Increased Interest Rates Could Give These Real Estate Stocks The Mortgage Rate Jitters

Written by SmallCapPower.com

The TSX real estate stocks on our list today could either benefit or suffer from increased interest rates; those that provide brokerage and lending services may see their returns increase; however, the ones on the development side who use financing for their operations will certainly experience the downside of rate hikes.

As the banks begin to raise their mortgage rates, one-by-one, real estate companies that borrow will start to feel the pinch. Increasing mortgage rates will ultimately lead to larger current liabilities for real estate companies, and they’ll have to balance how much they pass down onto their tenants. If the real estate brokers tack on higher rental payments to cover their margins it may just push the small business owners out of the property.

[Given the above, the following] 4 TSX real estate stocks could get the mortgage rate jitters:

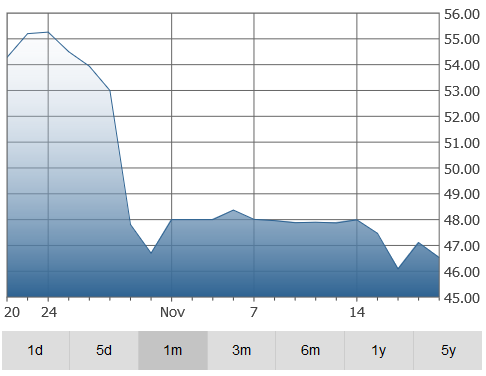

1. Colliers International Group Inc. (TSE:CIGI) (CIGI) – $47.11

Real Estate Services

Colliers International Group Inc. is engaged in the provision of commercial real estate services. The Company’s primary services are outsourcing and advisory services, lease brokerage and sales brokerage. It provides services for sales, leases and mortgages in various areas, such as landlord representation, tenant representation, and capital markets and investment services. The Company’s Outsourcing and Advisory Services Division provides corporate and workplace solutions; appraisal and valuation services; facility, property and asset management services; project management services, and research for commercial real estate clients.

- Market Cap: $1,756.43(mm)

- Net Asset Value – Actual (FY0, Millions, CAD): $207.99

- Total Current Liabilities (FQ0, CAD, Millions): $567.38

2. FirstService Corp. (TSE:FSV) (FSV) – $55.49

Real Estate Services

FirstService Corporation is a provider of residential property management and other essential property services to residential and commercial customers. The Company’s operations are conducted in two segments: FirstService Residential and FirstService Brands. FirstService Residential is a property manager and provides a range of ancillary services primarily in various areas, including on-site staffing, including building engineering and maintenance, full-service amenity management, security, concierge and front desk personnel, and landscaping; banking and insurance products, and energy conservation and management solutions. FirstService Brands provides a range of property services through franchise networks and Company-owned locations.

- Market Cap: $1,997.59(mm)

- Net Asset Value – Actual (FY0, Millions, CAD): $232.55

- Total Current Liabilities (FQ0, CAD, Millions): $227.87

3. Mainstreet Equity Corp. (TSE:MEQ) (MEQYF) – $33.00

Real Estate Rental, Development & Operations

Mainstreet Equity Corp. is a Canada-based real estate company that is focused on the acquisition, redevelopment, repositioning and management of mid-market rental apartment buildings in four Canadian markets: Vancouver/Lower Mainland, Calgary, Edmonton and Saskatoon. The Company’s wholly-owned subsidiary is Mainstreet Equity USA Corp.

- Market Cap: $294.85(mm)

- Net Asset Value – Actual (FY0, Millions, CAD): $620.41

- Total Current Liabilities (FQ0, CAD, Millions): $62.14

![]()

4. Tricon Capital Group Inc. (TSE:TCN) (TCNGF) – $9.09

Real Estate Services

Tricon Capital Group Inc. is an asset manager and principal investor focused on the residential real estate industry. The Company operates through five segments. Through Tricon Housing Partners, its land and homebuilding investment vertical, it invests or co-invests in private commingled funds, separate accounts and sidecars. Tricon American Homes, its single-family rental home investment vertical, has an integrated platform responsible for the acquisition, renovation, leasing and property management of single family rental homes. Tricon Lifestyle Communities is focused on acquiring and managing existing three- to four-star manufactured housing communities. Tricon Luxury Residences, a multi-family build to core investment vertical, is focused on developing and managing a portfolio of Class A purpose-built rental apartments. Its Private Funds and Advisory business manages and originates investments through private commingled funds, separate accounts, side-cars or syndicated investments.

- Market Cap: $1,023.24(mm)

- Net Asset Value – Actual (FY0, Millions, CAD): $924.78

- Total Current Liabilities (FQ0, CAD, Millions): $301.79

![]()

This article may have been edited ([ ]), abridged (...) and/or reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a faster ...

more