Playing The 5G Secular Trend Through Cell Tower Stocks

For those who are interested in long-term investing, the onset of 5G is certainly a secular trend one does not want to miss out on. While there are several industries/ securities that offer exposure to 5G, cell tower stocks offer an appealing investment avenue.

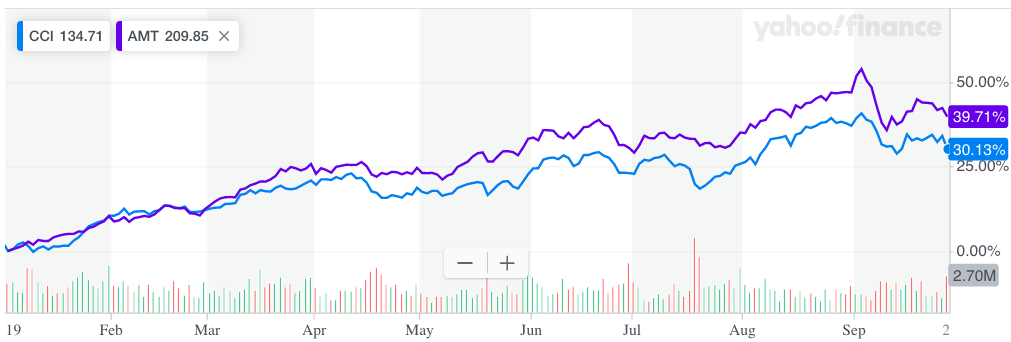

The two main cell tower stocks are American Tower Corporation (AMT) and Crown Castle International (CCI). Since the beginning of the year, AMT has returned 39.71% and CCI has returned 30.31%, both of which thwart the 19.15% return of the S&P 500. Let us evaluate the bullish case for the two stocks going forward.

Source: Yahoo Finance

The next generation network technology, 5G, has a wide set of applicable uses, including faster mobile data usage, self-driving cars, remote medical services, artificial intelligence-supported innovations/ developments such as smart cities and many more applications. Therefore, the addressable market for 5G services is clearly enormous. Regardless of the purpose for which this generation of network capabilities is being used for, there will certainly be a surge in the need for new cell towers to support the 5G infrastructures, which is where our two cell tower corporations come into play.

Both AMT and CCI operate as REITs, and their core business involves acquiring, developing and operating cell towers, on which they lease out space to other companies, particularly telecom corporations, that require network capabilities to carry out their business activities. Hence, these two companies are clearly well-positioned to benefit from the new wave of 5G demand given its wide applicable uses, because apart from telecom players, a diverse range of other industries and corporations are also likely to demand for space on cell towers to fully exploit the advantages offered by 5G.

While both companies own thousands of cell towers, it is vital to understand that 5G requires more ‘small cells’ (as opposed to large cell towers) that will need to be placed relatively closer to each other. AMT does not own any small cell towers, however, the giant does operate 1701 Distributed Antenna System (DAS) networks (according to its latest 10K report), which are built on existing building structures/ rooftops, particularly in urban areas. On the other hand, CCI is planning to increase its number of ‘small cells’ from 7,500 (in 2018) to 15,000 (in 2019). Hence CCI appears to be better positioned to leverage its assets to offer 5G network capabilities. This, of course, does not mean that AMT is not able to offer 5G capabilities, as in fact it recently signed a new long-term contract with AT&T to lease out space on its assets to offer 5G services for both mobile data services and its FirstNet program. Moreover, CCI’s assets & operations are focused within the US, whereas AMT extends a lot more global exposure, offering a more geographically diverse portfolio and well-positioned to exploit higher growth rates in markets such as India and African nations.

Governments around the world are prioritizing 5G developments within their countries to win the international deployment race, which works as a tailwind for tower cell stocks (particularly AMT from a global perspective). In fact, the US government has emphasized and taken initiatives for faster 5G development by freeing up spectrum space, cutting down approval time delay for tower building applications, and limiting the fees state governments can charge corporations for building towers. Thereby making it less costly and faster to build out 5G networks.

Financial Metrics Analysis

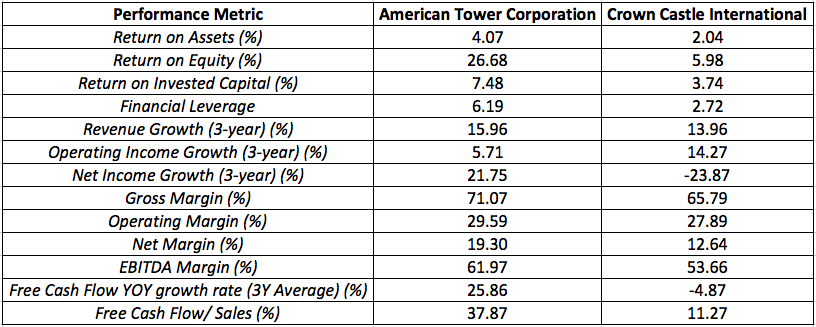

Let us assess the financial performance metrics of the two corporations:

Data Source: Morningstar

Firstly, AMT evidently offers 4 to 5 times higher Return on Equity (ROE) than CCI, 26.68% vs. 5.98% respectively, which makes AMT considerably more attractive for shareholders. Though we must also take into consideration the fact that AMT has more than double the leverage of CCI, which helps boost ROE (due to equity making up a comparatively smaller portion of total capital). Hence, Return on Invested Capital (ROIC) offers a more comprehensive perspective on how effectively both firms are using its capital to deliver returns. Turns out AMT still offers a higher ROIC than CCI, 7.48% vs. 3.74% respectively.

Furthermore, AMT also delivers higher profit margins, with an EBITDA margin of 61.97% vs. 53.66% for CCI. Additionally, while both companies are producing positive Free Cash Flow (FCF), AMT is clearly in a stronger FCF position than CCI, allowing it to more flexibly engage in capital expenditures and pay out dividends to shareholders. Though it is also worth noting that CCI pays a higher dividend than AMT, 3.17% vs. 1.62% (at time of writing).

Nevertheless, overall AMT has been delivering stronger financial performance than CCI.

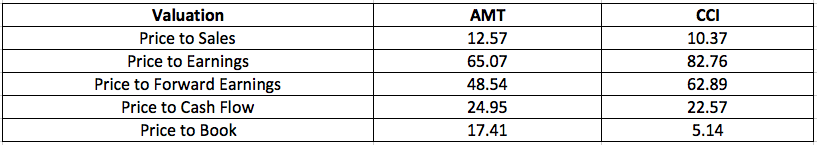

Valuation

Data Source: Morningstar

Both stocks are certainly very expensive. While AMT has offered superior financial performance, it is also more expensive than CCI in terms of almost every metric, except for PE/ Forward PE. Most notably, its P/B ratio of 17.41 is certainly excessive compared to that of CCI at 5.14. As a result, amid the recent development in the shift away from expensive growth stocks, AMT could be hit harder than CCI in the event of an oncoming recession and broader market downturn.

Risks

There are several risks that these cell tower stocks face, which we must take into consideration when considering investing in them.

High Leverage

Both companies are highly leveraged. AMT in particular has high debt levels, with a financial leverage ratio of 6.19. Amid the rising possibility of a recession and a stock market downturn, it will be the highly leveraged stocks that will sell-off the hardest due to their magnified risk profiles. Though it is also worth noting that cell tower corporations’ business models allow them to collect a relatively stable stream of rent income, as even during a recession, the demand for network capabilities is unlikely to fall sharply. Hence, as long as their tenants remain in an adequate financial condition to be able to continue meeting lease payment requirements, the two cell tower stocks should certainly not face survival issues/ severe turbulence even during a recession.

Geopolitical tensions

AMT holds high global revenue exposure. This actually brings several advantages to the company’s investors as they are more globally diversified and are well-positioned to not only reap the benefits of surging mobile data usage in emerging markets, but also enjoy exposure to booming applicable uses of 5G worldwide. In fact, around 20% of AMT’s revenue comes from India, which is expected to start deploying 5G from 2020, and support the corporation’s growth over the long-term.

However, this exposure also comes with its own risks. Tensions between India and Pakistan are on the rise, and the political climate within India is also tense amid religious conflicts. There are high chances of tensions escalating towards large-scale attacks. This would definitely not bode well for AMT, especially in the event of damage to properties on which AMT operates. Furthermore, according to its latest 10K report: “as a condition to the IP-I, the Indian government has the right to take over telecommunications infrastructure in the case of emergency or war”. Thus if the situation were to escalate to this extent, it would undoubtedly cause AMT’s stock to plummet, as it would put their Indian operations in jeopardy. However, this plunge would offer an attractive entry-point for long-term investors as soon as tensions in India cool back down. Hence investors should stay vigilant of any such opportunities.

Bursting of Bond Bubble

Another factor that has been driving the two REITs higher over the recent past has been the decline in the 10yr Treasury yield. As yields fall, income-seeking investors tend to flock towards bond proxies, and a notable beneficiary of this trend is the REITs sector, particularly high-yielders like CCI. However, the bond market is currently in a sensitive bubble, with high chances of it bursting going forward. So when bond prices spiral lower, it will inevitably cause yields to spike higher, which could induce outflows from REITs like AMT and CCI. Although with bond prices plummeting as a result of the bond bubble reversing, investors may be wary of dipping back into the Treasury market for a while until Treasury prices have bottomed, which could actually prove supportive for REITs as investors are less likely to flock out rapidly on a large-scale basis.

Nevertheless, with several sections of the yield curve still in inversion territory, and a weakening economy with rising chances of a recession, the Fed is very likely to step up its efforts to support the economy and thereby drive the 10yr yield higher. In fact, recent Fed minutes also suggest that the central bank is considering buying short-term debt securities to shorten the maturity profile of its balance sheet, which would also drive short-term rates lower and potentially drive long-term rates higher as the economic outlook improves. Hence, the rising 10yr yield could unfavorably impact REITs such as AMT and CCI. However, it is important to keep in mind that the 10yr yield is nowhere near the sole driver of these cell tower REITs, hence investors should not give it too much importance when making long-term investment decisions in these high-growth corporations that will play a vital role in cementing 5G network capabilities going ahead.

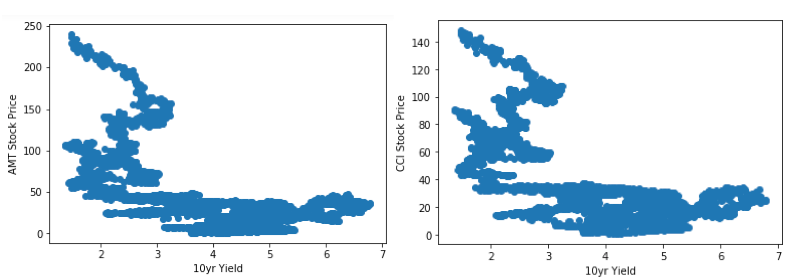

In fact, the meager importance of the 10yr yield in relation to cell tower stocks is evident through our regression analysis. Below one can find the two scatter plots between each of the tower cell stocks and the 10yr yield (since August 1998).

(Click on image to enlarge)

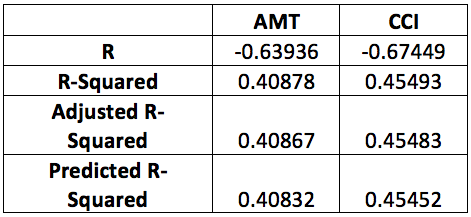

The scatter plots clearly show no clear/significant pattern between the 10yr yield and the stocks of the two cell tower corporations. Furthermore, below one can find a summary of some of the statistical results from the regression analysis.

The Pearson Correlation (R) confirms a negative correlation between the cell tower stocks and the 10yr yield; whereby rising Treasury yields would push these stocks lower, and vice versa. However, the R-Squared values for both regression models are in the 0.40s range, implying that the regression fit between these two variables is rather weak. Furthermore, the Predicted R-Squared values, which reflect how effective such models would be at forecasting future stock prices, are also notably infirm. Of course given that the model only contains one independent variable (10yr yield) also plays a role in the low R-Squared values. Nevertheless, the results from this analysis are sufficient to confirm that one should definitely not place too much importance on the 10yr yield when considering investing in these stocks, because AMT and CCI are certainly able to surge even during periods of rising yields. Therefore, any pullbacks in the REITs due to rising 10yr yields over the near-term will prove short-lasting, and investors should consider these a buying opportunity.

Bottom Line

While both REITs are very expensive presently, they certainly are appealing investment vehicles to play the secular trends in 5G deployment. Both corporations hold individual strengths. AMT seems to be delivering stronger financial performance and diversified global exposure to benefit from high Internet penetration rates in emerging markets like India. Alternatively, the domestically focused CCI possesses more ‘small cells’ to meet the requirements of 5G connectivity, incurs lower financial leverage and pays a higher dividend yield than AMT, 3.17% vs. 1.62% respectively. Overall, both securities offer great long-term potential as they continue to enjoy relatively stable lease-income growth amid growing demand for next generation network capabilities. I certainly recommend investors to stay on the lookout for significant pullbacks in these stocks for long-term buying opportunities.

Disclosure: I currently do not hold any positions in any stocks. I also have no commercial relation with any of the companies mentioned in the article.