Monthly Dividend Stock In Focus: American Finance Trust

When it comes to finding sources of income, investors generally look for securities with payouts that are safe, with a high dividend yield, and the potential for future dividend increases. The relative importance of these factors depends upon each investor’s goals, but securities that offer all three are rare.

One asset class that tends to offer a mix of these three characteristics is Real Estate Investment Trusts – or REITs. While not all REITs are created equal, many offer at least two of the three desirable dividend characteristics described above.

An example of this is the American Finance Trust (AFIN) which pays a very high current yield of more than 10%, although the dividend was recently cut. On the other hand, American Finance Trust pays its dividend on a monthly basis instead of quarterly, which allows for more current income, as well as faster wealth compounding.

American Finance Trust’s very high current yield and monthly payments make it look quite attractive for income investors, and while the trust faces its fair share of challenges, we see the lower dividend as sustainable for the time being.

This article will analyze the investment prospects of the American Finance Trust.

Business Overview

American Finance Trust is a REIT that is focused on acquiring single and multi-tenant real estate assets that are service-retail related. The trust seeks out lease terms of at least 10 years with a target loan-to-value of 45% or less.

The trust produces about $300 million in annual revenue and trades with a market capitalization of ~$860 million.

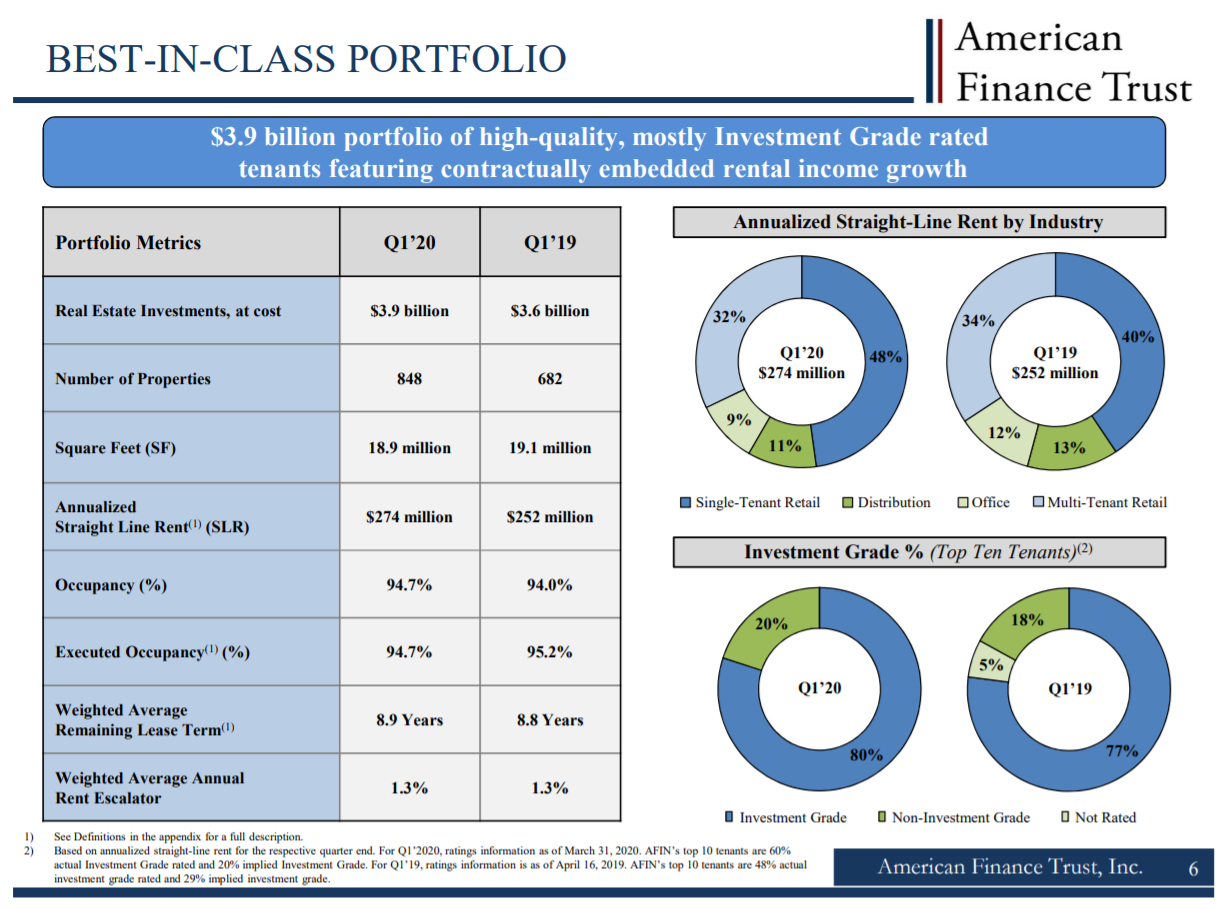

Source: Investor presentation, page 6

American Finance Trust’s portfolio currently consists of about $4 billion worth of real estate at cost – that is, before depreciation that is taken for tax purposes. The portfolio has more than 800 unique properties totaling about 19 million square feet, so American Finance Trust has a sizable scale and diversification.

Occupancy could be better at just under 95%, but that is still quite attractive for a retail-focused REIT. That class of REIT tends to have somewhat higher occupancy due to higher tenant turnover rates. The trust maintains a ~9 year weighted average remaining lease term, which is attractive for a retail REIT, but its rent escalator is just over 1% annually, so organic growth is somewhat difficult to come by.

American Finance gets about half of its revenue from single-tenant retail properties, but it also has significant exposure to other types of leases. In addition, it has been revamping its portfolio to contain more investment-grade tenants in its portfolio. This should reduce default risk in the coming years, improving safety and therefore the stability of its lease revenue.

(Click on image to enlarge)

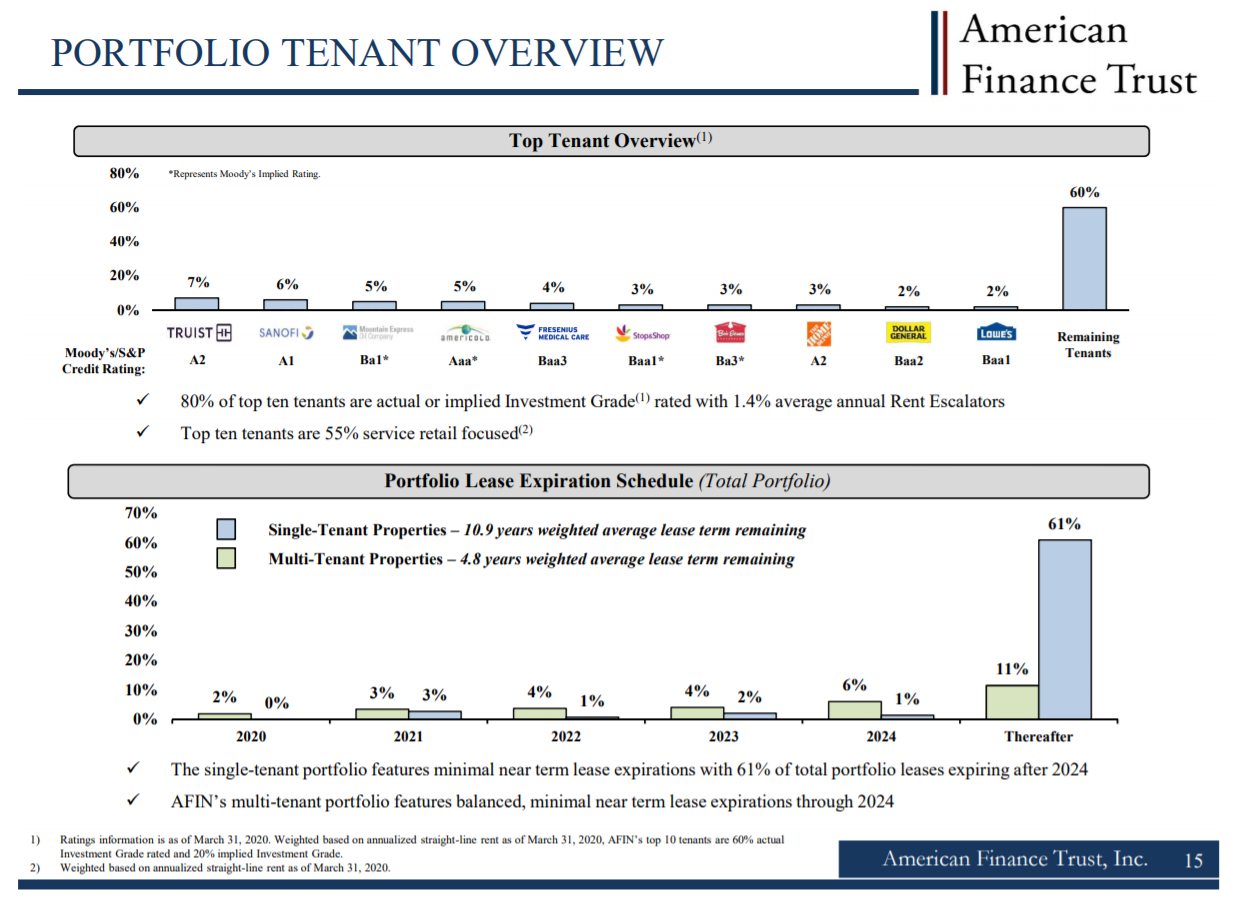

Source: Investor presentation, page 15

The trust has built a portfolio with tenants that have very high credit ratings – with many of them being publicly-traded – and with tremendous diversification. Indeed, the top 10 tenants make up only 40% of total revenue, so the trust isn’t unduly exposed to any particular tenant. In addition, more than 70% of its current leases expire in 2025 or later, so there is a very high level of stability with the tenants. The downside is that with a small rent escalator built-in, and very few expiring leases, organic growth in the rent base will be tough to come by.

However, we see this very high level of diversification in tenants and lease terms as attractive for not only safety today, but for the future stability of revenue and by extension, the dividend.

Growth Prospects

As mentioned, American Finance Trust faces an organic growth challenge because it has very few leases expiring in any given year and because its rent escalator is just over 1% annually, on average. This combination of factors means that the overwhelming majority of the trust’s rent base does not change year-over-year, which provides stability and safety. However, it also means growth can be challenging to achieve.

Still, the trust has managed to boost its top line and funds-from-operations per-share, or FFO, over time through acquisitions.

(Click on image to enlarge)

Source: Investor presentation, page 9

The trust has been active in recent years in unloading properties with less desirable characteristics and using the proceeds to gain more properties with favorable traits and investment-grade tenants. The trust has acquired 454 properties since the beginning of 2017 while divesting 92 properties to generate cash to invest elsewhere. The trust has continued to be a net acquirer in recent periods as well, so we see no sign this activity will cease going forward.

This is the primary growth lever that American Finance Trust has today. In essence, the trust is using the stable and predictable cash flows from its existing tenant base to finance future growth.

(Click on image to enlarge)

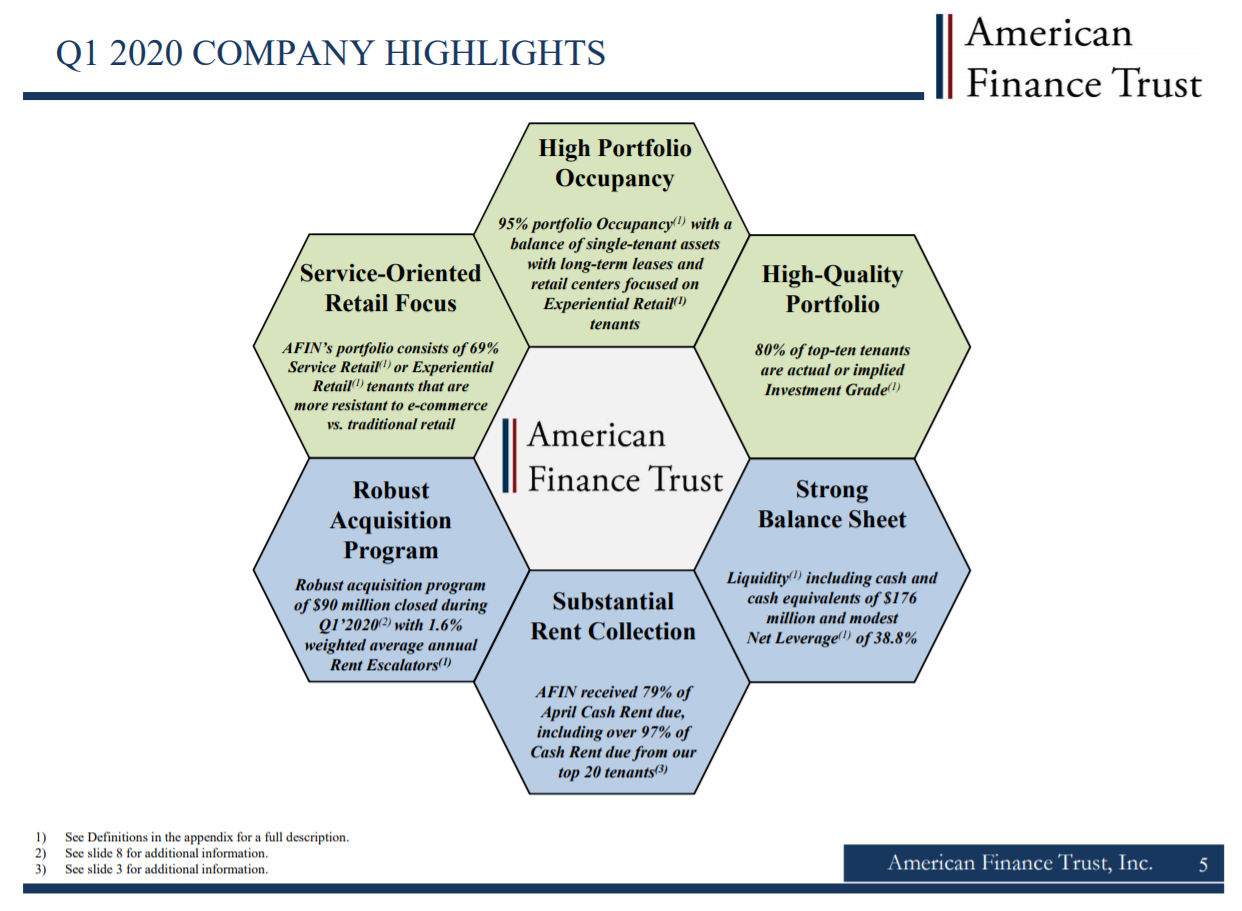

Source: Investor presentation, page 5

The trust reported first-quarter earnings on May 6th and showed good progress despite very challenging conditions due to COVID-19. Perhaps the most important metric the trust reported was April rent collection, which came in at 79% of total rent due.

While that is far from ideal, many retail-focused REITs saw very little rent collection in April, particularly those exposed to restaurants and other service businesses. The high-quality tenants American Finance Trust has in its portfolio are generally in less discretionary businesses, and therefore were able to pay most of contracted rent during one of the worst crises the US has endured from an economic perspective.

(Click on image to enlarge)

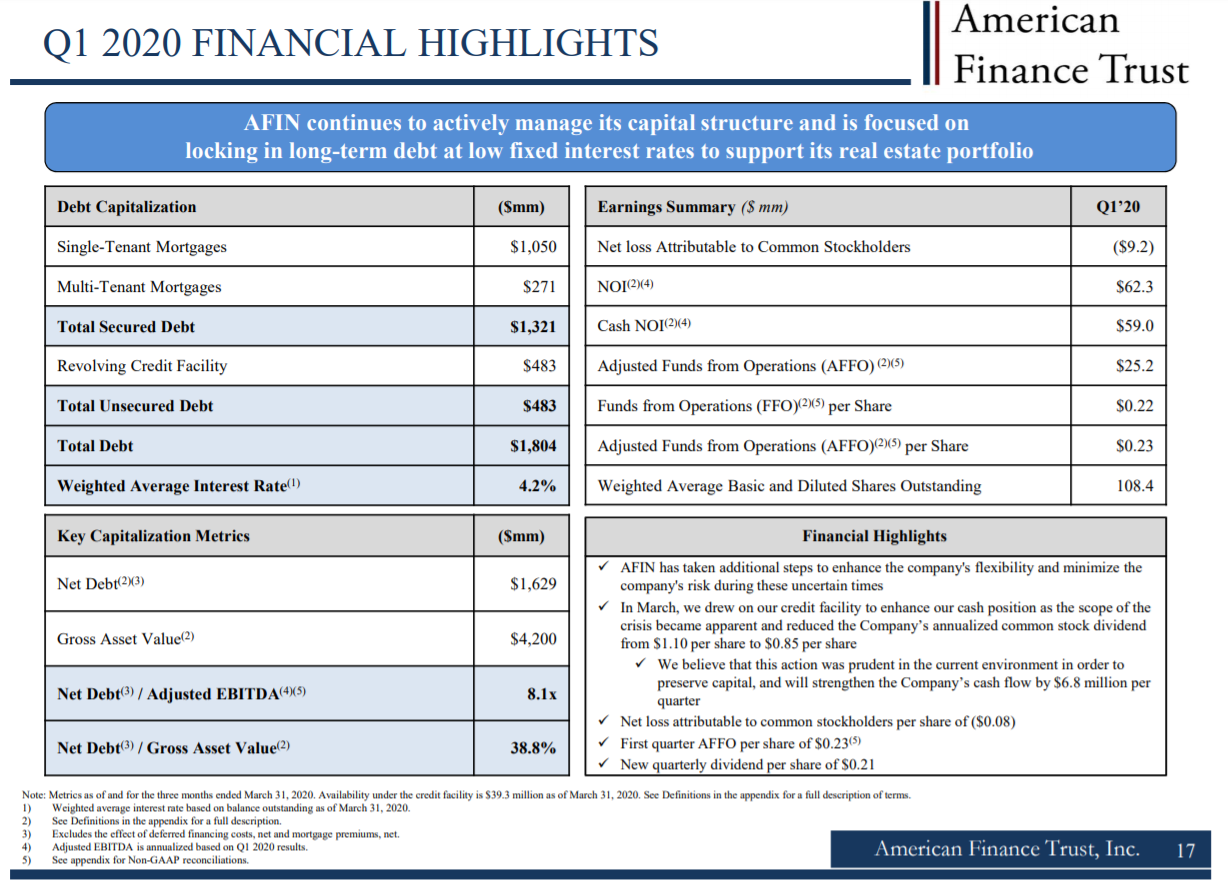

Source: Investor presentation, page 17

The trust reported net operating income, or NOI, of $59 million on a cash basis in Q1. FFO-per-share came in at $0.23 on an adjusted basis during the quarter, as earnings saw very little impact from the COVID-19 crisis. We caution that Q2 will see a much larger negative impact on NOI and FFO because missed rent payments began in earnest in April. However, we also see the rebound into May and June as substantial, so Q3 should be back to a state of normalcy for American Finance Trust, with Q2 being the outlier for 2020.

The trust does have a significant amount of debt, ending Q1 with $1.8 billion on the balance sheet. The trust took additional steps in Q1 to boost liquidity, which just about every other REIT did as well given the extraordinary circumstances. While this is understandable, the trust now possesses a debt to adjusted EBITDA ratio of 8.1, which is enormously high. Its weighted average interest rate is just 4.2%, so it can more than cover its payments with its capitalization rates in the mid-to-high single digits, but perhaps the biggest risk to American Finance Trust is its debt load.

Despite this debt load, we see the trust’s long-term fundamentals as favorable and in particular, we like its relative stability of its portfolio. We would prefer less debt but on the plus side, nearly $500 million of the $1.8 billion of total debt is a revolver that, presumably, won’t be needed later this year or into 2021. That remains to be seen but we see the current level of debt as a spike higher due to COVID-19 rather than a sustainable level.

In total, we see mid-single-digit FFO-per-share accruing for American Finance Trust in the coming years, primarily from acquisition activity, but with a low level of organic growth as well.

Dividend Analysis

American Finance Trust recently declared its monthly payments for July, August and September at a rate of $0.0708333 per common share. That works out to $0.85 per share on an annualized basis, which is good for a current yield of nearly 11%.

That’s impressive, and certainly a sizable draw for income investors, particularly given the monthly payments instead of quarterly. However, American Finance Trust cut its distribution for the second quarter from a prior annualized level of $1.10 per share. That’s a sizable cut, but investors should keep in mind that many REITs have slashed their payouts down to token levels, or ceased them altogether because of COVID-19.

We expect the trust to earn at least $0.90 per share in FFO this year, taking into account that Q2 results will be substantially weaker than normal. That means that the new dividend of $0.85 per share should be sustainable not only for this year but next year as well. Indeed, we expect to see at least $1 in FFO per share next year as American Finance Trust can get back to its former growth track.

With stable tenants and a full pipeline of acquisitions, we think the current dividend is safe. The primary risk to this is a second wave of widespread economic shutdowns due to COVID-19, which could send the trust’s tenants into default. We don’t see this as particularly likely at this point, but American Finance Trust is a high-risk, high-reward situation.

Final Thoughts

We like American Finance Trust’s tenant base, its stable earnings profile, and its very high dividend yield along with monthly payments. We note that there is still some uncertainty surrounding potential shutdowns to come due to COVID-19, but we expect the current dividend to be safe for the time being.

With a nearly 11% yield, this stock is quite attractive to income investors, and it is still trading at just half the level of its pre-crisis highs, meaning the value proposition is much better than it was as well. The high yield is attractive, but as is typical with extreme high-yielding stocks, there is a higher level of risk.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more