Top 3 U.S. REITs For The Rest Of 2020 And Beyond

The tax structure behind REITs is designed for the business to distribute the largest part of their profit to shareholders (unit holders). For many, Real Estate is the definition of stability in the investing world.

However, one must be careful about which type of Real Estate you choose. Classic retailers are under significant pressure and many shopping malls have and will deal with bankrupt tenants. Industrial REITs including warehouses, distribution centers, data centers, and cell towers are likely going to do well as they are supported by e-commerce and the internet. This is obviously a sector where you can invest 30% of your portfolio and still achieve a great diversification within the various sub-sectors.

This sounds like a sound plan for income-seeking investors.

For Retail REITs, I would pass. Most of them slowed down in 2019 due to the e-commerce trend. This trend will not stop in 2020… far from it. I’m more interested in apartment REITs.

That being said, one must make sure the REIT chosen will not only be able to sustain its dividend payment, but also to increase it. This is why I’ve built this US REITs ranking. This top three should give you the guidelines you need to select the right REIT for your portfolio.

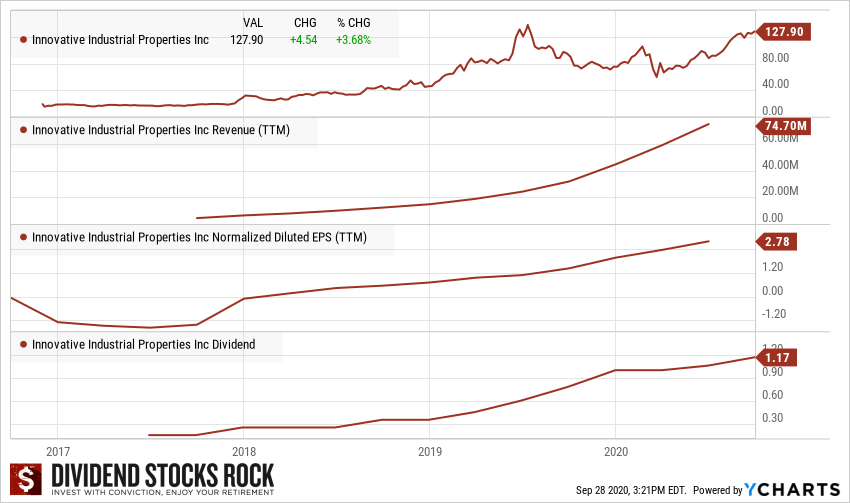

3. The Cannabis REIT

- Company Name: Innovative Industrial Properties

- Ticker: IIPR

- Dividend Yield: 3.65%

- Dividend growth since: 2017

- Distribution: Quarterly

Business Model

IIPR is a real estate investment trust engaged in the acquisition, ownership, and management of specialized industrial properties leased to state-licensed operators for their regulated medical-use cannabis facilities. It conducts its business through a traditional umbrella partnership real estate investment trust, or UPREIT structure, in which properties are owned by Operating Partnership, directly or through subsidiaries. The company faces competition from a diverse mix of market participants, including but not limited to, other companies with similar business models, independent investors, hedge funds, and other real estate investors, hard money lenders, and cannabis operators.

Investment Thesis

The cannabis industry is developing fast these days, but it’s not done without hiccups. A good way to enjoy part of this potential is to go through a REIT specialized in medical licensed marijuana growers. You won’t get the full hype (as compared to a grower), but IIPR is definitely looking to grow and fast. In the first 11 months of 2019, the REIT acquired 30 properties, and it keeps growing at a very fast pace. Both funds from operation (FFO) and dividend are following the same trend recently.

As for the units, Innovative Industrial Properties is currently fully rented and also grows through acquisition. Finally, it wouldn’t be a surprise to see more U.S. states legalizing marijuana. This could result in more growth potential for the REIT.

Potential Risks

Make no mistake, IIPR doesn’t touch the actual plant. It is not involved in producing any cannabis-related products. However, this doesn’t mean its stock won’t be affected by the hype (or fear). As you can see on the price graph, you can guess that if you invest in IIPR, you also buy a ticket for a roller coaster ride. It’s nice to see a company growing fast, but if management pays too much for their next acquisition or fails to integrate them, it could get ugly. While management goes on a shopping frenzy for new acquisitions, the cannabis bubble also pushes property prices higher. The cannabis sector is highly sensitive to regulations. What if laws change? IIPR had to offer rent deferral for some tenants, so don’t expect huge dividend increases in 2020.

Dividend Growth Perspective

The REIT paid its first dividend in 2017. At this point, the company dividend graph looks like a launching ramp. The stock price is at its peak right now, but I believe the REIT is not done growing so it could still be a good play to enjoy a solid ~4% yield. Management seems confident in the company’s future as it grows both its business and its dividend at a similar pace. The REIT targets at 75-85% AFFO payout ratio.

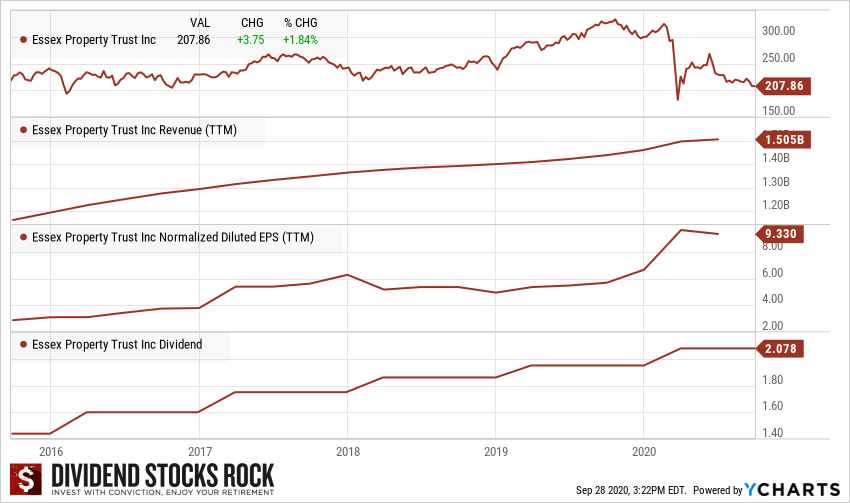

2. The Tech REIT

- Company Name: Essex Properties

- Ticker: ESS

- Dividend Yield: 3.67%

- Dividend growth since: 1994

- Distribution: Quarterly

Business Model

Essex Property Trust owns a portfolio of 250 apartment communities with over 60,000 units and is developing seven additional properties with 1,960 units. The company focuses on owning large, high-quality properties on the West Coast in the urban and suburban submarkets of Southern California, Northern California, and Seattle.

Investment Thesis

Essex Property Trust is everything a REIT should be: a dominating position in a rich market, a decent yield, and a stellar dividend growth history. Most income-seeking investors are looking at REITs with poor growth vectors and high dividend yield. If you are willing to go under the 4% yield level, you will find this beauty. Your income will be safe and protected against inflation. Plus, you will likely enjoy some value appreciation over the long haul. During the recession of 2008, ESS kept increasing its dividend while maintaining a strong FFO per share. The REIT positioned itself during the recession to make sure it thrives once the economy was ready to roll again. ESS regularly acquires multiple family REITs and successfully integrates them in their business model. Finally, Essex is well-established in rich and growing markets with the state of California and the city of Seattle. This REIT should ride on strong demographic and job growth tailwinds in the upcoming years.

The pandemic should not affect Essex too much. As the Dividend Aristocrat focuses on high-quality apartments around tech hubs, it attracts professionals and tech sector workers who won’t feel the recession much. Apartments REITs in themselves are interesting right now as they have not fully recovered from the market drop. ESS offers a good entry point at the current price.

Potential Risks

If you read the investment thesis, I think we made it clear that we like ESS. Its narrow market concentration is at the center of its success. In the past, we also saw similar growth stories ending in nightmares. While it seems unlikely to see California becoming a poor state, an important economic slowdown would greatly hurt ESS’s business model. ESS is clearly making a play on the tech sector by focusing on tech hub such as San Francisco and Seattle. The REIT usually offer short leases opening the door for more revenue volatility. Demand for apartments come and go. Building too many properties could end-up with oversupply in the event of a severe recession. Not to mention that California is currently hit hard by fires. Will it end up in people moving further away? It is possible. Still, Essex has proven its resilience as it keeps increasing its dividend during the tech bubble and the financial crisis.

Dividend Growth Perspective

This REIT has successfully increased its dividend yearly since 1994. This means Essex has never missed a dividend increase since its IPO in 1994! ESS is generating strong funds from operations (FFO) quarter after quarter. During their latest earnings report (ending March 31, 2020), the REIT posted core FFO per share of $3.48 while paying a $2.078/share dividend. We are talking about a 55% payout ratio. Essex also shows $1.6B in liquidity and a decent debt ratio. Shareholders can sleep well with a ~3.5% yield and a dividend increasing by 5-6% year after year.

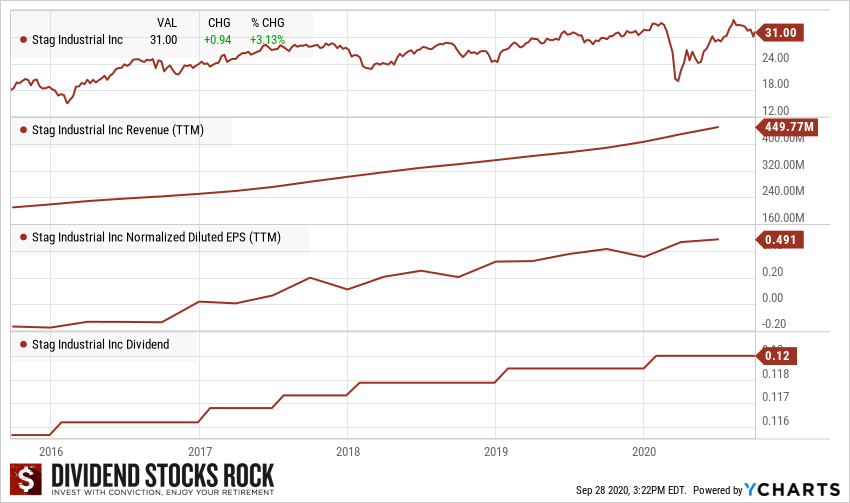

1. The Industrial REIT

- Company Name: Stag Industrial

- Ticker: STAG

- Dividend Yield: 4.49%

- Dividend growth since: 2011

- Distribution: Monthly

Business Model

Stag Industrial Inc is a REIT primarily involved in the acquisition and operation of single-tenant industrial properties throughout the United States. Most of these facilities are located in Midwestern and Eastern U.S. states. Stag Industrial derives nearly all of its income in the form of rental income from its portfolio of warehouse and distribution properties. STAG generates most of its rental revenue from its facilities located in Midwestern and Eastern U.S. cities. Stag Industrial’s largest customers include automotive (~12%), air freight and logistics (~9%), and commercial services & supplies (~8%).

Investment Thesis

While the growth of e-tenants’ credit profile is important, the need for warehouse space keeps growing. STAG is one of the largest players in that field and uses its size and strong balance sheet to acquire more real state in this playground. The REIT shows ~43% of its clients handling e-commerce activity. We appreciate STAG’s highly diversified tenant base offering warehouses to multiple industries. Roughly 55% of their tenants’ credit profiles are publicly rated and 30% of all tenants show investment grade. STAG focuses on smaller and individual properties instead of going for the big lots. This enables the REIT to face less competition and improve diversification.

As it’s the case for Essex, Stag should not be hit too hard by the pandemic. As most of its tenants are directly or indirectly linked to e-commerce, they should continue to grow. In fact, Amazon is their biggest client, but Stag is still very diversified.

Potential Risks

The REIT debt keeps going up every quarter. The company has more than doubled its debt (now around $1.5B) over the past 5 years. Still, STAG shows a credit rating of BAA3 (Moody’s) and BBB (Fitch). The issue with such an aggressive plan is not only the debt level but also the risk of getting too big. There are massive investments in the industrial REIT sectors, and we could reach oversupply at one point. Everything is rosy when the economy rolls, but the demand for warehouses could also slow down at some point. We like the business and the monthly dividend, but we think there is little upside potential at this point.

Dividend Growth Perspective

STAG offers a high yield (~5%) paid monthly. This is perfect for income-seeking investors. Through the REIT diversification and stellar business model, you can expect to get paid for several years. Unfortunately, the latest dividend increases were minimal. Your paycheck will cover inflation, but don’t expect impressive growth. You can look at STAG as a “deluxe” bond. Its business model has been proven “COVID-19 proof”, you can sleep well with this one.

Final Thought

Remember, income at retirement without growth won’t last very long. To protect your paycheck from getting eaten by inflation over the years, look for REITs and other dividend stocks that will provide you with a mix of yield and growth.

Disclaimer: Each month, we do a review of a specific industry at our membership website; Dividend Stocks Rock. In addition to have full access to 12 real-life portfolio models, readers can also ...

more