Monthly Dividend Stock In Focus: Realty Income

Investors that are interested in owning stocks for income can find it easy to be drawn to Real Estate Investment Trusts, or REITs. These stocks offer investors the chance to own a piece of a trust that leases out properties and passes essentially all of its earnings back to shareholders in the form of dividends.

Stocks that are structured in this way generally offer high yields, but not all are created equal.

One that we believe is superior to many of its competitors is Realty Income (O). Not only does it offer investors a nearly 4% yield, but Realty Income’s dividend history is extraordinary.

And apart from having a very strong dividend history, Realty Income pays its shareholders monthly instead of quarterly, which affords investors faster compounding of wealth.

This article will discuss Realty’s business model, its growth prospects, and its dividend in detail.

Business Overview

Realty Income is a retail-focused REIT that has made its name in the investing world with its dividend growth history. Part of its appeal certainly is not only in its actual payout history, but the fact that these payouts are made monthly instead of quarterly.

The trust owns about 5,800 properties and has a market capitalization in excess of $21 billion.

Realty Income focuses on standalone properties, rather than ones connected to a mall, for instance. That increases the flexibility of the tenant base, and helps the trust diversify its customer base.

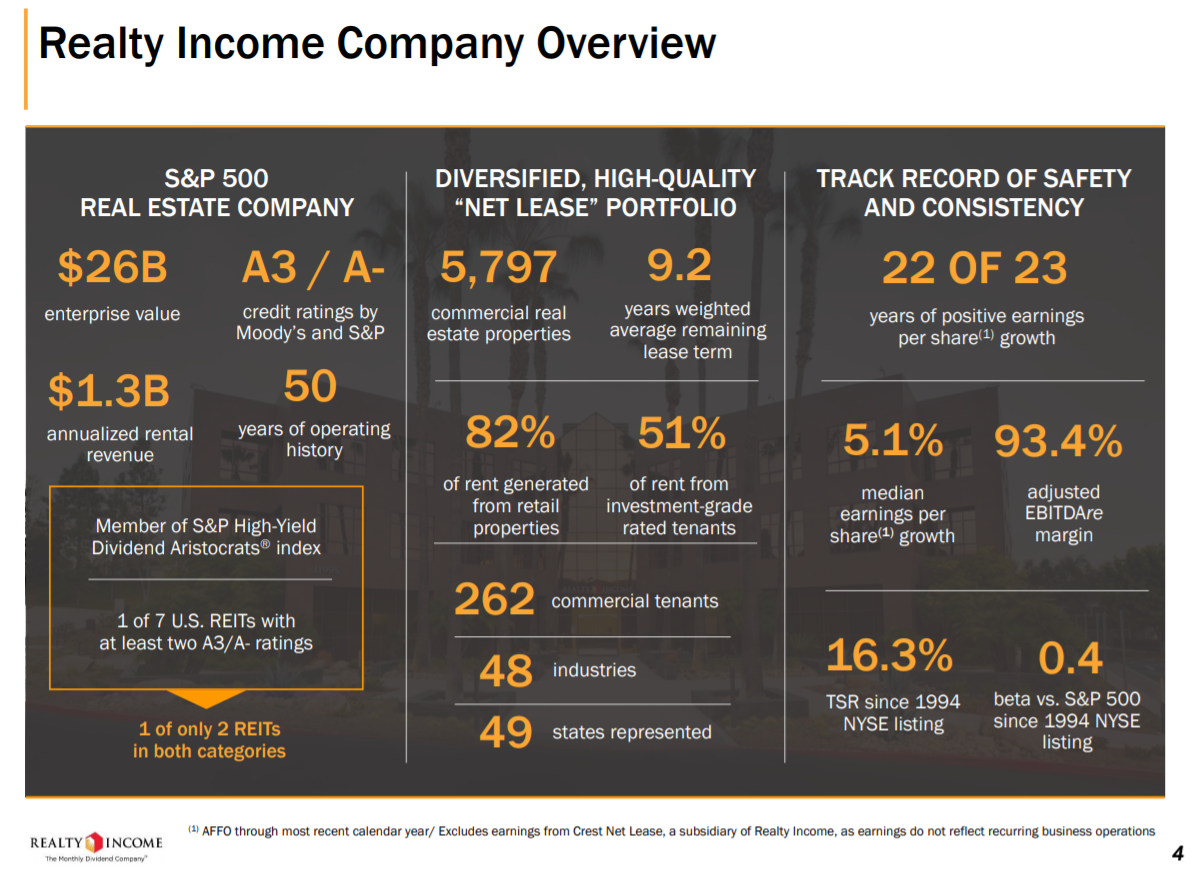

Source: Q4 Investor Presentation, page 4

The trust has annualized revenue of ~$1.3 billion and is one of only two REITs that can say it is a member of the Dividend Aristocrats and has at least two A3/A- credit ratings.

The trust has 262 different tenants across 48 different industries in nearly every state in the US. Importantly, it also has 22 years out of the last 23 where it generated positive earnings growth.

Realty Income reported its fourth quarter earnings on February 20th, and results were strong. The trust reported revenue of $343 million, a 10% increase from the year-ago period. Growth came from a larger asset base from new investments, as well as increasing rents for existing properties.

Funds-from-operations, or FFO, rose meaningfully but some of that growth was offset by dilution that occurred in 2018. As a result, FFO-per-share rose only 3.9% in Q4 to 79 cents.

Guidance for 2019 was for $3.25 to $3.31 in FFO-per-share, implying a growth rate of about 3% over 2018’s results.

Source: Q4 Investor Presentation, page 6

This slide highlights some of the key accomplishments the trust had during 2018, not the least of which is $1.8 billion in new properties.

Apart from that, the trust managed to capture 103.3% of expired rent, keeping not only its occupancy rates high but its average lease per square foot as well. Last year was another one in a very long line of periods with steady, predictable growth from Realty Income.

Growth Prospects

Realty Income’s growth has been quite consistent; the trust has a very long history of growing its asset base and its average rent, which have collectively driven its FFO growth. We don’t believe this has changed and thus, we see its growth capacity in the low single digits annually, as it has been for many years.

Realty Income will achieve these results by simply continuing to do what it has always done.

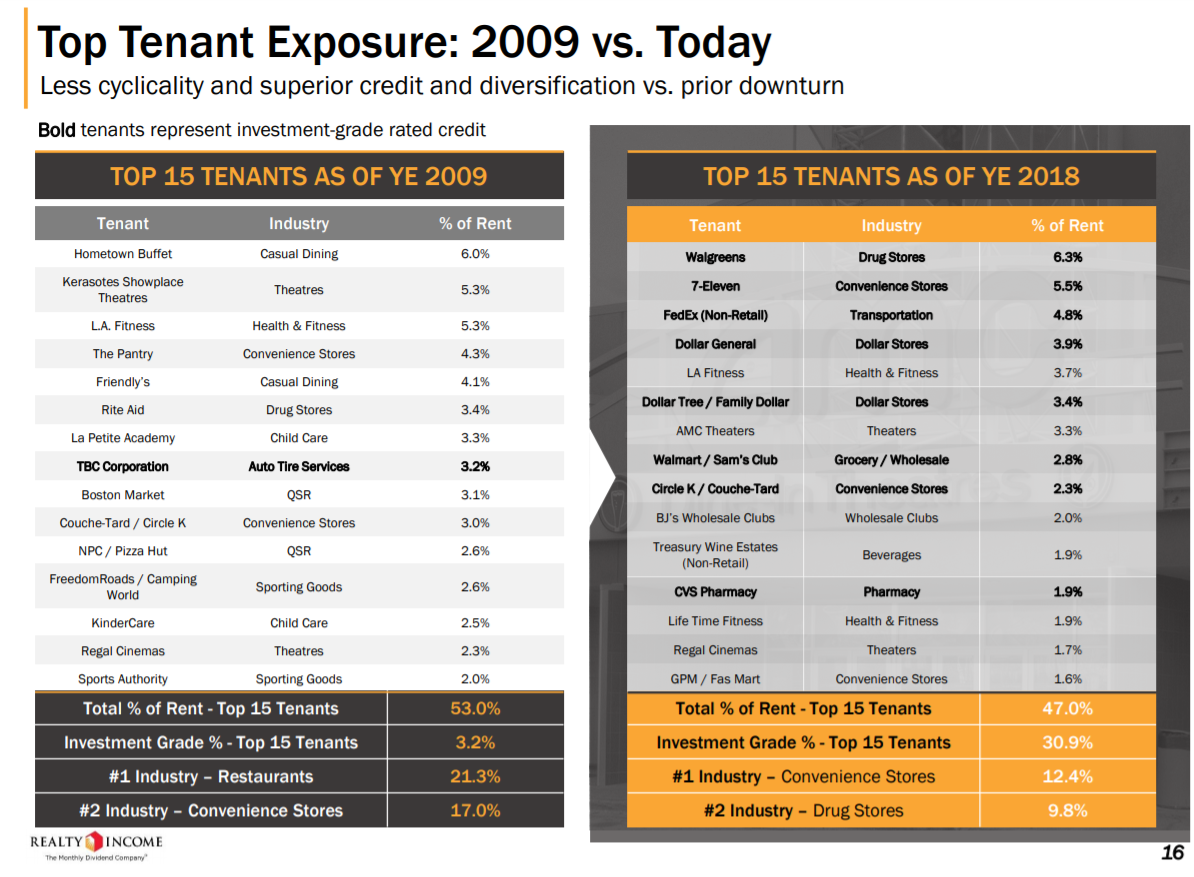

Source: Q4 Investor Presentation, page 16

One thing the trust has done in the past decade is to reduce its exposure to lower-quality tenants. In 2009, the trust’s investment grade tenants in the top 15 were just 3.2% of revenue and the trust was highly reliant upon restaurants, which are notoriously cyclical.

Today, 30.9% of its top 15 revenue comes from investment grade tenants, and it has more than halved its reliance upon restaurants, favoring convenience stores and drug stores instead.

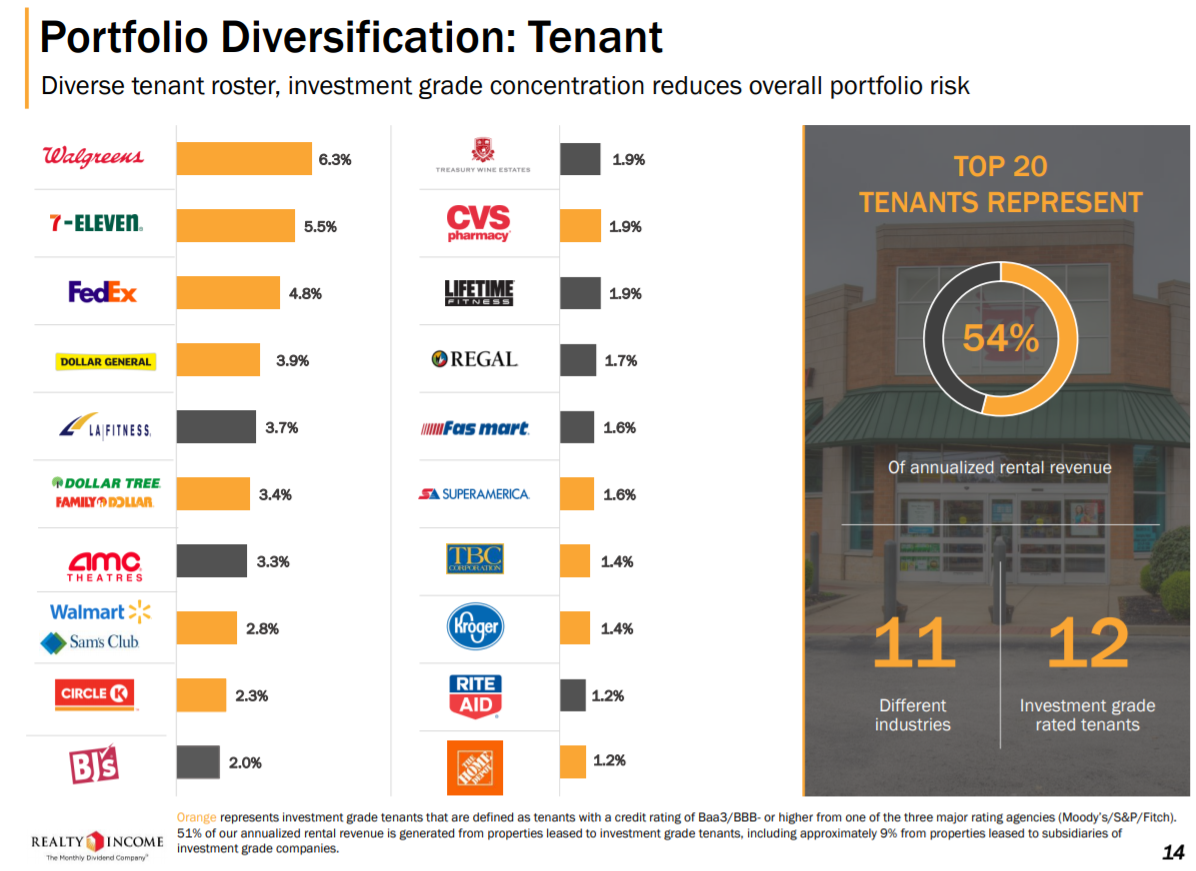

Source: Q4 Investor Presentation, page 14

The trust’s list of tenants is a high-quality, diversified group where its highest exposure is Walgreens (WBA), one of the largest drug retailers in the world. Even then, its largest tenant is just 6.3% of total revenue.

Its top 20 tenants represent 54% of revenue, but that group is from 11 different industries and 12 of them are investment grade rated.

In addition, 96% of its revenue is protected against e-commerce threats, meaning the rise of giants like Amazon (AMZN) shouldn’t have an outsized impact on its tenants results.

Source: Q4 Investor Presentation, page 18

The same is true for its geographic diversification, which is outstanding. Realty Income’s highest concentration is Texas, but it is just 11.5% of revenue.

This diversification, like the industry composition, helps Realty Income lessen its risk from sector downturns, and allows it to capture growth over the long term.

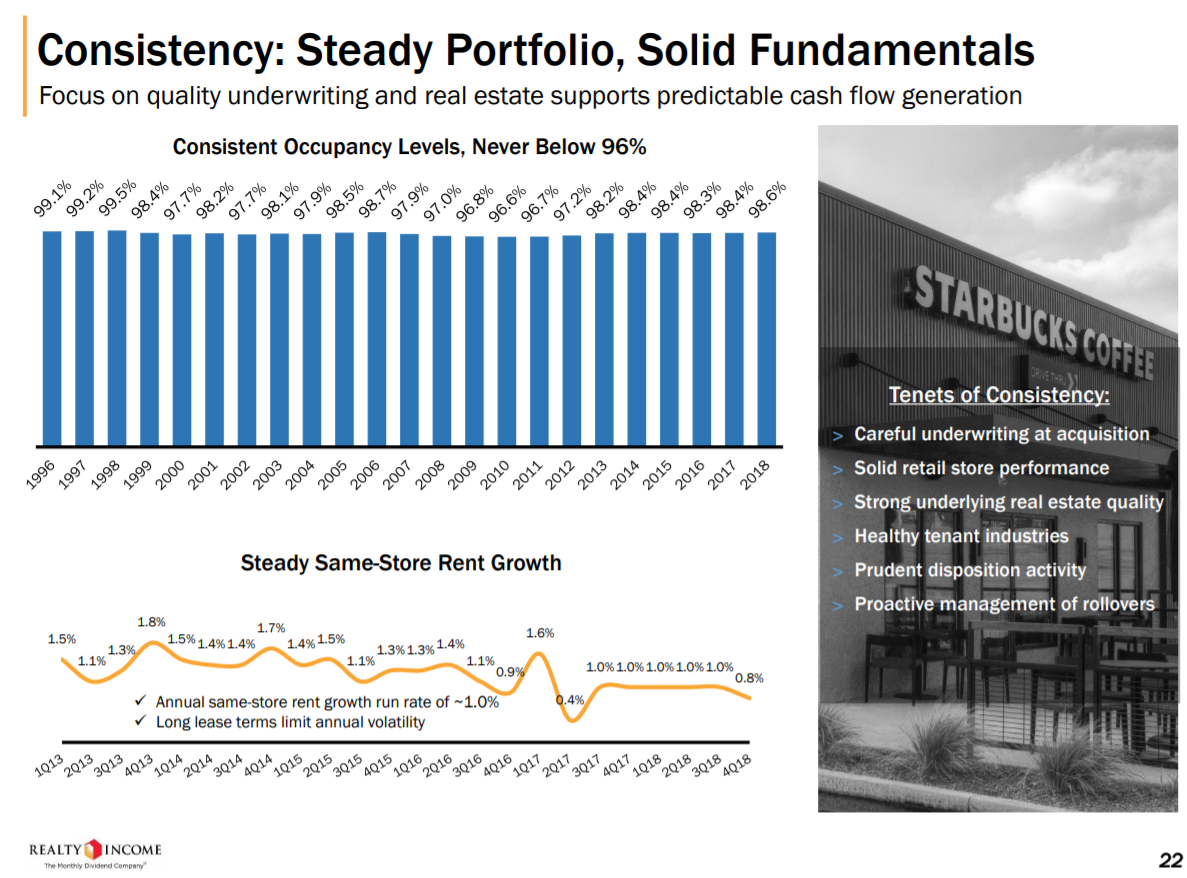

Source: Q4 Investor Presentation, page 22

All of this has resulted in Realty Income’s results over time being truly outstanding. Occupancy has never been below 96%, which is an unbelievable track record of consistency as this period contains the dot com bubble, as well as the financial crisis and the recessions that followed those events.

Same-store rent growth has always been positive as well, meaning Realty Income is capturing more revenue on its portfolio over time. Its long-term leases also afford it relatively low annual volatility in its rent terms.

Putting all of this together, we see Realty Income as producing low single digit FFO-per-share growth over time, consistent with its recent history.

Dividend Analysis

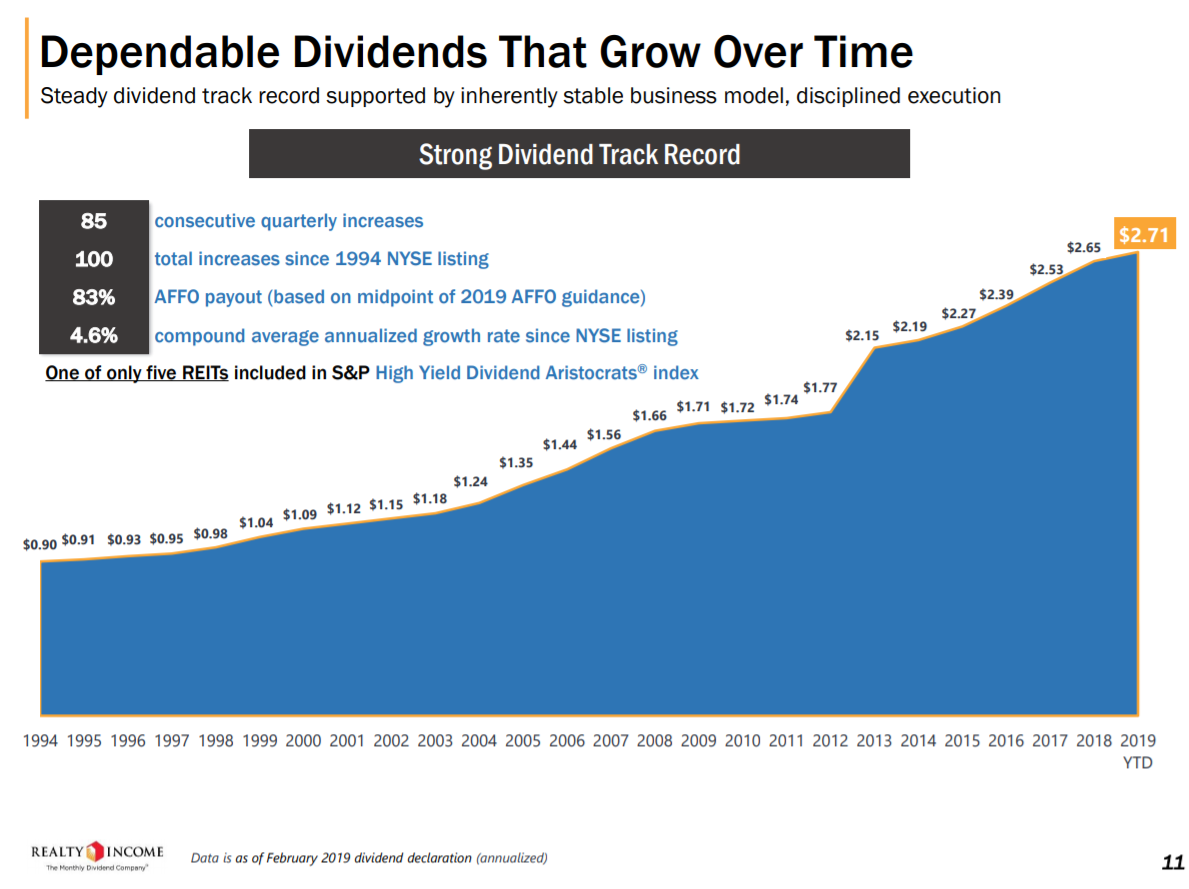

Realty Income’s dividend history is second to none in the world of REITs. Its dividend has been increased a total of 100 times since it came public in 1994, and it has been increased for 85 consecutive quarters as of today.

Most dividend stocks strive to increase their payouts annually; such a long streak of increases each quarter is much rarer.

Source: Q4 Investor Presentation, page 11

The dividend is also safe considering not only this extraordinary history of boosting the payout throughout all types of economic conditions, but also because the trust pays out just over 80% of adjusted FFO.

That means that even with flat FFO, the dividend is still sustainable. We expect the payout to continue to rise in the low to mid-single digits annually, as it has for so many years.

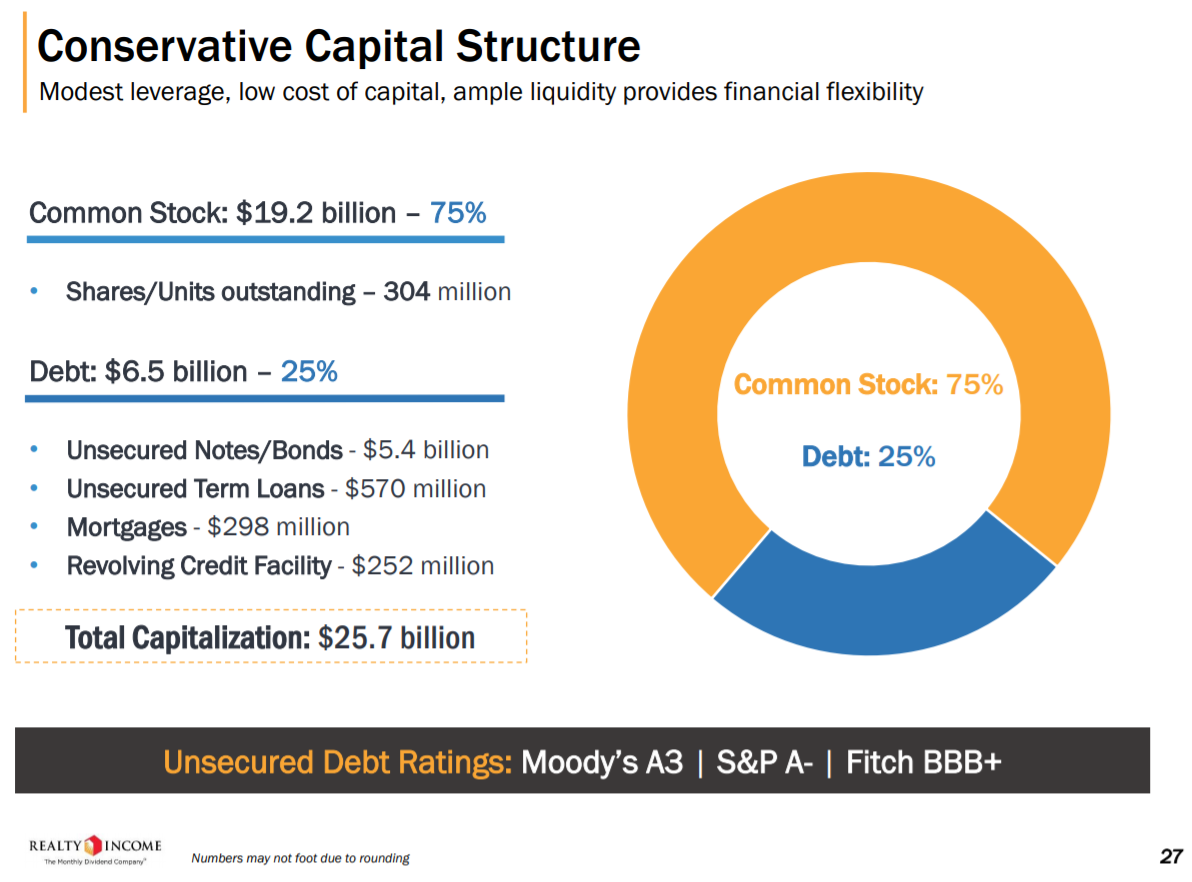

Realty Income is able to maintain this record not only because its business is fundamentally superior, but also because its capital structure is very conservative.

Source: Q4 Investor Presentation, page 27

The trust has strong, investment-grade ratings on its credit and it gets three-quarters of its financing from its common equity. This means that the trust spends relatively less on servicing debt and while dilution has been a minor headwind over time, the formula clearly works.

Realty Income doesn’t have major debt due until 2022 when it will almost certainly refinance its obligations. In other words, liquidity and leverage aren’t concerns for Realty Income, adding to the allure of the stock for income investors.

Final Thoughts

REITs are favorites among dividend investors because they pay out the vast majority of their earnings to shareholders via dividends, which generally leads to high yields.

Realty Income’s 3.9% current yield is fairly low among REITs, but that is because the trust has a track record of success that is unrivaled. This leads to investors paying a premium for the stock, driving the yield lower.

However, for income investors looking for a nearly 4% yield and a secure payout, Realty Income fits the bill. This is not a growth stock, but from a pure current income and dividend growth perspective, Realty Income is difficult to beat.

Realty Income is arguably the top monthly dividend stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more