Look Beyond The Market Valleys - To Companies Like STAG

The two big issues today are COVID-19 and the economy. Fix the former and the latter will follow as night follows day.

Assuming Americans are not so stupid that we can all wear a mask, avoid close contact with strangers, and practice good hygiene for a finite period of time while various vaccines are approved for use and plasma transfusions become more common, then COVID-19, get thee behind me.

Once we have borne what seems to some to be the horrid trial and tribulation of being safe and healthy, we will be able to open restaurants and start and re-start businesses. I say it this way, distinguishing between start and re-start, because according to data from the U.S. Bureau of Labor Statistics, about 20% of U.S. small businesses fail within the first year. By the end of their fifth year, roughly 50% have faltered.

These are averages in a non-pandemic year. When you read scary headlines that x% of businesses have closed during the time of COVID-19, remember these numbers. Also note that losing a job has made tens of thousands of people who wanted to strike out on their own “just do it.” I expect for every business that fails, another will open. God bless entrepreneurial capitalism!

So, can we now move on to forgetting about all the ancillary scare news and talk about what the likelihood is of making money in the remaining weeks of 2020 and next year?

Yes, the stock markets - and the economy - will likely experience bumps in the road from time to time. But keep your eye on the prize! A physically healthy populace and a rebounding economy suggest the occasional volatility should not dissuade us from enjoying the fruits of the longer-term trend.

Post-COVID-19: Productivity will be the key to economic revival

Increased productivity is unlikely to be found by owning the COVID-19 winners like Zoom (ZM), Netflix (NFLX), and video games companies. These might hold their own, but it is the entire market with its materials, health care, energy and other sectors that will most likely benefit by rising once again. And they can still be purchased at reasonable prices.

We do not want to be out of this kind of market. I am willing to maintain my current cash position in my Growth & Value Portfolio during these next weeks of volatility, but I will be looking to buy at times of weakness.

I am particularly interested in the mid- and small-cap stocks, which have historically outperformed their large-cap brethren. Beginning in 2018, small-cap stocks’ performance cratered, and they have not recovered yet.

For the last two years, it has been all about the FANGs, FAANGs, FANGMANs, FANMAGs or whatever other silly acronym you want to use for the momentum darlings that attracted buyers for no other reason than because they are (or were) going up. At their current levels, these choices are at or approaching the valuation levels last seen in the dot-bomb of 2000.

In addition to selecting small- and mid-cap growth selling at reasonable prices over large-cap momentum movers, there is one other change I am slowly moving toward. I also plan on overweighting the best of the cyclical stocks - and have already started down that path. I am still looking for growth, however, I want growth at a “value” price wherever possible. Growth is what the country, and the world, needs. I predict that those companies providing it will be amply rewarded.

Enter STAG

One example of the type of company that has not yet recovered fully is STAG Industrial Inc. (STAG). I am not a big fan of REITs at this point in the US economic cycle, but I make an exception for warehousing and data center REITs.

If you believe, as I do, that COVID-19 will be defeated by a combination of the best thinking of the world’s finest medical minds; the speed, efficiency and capabilities of our large ethical pharmaceutical companies; government coordination of relief; and a public that - at least for the most part - takes serious things seriously, then you must conclude that the economy will be rebounding in 2021.

Warehousing / industrial companies, often organized as REITs, provide industrial space for companies, from the very large to the very small, to store their products between manufacture and sale. These third-party firms that specialize in warehousing are the sites used by clients like Amazon (AMZN) (which now owns most of its own such properties), Wayfair (W), Target (TGT), and others for distribution, drop-shipping and other fulfillment and customer services.

"Warehousers" are a key component of the logistics chain that allows even the newest and smallest companies to start an online retailing business from anywhere in the entire world and ensure that their products are delivered to customers.

The real benefit of a warehousing company? Some of their tenants will grow, while others will falter. Some new ones will always be formed, and some will go out of business. The warehouser doesn’t care! As long as their warehouses are busy, they do not share in the ups and downs of any one company, unless they have vetted a single company and decided to custom-build a facility for them. (STAG does this quite frequently.)

Sometimes this means the industry’s rents might be a little less than other times or, like during early COVID-19 times, rents were paid late. More often, the growth curve will be slowly and steadily increasing as the best tenants remain and the rest are winnowed out.

After analyzing all these companies, I have selected three. My largest position is with STAG, a warehousing and industrial REIT that has a different approach to the business.

STAG’s approach is to find the highest-quality companies. It then strives to fill most of its buildings with one single tenant that is a known survivor, cultivating the relationship over time. Beyond that guiding principal, STAG does not limit itself to a single type of building, nor does it pride itself on only buying (expensive) properties in Class A markets or locating only in (expensive) Tier 1 cities.

Instead, the company looks for properties that will provide the highest internal rate of return. By not trying to be 3 miles closer to the “best” distribution points or in the most attractive business parks, STAG can acquire properties at a higher cap rate than most of its competitors. Some of this can be passed along to tenants who do not mind an extra 10 minutes between order fulfillment in-house and shipping to the customer. Not every product needs to be delivered a nanosecond later!

(Source: STAG Industrial website)

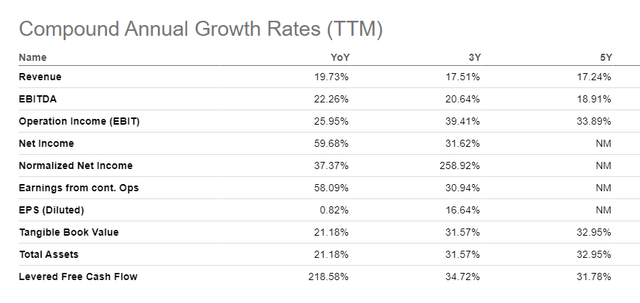

This business model has been quite successful for STAG. It has grown its funds from operations (FFO) more steadily than not only most of its competitors, but most firms in the rest of the REIT universe. (FFO refers to the figure used by REITs to express the real cash flow from their operations. FFO per share is a far better metric for REITs than earnings per share.)

As a result of its increasing FFO, the company has also been reducing debt at a steady rate. The debt carried by STAG is covered by more than 5 times.

Why STAG now more than ever?

The changes wrought by COVID-19. Or, more to the point, what COVID-19 uncovered as a flaw in many manufacturing strategies.

So much US manufacturing was outsourced to other nations, due solely to the differential between the standard of living cost of labor in the US versus some other nations. Shortages during COVID-19 brought home the impact of bottlenecks for some companies with 100% outsourced product manufacturing and the smoother sailing of those closer to home.

I see the entire warehousing/industrial industry benefiting from a certain level of re-shoring by manufacturers bringing it all, or a good portion of it, back to the US. There is now an ongoing resurrection of domestic manufacturing, much of it accurately portrayed as a matter of national security. Prior to this pandemic, for instance, the U.S was almost entirely reliant on importing all kinds of medical supplies, including something as pedestrian (until you need them) as face masks.

STAG already has meaningful exposure to domestic production, unlike many of its competitors who have chosen over the years to load up on their expensive facilities near the ports of Los Angeles and Long Beach, Seattle, New Orleans, New York, etc.

These competitors’ strategies often made sense when the bulk of the US population seemed to be moving more and more into the big cities. But with work from home a reality for many people now, this too is changing. More people are moving to suburban and exurban locations, so the warehouses no longer need to be within the urban areas solely for speed of product distribution.

The bulk of STAG's properties are located in these smaller cities and suburban areas where people live - and now work as well. Most of its warehousing and industrial competition is in the city centers that are at risk of losing, not gaining, consumers.

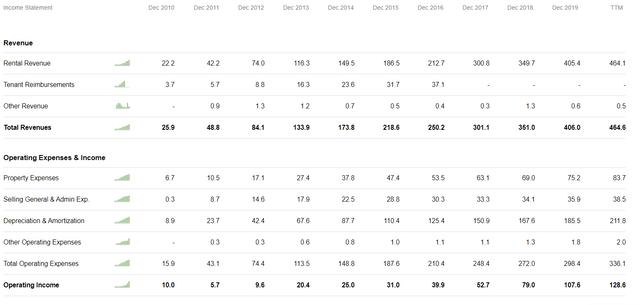

I have selected STAG because it enjoys a strong balance sheet - always a prerequisite for my choices - a current valuation that is better than its peers, and a history of consistent growth. You will notice that, while the stock price declined during the great decline in the first quarter, the REIT's revenue and operating earnings were barely interrupted.

(Source: Seeking Alpha Premium)

(Source: Seeking Alpha Premium)

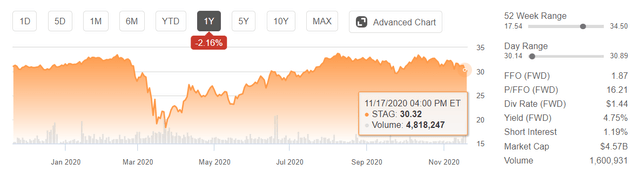

As you can see below, while the bigger names I believe to be disadvantaged by the changes COVID-19 uncovered have all shot up, STAG is still selling at the same price you could have bought it for at the beginning of the year.

(Source: Fidelity.com)

The REIT has a strong balance sheet, a track record of consistent growth, and most importantly, its valuation is quite attractive relative to peers at 15.9X forward FFO, compared to over 21X for the sector.

I will mention one other plus for the entire industry. There is a whole lot of roof space in the warehousing/industrial properties. Acres of it per many single installations, and square mile after square mile of it for the industry as a whole. What if, instead of being heat sinks that require huge amounts of energy expenditure to condition the air beneath these buildings, these firms were to place solar arrays atop all those buildings.

Alas, I did not think of this first. But I do believe it is a brilliant idea, and STAG is one of the early adopters of this innovative use of wasted space. The company has already begun to adopt this procedure, and it will be continuing to do so. Reducing energy costs while creating excess energy that can be used to replenish the grid? Doing well by doing good.

But then, that is the way STAG has always worked.

Yours in good health and optimism,

Disclosure: I am long STAG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it ...

more