out of the private sector using the "greater good" as their justification.

Most people do not realize big government acts as a wall against deflation. Over the years as the government has grown it has created a wall of rising resistance to a pullback in prices. Today with more employees guaranteed their wages will not fall, and governments committed to buttressing their economies during "hard times," people have less to fear when it comes to seeing their incomes slashed. In this way, big government is more aligned to creating inflation or stagflation than adding to a self-feeding deflation loop. All these factors mean we should all begin to prepare for higher rents and expect the cost of a place to live and do business to edge ever higher with any reprieve due to high vacancy rates as only temporary.

It Comes Down To What You Can Afford

It Comes Down To What You Can Afford

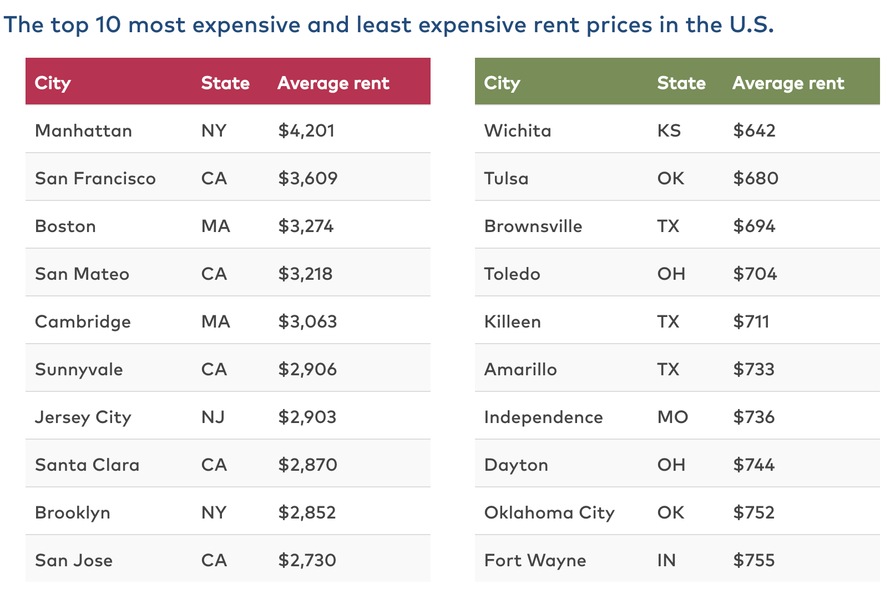

Rising property taxes and fees, utility bills, as well as increased maintenance cost, must be passed on or the supply of housing will substantially decrease. This translates into housing simply becoming unavailable which is what happens under price controls. Ever higher rents are already driving people away from expensive-coastal-cities expensive coastal areas such as New York City and San Francisco into Sun Belt cities where relatively cheap rents, nicer weather, and good job opportunities await.

A recent monthly report from RentCafe, a nationwide apartment search website that enables renters to easily find apartments and houses for rent throughout the United States, indicates this trend is already beginning to lift the cost of living in what were often considered inexpensive areas to live. While across the nation average rents climbed only just 3.3.% year over year according to Rent Cafe's Yardi Matrix, in January rents rose most rapidly in smaller cities such as the suburb of Henderson outside Las Vegas, Nevada. Of large metro areas, Las Vegas stood out as the city where rents saw the fastest growth (+8.3%)with rents in Phoenix, Arizona, also seeing a large (+7.6%) increase. Still, even larger increases occurred in smaller cities like Midland, Texas (17.7%), Odessa (14.2%) and Reno (10%).

Click On this List to Enlarge!

Click On this List to Enlarge!

Add to the issue, demographic trends will continue to support housing demand as older less expensive units come offline and are replaced by newer more expensive units the cost will be passed on. In the future, higher interest rates will be of little help in bringing down housing cost because the financing cost to build new rental units will rise. While this may impact what rental units sell for it does little to lower the monthly debt service of landlords which is part of their expenses that feed directly into rents as the overall cost of doing business.

As you read this article it is important to realized rising rental and housing cost is in part being driven by America's frustrating housing policy that allows or is complicit with watching roughly 80% of new apartment construction flowing into the high-end luxury market. The government holds huge responsibility for a rising share of our housing problems in low-income situations because its policies avoid dealing with the growing number of tenants that are poor. Irresponsible government housing cherry-picks the best of the low-income renters providing them with very low rents and nice apartments and dumps the rest on the private sector. The best way to address or level the playing field would be to move away from public housing and give those needing housing aid "rent only vouchers" that could be used with any landlord rather than putting these people into a quasi-government run project.

Not only is all this discombobulating enough, even when our government funds low-cost housing it is often squandered. Fort Wayne, the city where I live, has announced another incestuous boondoggle to be built "low cost " housing using government money. Fort Wayne is on the list of least expensive places to rent and it should be noted that a slew more new apartment projects are already under construction which will pressure rents even lower. We can now add to these, Posterity Heights, a multi-phased development designed to provide net-zero housing, electric car sharing, an on-site early childhood learning center, education and job opportunities, healthy food and other amenities for traditional and single parents on a path to self-sustainability.

The $42 million development will indeed be a monument to governments inability to act responsibly. Let me be clear, these residential units are not "plain Jane" in nature but an "over the top" effort to build an expensive monument to "affordable housing" that can act as a model for other communities. This is a cutting-edge experiment so inclusive that it even provides an electric car-sharing program for residents. This is exactly the type of project that raises the ire of hard-working taxpayers who wonder why their lower-income neighbors are enjoying new side by side refrigerators and have trash compactors while they don't.

In the long run, rather than pouring money into the hands of those needing housing in areas that are very expensive to live, the government would be wise to encourage many of these people to relocate to where housing is both plentiful and less expensive. Over the long run, this would be a "win-win" in that it would lessen the cost of housing low-income people while supporting housing values and encourage renovation of the housing stock in these areas. The amount people pay in rent for a small apartment over three to four years in an area like New York City or San Francisco is often less than the cost of a home in some cities.

Many people that have tried out the role of being a "landlord" will testify that it really is not all that fun and the risk to reward ratio is totally out of whack. We live in a society that is becoming more progressive and bending over to protect the rights of what they call the "most vulnerable." This means the rights of property owners are often thrown under the bus for the "greater good." A difficult and expensive court system coupled with a lack of desire on the part of society to protect the rights of landlords has driven many small and private providers of housing from the market. Many of the judgments ordered paid by the courts are never paid and impossible to collect. When considering all the above it is difficult to see lower rents in our future.

Footnote: Here's an article that sheds a bit of light on this issue of evictions that result in people becoming homeless. I have found the reason many people are evicted is because they do not follow the rules. This often means they become ineligible for government housing programs. By making them "ineligible" for certain programs the government shrewdly and cleverly sidesteps having to deal with these people. It must be noted, the unintended consequences of government policy that sidesteps responsibility for the dysfunctional poor only add to America's housing woes.

This blog is not written for moneyor profit but as a way to share ideasand thoughts. If you liked this post

feel freeto share.