This Investing Strategy Will Beat The Market For 10 Years

The last five years have been very good for stock market investors. The S&P 500 SPDR as a proxy for the overall market has produced a 13.2% average annual return for the five years through the end of September 2015. However, going into the future, it looks like returns may be lower, possibly a lot lower. If you are like a lot of investors and need your investment account values to grow to meet your income needs in the future, it may be time to implement some different strategies to select stocks.

Recently I was watching Bloomberg and caught an interview with Ray Dalio, the founder and chairman of Bridgewater Associates, a very successful money management and hedge fund firm managing over $150 billion. He started the company in 1975, so Dalio has participated in the markets through numerous up and down cycles. In the interview he made a pretty good argument that the overall stock market returns will average just 3% to 4% per year for the next decade. If you are interested you can see the video excerpt here.

With economic activity around the globe slowing and the U.S. GDP growing at an anemic 2% to 3% per year, investment returns matching the economic growth rate seem like a strong possibility. The above average (the S&P 500 averaged 8.75% per year since the early 1990’s) returns of the last five years were primarily due to the natural market recovery out of the 2008-2009 bear market caused by the financial crisis. Now stock prices are more dependent on company earnings growth, and on average profits will grow at about the same rate as the overall economy.

A shift to lower overall returns from the stock market means that some of the current popular strategies will not work very well. Buying index ETFs, using a robo investing program or working with an advisor that farms out your money may very well lead to disappointing results a decade from now. To have acceptable investment results for the next 10 years requires an individual stock selection strategy that will separate out the small number of winners from the expected very average pack of stock market returns.

The great thing about the stock market is that there will always be companies that do well and have stock returns that beat the averages. As an individual investor you need to find a strategy or an advisor with a method designed to find stocks that can thrive in a low growth environment. There will be different approaches that work, but I would like to discuss one that you might want to consider. My investment strategy focuses on higher yielding stocks that can also grow their dividends. Remember we are trying to outperform in an environment where the overall stock market is generating 3% annual returns.

With some stock screening and some research, you can find stocks with current yields that exceed the 3% total return projection. If you own stocks that yield 5% or 6% and the market is only generating 3% total returns, you are already ahead. Then add in some dividend growth and your brokerage account growth should trounce the market averages. Here are a couple of example stocks.

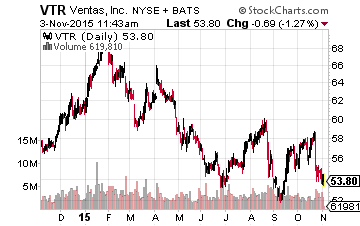

Ventas, Inc. (NYSE:VTR) is a large-cap REIT that currently yields 5.4%. The company has increased its dividend rate by 9% on average for more than 10 years. Ventas operates in the growing healthcare space, so there is a good chance that the company can continue or stay close to its historic dividend growth. Combine a 5% yield with 9% annual dividend growth and you have a stock that will produce low teens total returns over the long term.

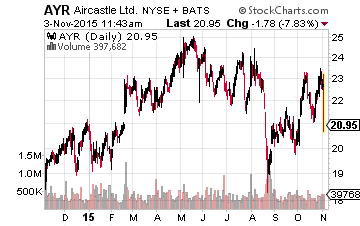

Aircastle Limited (NYSE:AYR) is a mid-cap company that buys commercial aircraft and leases them to airlines around the world. Aircastle’s business model lets it generate mid-teens returns on its invested capital. The current AYR yield is 3.8% and dividends are growing about 10% per year. What I like most about this stock is that it generates something like $4.00 per share in free cash flow each year and the current dividend rate is $0.88 per year.

These are a few examples of the types of stocks I look for to recommend to my Dividend Hunter subscribers. I tend to lean towards the higher yield stocks, to start earning income quickly that can be reinvested. Currently the average portfolio yield is about 8% and my forecast is for 6% annual dividend growth.

Finding companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term. The combination of a high yield and consistent dividend growth in stocks is what has given me the most consistent gains out of any strategy that I have tried.

Disclosure: more