LTC Properties Is A Diamond In The Rough

Summary

- All of LTC's leases are triple net, such that the lessee is required to pay additional charges including taxes, insurance, assessments, maintenance, and repairs.

- Driving the consistent performance is LTC’s 2.5% average rent escalators and nearly 100% tenant retention.

- On the 1st of October, LTC increased its monthly dividend from $0.17 to $0.18 per month.

- I’m maintaining a BUY rating and I will wait on a better margin of safety.

Most all healthcare REITs have been on sale in 2015, and as a result, I have been paying close attention to my portfolio by tactfully cherry-picking the winners, hoping to unlock the most value in 2016. Many of the well-known blue chip REITs have become cheap by most metrics, and as 2016 approaches, I decided that it was time to re-balance a few names in order to optimize long-term results.

After carefully evaluating each of my holdings and paying close attention to sector and sub-sector trends, I decided to re-balance my portfolio - selling two whole REIT positions and rounding out the edges with a few existing names. Earlier this week, I provided my premium members with an update on various new transactions and over the next few days, I will be writing on the positions that I have sold.

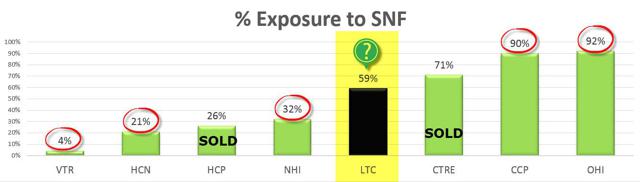

One of the key reasons that I decided to re-balance my healthcare REITs was because of the substantial concentration in skilled nursing. A few days ago, I wrote an article on Omega Healthcare Investors (NYSE:OHI), currently a core holding, and I also have begun to modestly increase exposure in Care Capital Properties (NYSE:CCP). Given the fact that these two REITs are "pure play" companies, I feel as though they will perform better due to the circle of competence and the experience within the management ranks of these REITs.

(click to enlarge)

As I said, I will soon provide an update on REITs that I have sold, and I am also continuing to monitor existing and proposed positions.

LTC Is a Simple REIT

One REIT that I have been researching for three years is LTC Properties (NYSE:LTC). In fact, I wrote my very first article on the company exactly three years ago (December 31, 2012), and since that time, I have written numerous articles on the company.

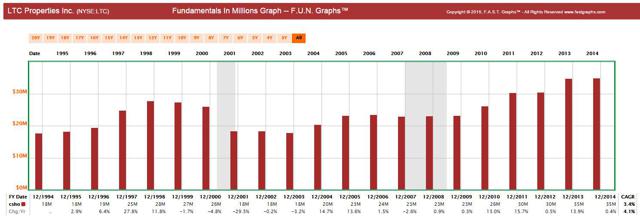

LTC has been around for over 22 years, the company was incorporated on May 12, 1992, in the State of Maryland, and commenced operations on August 25, 1992. LTC invests primarily in senior housing and long-term healthcare property types, including skilled nursing properties (SNF), assisted-living properties (ALF), independent living properties (ILF), and combinations thereof. Here's a snapshot of the company's growth in assets:

(click to enlarge)

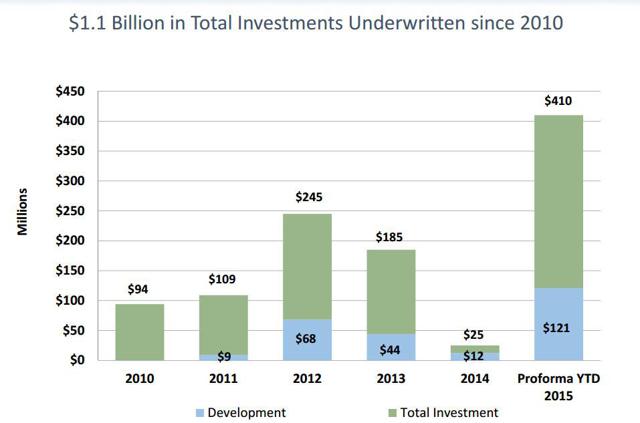

As you can see, the company began ramping up acquisitions in 2010, and here's a snapshot of growth (in assets) since that time:

(click to enlarge)

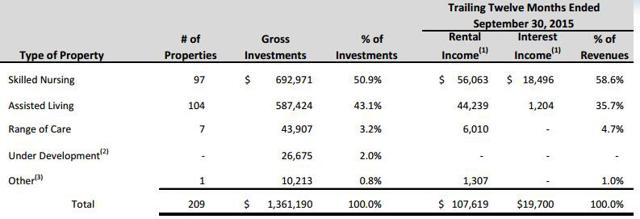

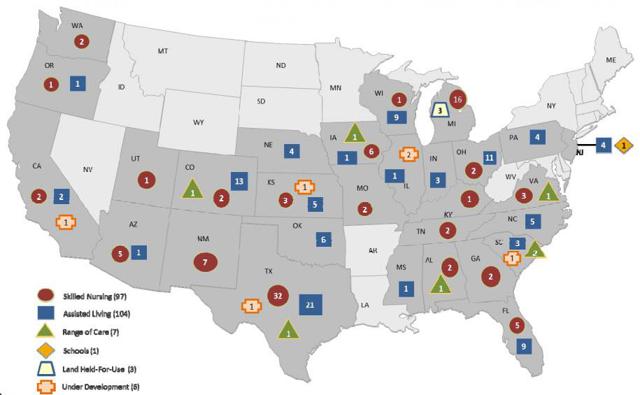

As of Q3-15, LTC owns 209 properties that consist of 97 skilled nursing properties (50.9% of revenue), 104 assisted living properties (43.1% of revenue), 7 range of care facilities (3.2% of revenue), and 1 other property (.8% of revenue).

(click to enlarge)

LTC owns or holds mortgages on properties that include investments in 29 states (coast-to-coast) leased or mortgaged to 36 different operators.

(click to enlarge)

LTC has a well-balanced geographic footprint. Texas has the highest concentration (20.7%), followed by Michigan (15.2%), and Colorado (9.6%).

Continue reading on Seeking Alpha.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

Disclosure: more