These 3 REITs Are Expected To Announce Dividend Increases In January

To build momentum from your income stocks going into the new year, consider buying into those REITs that should announce higher dividend rates in the first month of 2020. Each month I publish a list of those real estate investment trusts (REITs) that should announce higher dividend rates in the upcoming months. This knowledge can give you a jump on the rest of investing public, which will be surprised when the positive news is announced.

I maintain a database of about 130 REITs. With it I track current yields, dividend growth rates and when these companies usually announced new dividend rates. Most REITs announce a new dividend rate once a year, and then pay that rate for the next four quarters.

Currently about 85 REITs in my database have recent and ongoing histories of dividend growth. Out of that group, higher dividend announcements will come from different REIT companies during almost every month of the year. With the potential of continued low yields on fixed income investments, the prospects of higher dividend payments coming in January will help to offset any share price disruptions resulting from announcements out of the Federal Reserve Board.

My list shows three companies that historically announce higher dividends in January and should do so again this year. Investors will start earning the higher payouts in the new year. But remember, you want to buy shares before the dividend announcement to get the benefit of a share price bump caused by the positive news event. Here is this of REITs to consider:

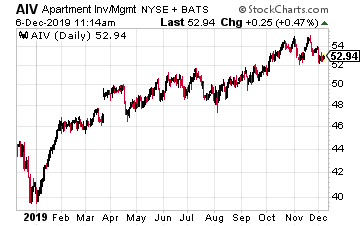

Apartment Investment and Management (AIV) is a mid-cap sized REIT that owns and operates about 140 apartment communities. About 40% of the company’s properties are in coastal California, with the balance spread across major U.S. metropolitan areas.

Last year, AIV increased its dividend by 3%. Also, in early 2019 the company declared a $2.02 special dividend. You can’t count on special payouts, but it does show a company focused on getting cash back to investors.

Cash flow growth has been comparable in 2018, and I forecast a 6% to 7% dividend increase in January. The new dividend rate announcement will come out in late January with a mid-February ex-dividend date and payment at the end of February.

AIV yields 3.0%.

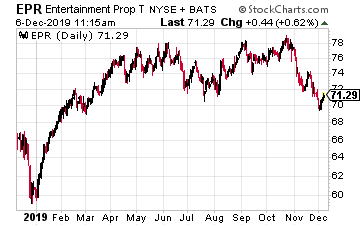

EPR Properties (EPR) focuses its real estate investments in three different business sectors. Primary is the ownership and triple-net leasing of entertainment complexes and multiplex theaters. The second sector is the ownership of golf and ski recreation centers, also triple-net leased. The third sector is the construction, ownership and leasing of private and charter schools.

EPR pays monthly dividends and has grown the dividend rate by an average of 7% per year for the last eight years. In 2019 the company was active in both acquisitions and new developments.

One big news item is that EPR sold its entire charter school portfolio.

The new dividend rate is announced in mid-January, with an end of January record date and mid-February payment.

This stock is a long-term recommendation in my Dividend Hunter high-yield service.

EPR is a monthly dividend payer and has increased its dividend by 31% since I first brought it to the attention of my Dividend Hunter readers.

EPR currently yields 6.4%.

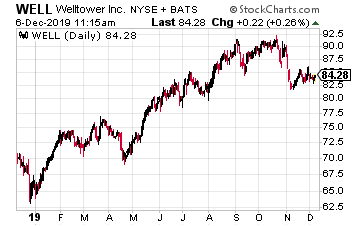

Welltower Inc (WELL) is a large cap healthcare sector REIT. The company owns properties concentrated in markets in the United States, Canada and the United Kingdom.

The portfolio is divided into three segments consisting of: Seniors housing, post-acute communities, and outpatient medical properties.

Triple-net properties include independent living facilities, independent supportive living facilities, continuing care retirement communities, assisted living facilities, care homes with and without nursing, Alzheimer’s/dementia care facilities, long-term/post-acute care facilities and hospitals.

Outpatient medical properties include outpatient medical buildings.

Welltower had increased its dividend every year since 2009 but has not increased its dividend for the last two years. 2019 net income an FFO per share growth has been solid, and the company is ready to restart dividend growth.

To get back on the dividend growth track, I expect a 2.0% to 2.5% increase to be announced in January.

The announcement will come out at the end of the month, with an early February record date and payment around February 20.

The stock yields 4.1%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more