Insiders Are Loading Up On These 3 Attractive Small Cap Stocks

After heading straight down in August and through most of September, the market bounced back in a big way in October with the main benchmarks ending up some eight percent for the month. It was the best monthly performance for stocks in many years and gets us up to basically flat line for 2015, other than the NASDAQ which is up better than six percent for the year.

However, over 50% of the stocks in the market remain under their 200 day moving averages despite last month’s big rally. Large cap growth has definitely been the way to play the recent rise. The S&P 100 index has climbed more than a dozen percent off its low in late August. That is more than twice the five percent or so the small cap Russell 2000 has managed to post over that time frame.

Ever being a contrarian, this leads me to believe this recent divergence could be an investment opportunity. Small and mid-caps are less exposed to the weak global economic environment as well as the currency impacts from the strong dollar. It seems logical that once sentiment gets more positive on the high beta parts of the market like small caps and biotech and if the rally broadens, these small cap names could start to outperform their larger brethren once again.

Looking to go hunting for bargains, I took a look at some attractive risk/reward plays that corporate insiders have been buying lately. Let’s start with small biopharma play

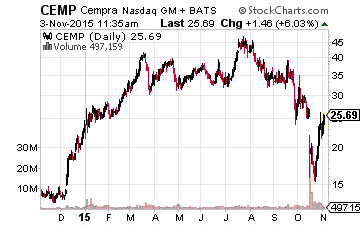

Cempra Inc. (NASDAQ: CEMP)

The stock of this promising company was more than cut in half in the recent bear market in biotech and also due to one failed trial result. The shares have started to claw back some of those losses recently and two directors recently bought just under $50,000 of new shares.

Cempra is a clinical-stage pharmaceutical company focused on developing antibacterials to meet critical medical needs. The company has two lead antibacterial products, both in the treatment of infectious diseases (Solithromycin and TAKSTATM (CEM-102)). These compounds address the urgent and increasing need for new treatments targeting drug-resistant bacterial infections in both the hospital and the community.

Two months ago the company received Fast Track review for Solithromycin from the FDA for the treatment of community acquired bacterial pneumonia (CABP). This provides for a rolling review of the New Drug Application (NDA) and a five-year period of market exclusivity for the indication, if approved. Three analyst firms reiterated their buy ratings on Cempra in the back half of October. Their price targets range from $38.00 a share to $40.00. Not a big stretch given Cempra got up to $45.00 a share before the stock’s recent “hiccup.” The shares trade near $22.00 a share and the stock has a market capitalization of approximately $1 billion.

Moving into a completely different industry,

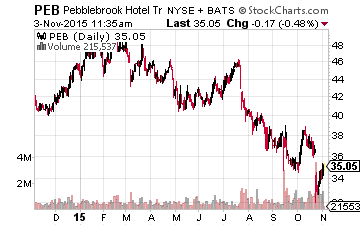

Pebblebrook Hotel Trust (NYSE: PEB)

looks interesting here after a recent 15% decline caused by a slight decrease in forward guidance. The company is still seeing solid RevPAR (Revenue per available room) growth and is experiencing rising margins and record occupancy levels. It expects solid growth to continue within its lodging portfolio through at least 2018.

Late in October, the company’s CEO took advantage of the recent weakness in the stock and bought some $175,000 of new shares. This REIT should see approximate 20% growth in FFO (Funds from Operations) in both FY2015 and FY2016. The shares trade at a very reasonable 11.5 times forward FFO and also yield 3.4% after a better than 30% dividend hike earlier in the year. The REIT trades for around $34.00 a share and has a market capitalization of $2.5 billion.

Moving out on the risk scale we move onto

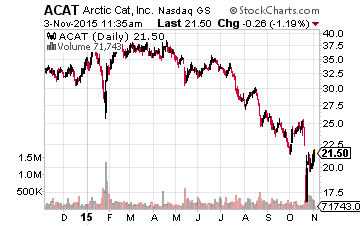

Artic Cat (NASDAQ: ACAT).

This company manufactures and markets snowmobiles and all-terrain vehicles (ATVs), and recreational off-highway vehicles under the Arctic Cat brand name. The company has approximately 20% of the overall domestic snowmobile market and just over 10% ATV market share. 60% of sales come from the United States and just under 30% comes from our neighbors to the north.

The company has struggled this year working off excess inventory and with the expense of a new marketing campaign. A warmer than average winter was also problematic. After making $1.40 a share in FY2015, profits are tracking to just over breakeven this fiscal year (company’s fiscal year begins April 1st). The stock is down more than 40% from its level in March and goes for $20.50 a share.

Insiders seem to be signaling that better times lie ahead. Six different insiders bought new shares late in October including the company’s CEO and CFO. Growth and profits should return in FY2017 with the current consensus calling for around $1.25 a share in earnings on a year-over-year revenue increase in the mid to high single digits. The company’s market capitalization is less than $300 million and it has a solid balance sheet. The stock goes for just over 40% of annual sales.

Disclosure: more