REIT Pair Trade: Long Prologis And Short Simon Property Group

Summary: REIT Pair Trade

With more shoppers turning to online avenues, we expect brick and mortar shopping malls will continue to lose relevance and value. At the same time, companies are increasingly eager to compete with Amazon (Nasdaq:AMZN) by offering fast shipping. To do so they are leasing logistics centers and warehouses near cities and busy areas. We expect these market trends to put pressure on mall REITs and benefit logistic REITs. Our firm recommends an equal weight pair trade, going long Prologis (NYSE:PLD) and short Simon Property Group (NYSE:SPG).

Specifics: Long Prologis and Short Simon Property Group

Our firm recommends a pair trade position given our agnostic views on the REIT market overall. By going long Prologis and short Simon Property Group, investors are able to take a market neutral approach that hedges against the sector and overall REIT market. This approach limits investors to stock-specific risk, which is the focus of our analysis. Given the pressure on mall REITs and the positive market trends for warehouse REITs, we expect Prologis to increase further (or decrease less) than Simon Property Group, regardless of how the market reacts.

There are several reasons why Simon Property Group stood out as the worst performing mall REIT and why Prologis was selected as our long warehouse REIT, which are detailed below.

Simon Property Group

Simon Property Group is the largest retail-focused REIT in the US, consisting of 108 malls, 67 outlets, 14 mills, 4 lifestyle centers, and 13 other retail properties. The REIT's pure focus on malls puts it at high risk for retail closings. In its SEC filing, Simon Property Group states, "some of our properties depend on anchor stores or other major tenants to attract shoppers and could be adversely affected by the loss of one or more of these anchor stores or major tenants." SPG lists the retail anchors and selected major tenants in each of their properties, and Sears (Nasdaq:SHLD) is included in 76 of them (~77% of the properties). Other major retail tenants included: Macy's (NYSE:M), JC Penney (NYSE:JCP), Target (NYSE:TGT), and Dicks Sporting Goods (NYSE:DKS), all of whom have recently announced store closings and seen their stock prices drop.

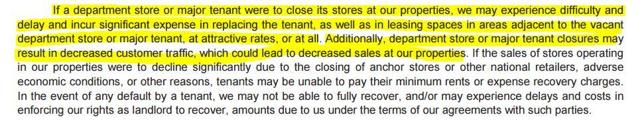

Simon Property cautioned that if major retailers leave, it could face significant expense in replacing these tenants and may have to do so at less attractive rates--or not at all. Given the network effect of malls, the closing of one store could adversely impact all stores in the mall.

Despite announcements of store closings, SPG's stock price is down just 4.2% YTD versus the 5.4% increase for the S&P500. Given the significant portion of revenue at risk with these major retailers closing stores, the market has not fully reacted to the news.

(Click on image to enlarge)

Another major concern to us is the company's highly leveraged balance sheet, which leaves little room for misstep. The company has one of the highest debt to asset ratios amongst all retail REITs. In 2016, the company paid $857.5M in interest expenses, equaling an interest coverage ratio of 31.5%. Such a high interest coverage ratio is troubling and well above the average in the REIT industry. These rates could increase further with rising interest rates. The company has total liabilities of $26B, which is more than 5x its total equity. Any reduction in revenue or profit margins could put SPG in danger of being unable to meet interest expenses.

We also liked that the large size of Simon Property Group minimizes risk that SPG will become an acquisition target, as struggling mall REITs seek to consolidate. Risk that we are shorting a company that could become an acquisition target is minimized as SPG is the largest retail REIT in the US. Similarly, in choosing a REIT to invest in, we focused on large market cap stocks so as not to introduce small cap vs. large cap exposure to the pair trade.

On March 17, 2017, Goldman Sachs downgraded the company to reflect its expectations of a slowdown in earnings growth in the upcoming earning report. The company is expected to report earnings on April 27th. The stock was also recently downgraded by SunTrust Robinson Humphrey (1.20) and Deutsche Bank (1.09).

Prologis

Prologis leases modern logistics facilities to ~5,200 customers and is poised to grow as companies transition more retail online. In 2016, it leased more than 180 million square feet of logistic real estate. Due to strong demand, Prologis finished 2016 with the highest-ever occupancy rate of 97.1% (occupancy rate in 2015 was 96.9%) and rental rates for the year grew by 13.8%. Prologis credits this growth to improved operating conditions and strong demand and expects this trend to continue for the next five years.

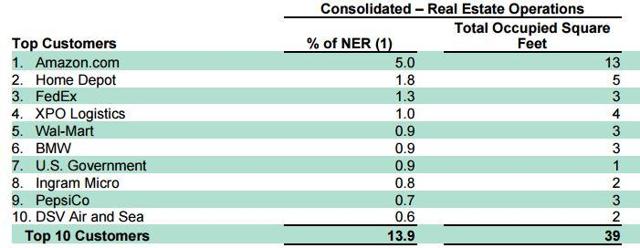

Prologis has a strong customer base. The company's top customer is Amazon , which contributes to 5% of the net effective rent for Prologis. Other big name customers include: DHL, FedEx (NYSE:FDX), Home Depot (NYSE:HD), and Wal-Mart (NYSE:WMT). The company has a diverse group of customers, with no one customer accounting for a material amount of revenue.

(Click on image to enlarge)

Prologis is also well diversified in terms of the industries, leasing to companies ranging from automotive to consumer products and ecommerce; and has recently focused on expanding outside North America. White the company generates the majority of NOI from North America, the company is taking steps to further diversify, by deploying significantly more capital and development products abroad.

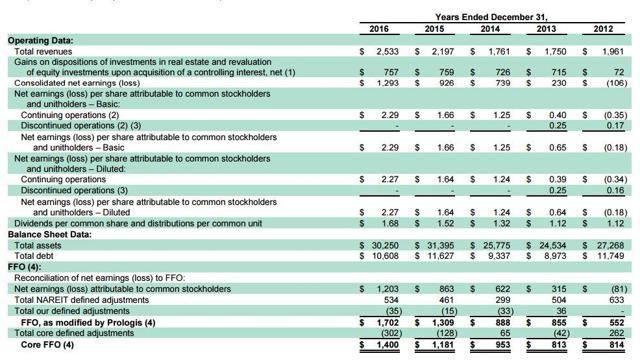

The company has shown consistent growth, generating revenue of: $1.76B, $2.20B, and $2.53B in 2014, 2015, and 2016, respectively. Core FFO grew from $953M in 2014, to $1.18B in 2015, and to $1.40B in 2016. In addition, the company has a strong balance sheet with $4.0 billion in liquidity. Leverage fell from 38.4% at the end of 2015 to under 34.6% at the end of 2016 and debt-to-EBITDA is down from 5.6% in 2015 to 4.7% in 2016.

(Click on image to enlarge)

During the fourth quarter, Moody's and S&P upgraded Prologis' credit rating to A3 and A-, respectively. Prologis is one of the few REITs with an A-level credit rating and is now able to access capital at a lower cost. The company has the liquidity needed to fund further growth and is able to borrow money at a competitive rate.

Valuation

DDespite better market and company specific conditions at Prologis, compared to Simon Property Group, the two trade at similar valuations. Simon Property Group trades at a EV/EBITDA ratio of 19.04, slightly above 17.58x for Prologis and at a P/FFO of 14.28x versus 16.98x for Prologis.

|

SPG |

PLD |

|

|

Market Cap |

$54.3B |

$28.9B |

|

P/FFO |

14.28x |

16.98x |

|

EV/EBITDA |

19.04x |

17.58x |

(Company Annual Reports)

Conclusion: Go Long Prologis, Short Simon Property Group

We are convinced that current market trends towards increased online shopping at the expense of brick and mortar stores will continue and put pressure on mall REITs, while benefiting logistic REITs.

Simon Property Group and Prologis stood out to us as the biggest loser and winner from these changes.

Given our agnostic views on the REIT market in general, we recommend investors take an equal weight pair trade, going long Prologis and short Simon Property Group.

Disclosure: I am/we are long PLD.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more