Foreign Investment In U.S. Real Estate Remains Elevated; Capital Preservation And Stability Often Prioritized Over Yield

Executive Summary: Direct foreign investments in U.S. commercial real estate accounted for 17 percent of total dollar volume during 2015, but cross-border activity has trended lower so far this year.

Major U.S. commercial property sectors and hotels continue to post strong performance, reinforcing property values and encouraging investment.

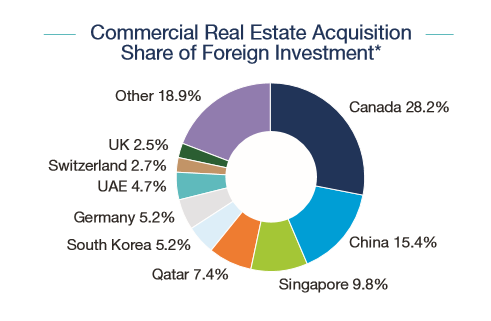

Canada is perennially the largest foreign buyer of U.S. properties and heads the list in the first half of 2016, followed by China, Singapore and Qatar.

Single-asset purchases likely comprise the largest portion of the foreign capital flowing into U.S. commercial real estate. International high-net-worth individuals have made inroads into the private investor market segment.

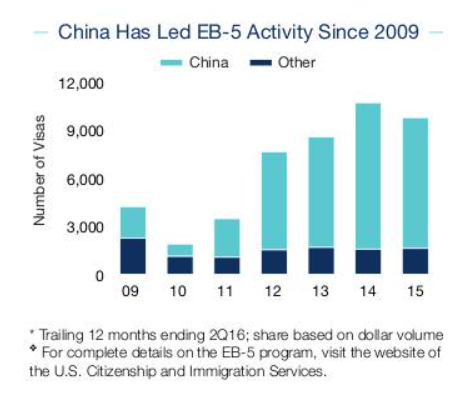

The EB-5 Immigrant Investor Program has emerged as a significant channel for bringing foreign capital ashore and as a way for foreign nationals to gain a visa. Investments are often deployed as mezzanine debt rather than equity.

Foreign demand for U.S. commercial real estate elevated.

Global financial market volatility, weak foreign economies, low alternative investment yields and a variety of factors creating uncertainty have reinforced the advantages of direct investment in U.S. commercial real estate. Together, these forces have drawn additional foreign investment to the U.S., encouraging many to focus on capital preservation and asset stability rather than yield. Since foreign investors’ objectives are often quite different from their domestic counterparts, they can occasionally outbid domestic parties for specific assets. Because the source of foreign capital is often hidden and channeled through U.S.-based funds and entities, competitors and sellers do not realize the bidder is actually from abroad.

Large deals grab headlines.

Considerable press is dedicated to high profile acquisitions made by international investors such as the $1.95 billion purchase of the Waldorf Astoria in New York City by Chinese investors last year. However, the majority of the acquisitions tend to be smaller assets purchased through funds and domestic intermediaries. Nonetheless, total direct foreign investment, where the international buyer can be identified, in U.S. commercial real estate totaled more than $90 billion in 2015, accounting for 17 percent of the total U.S. commercial real estate dollar volume. Historically, international investment in the U.S. has averaged 9 percent of the total. The rising strength of the dollar has slowed the pace of foreign investment so far this year. However, international investors still accounted for an estimated 11 percent of the dollar volume of all U.S. properties sold in the first half of 2016.

Gateway markets lead the list.

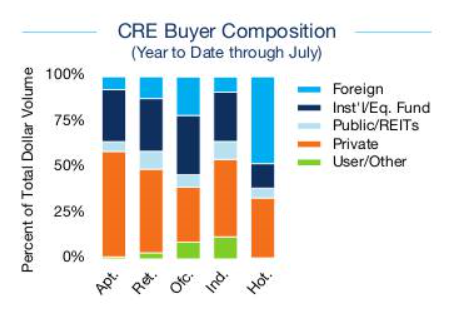

Foreign investors have traditionally favored gateway cities, partly because of the brand value of well known metropolitan areas, but also because these cities tend to face lower pricing volatility and maintain high market liquidity. Although some international buyers, particularly Canadians, venture to a wider range of markets, 43 percent of last year’s foreign capital invested in commercial real estate was concentrated in five major markets: New York City, Los Angeles, Atlanta, Chicago and Dallas. For the first half of 2016, San Francisco and Phoenix appeared in the top five, pushing out Atlanta and Dallas. The bulk of the foreign capital spent through the first half of 2016 was concentrated in office and hotel assets, comprising 72 percent of the foreign dollar volume. From a transactional perspective, apartments and industrial properties were the leaders, representing a combined 57 percent of direct purchases by cross border capital

Foreign Investment Drivers

Canada Leads Foreign Investment, But China’s Potential is Significant

The size, variety and transparency of U.S. commercial real estate has historically attracted investors from across the globe. Often, these investors seek long term return potential as well as capital preservation. Foreign investors frequently channel their capital through local intermediaries, making it difficult to identify international capital sources. Based on transactions where the investor’s origin can be identified, though, Canada leads inflows into the U.S. Singapore, Qatar and South Korea occupy spots among the five largest investors. However, a host of high net worth Chinese citizens, sovereign wealth funds and newly established insurance firms seeking portfolio diversification vaulted China to the second position on the foreign investor list. Since starting at a negligible level six years ago, China’s growing purchasing power enabled it to execute deals valued at nearly $13 billion over the 12 months ending in the second quarter. Given its vast population and significant accumulation of personal wealth, China will continue to emerge as a notable source of capital for investment in U.S. commercial real estate

Increasing investor sophistication broadens participation. Numerous high net worth individuals and families from overseas have been active single family buyers in the U.S., but many are becoming increasingly sophisticated real estate investors with sufficient capital to participate in U.S. commercial property ownership. Canada, the U.K. and Australia have long exploited cultural affinities and language familiarity to make inroads into the U.S. commercial market, while citizens of other countries have acted more cautiously. The rising population of high net worth individuals and households in China has launched a financial advisory and wealth management industry that could facilitate greater participation in U.S. commercial real estate. Improved access to professional investment advice could increase demand for real estate investments and eventually lead to greater direct ownership of hard assets. Some capital constraints persist; however, as Chinese citizens can currently move just $50,000 annually out of the country. A number of methods have been employed to circumvent this restriction, including pooling capital from multiple investors, although this strategy has been used less frequently recently.

Florida favored by Latin American capital. While Latin Americans comprise a considerable segment of the residential market, especially in South Florida, their trackable direct investments in commercial real estate have been more modest. The percentage of sales of less than $10 million where the source of capital was identified as Latin American comprised less than 5 percent of the buyer pool in deals completed in Florida over the past 12 months. Each of the four major property sectors, plus hotels, were represented in the deals conducted by Latin Americans during the period, with Miami Dade County the most active market. Rather than direct deals, most of the commercial real estate transactions by Latin Americans in Florida appear to be executed through U.S. based intermediaries and syndicators, or relatives that are residents of the state.

Wellpublicized big ticket deals just a fragment of foreign acquisitions. The purchase of high profile assets by foreign entities represents a disproportionately large share of cross border deals in the U.S. Recent sales of hotels in major cities, trophy office properties and portfolios of assets make good news and thrust commercial real estate into the consciousness of the general public. While foreign investors may be best known for their large purchases, a number of smaller investors from outside of the U.S. also claim a share of the vast $1 million to $10 million price tranche.

Foreign Investment By Property Type

Broad Array of Markets and Asset Types Targeted by Foreign Capital

Highnetworth individuals and other small private capital entities from foreign countries have become increasingly active in commercial real estate. In recent years, they have also gained a presence in the $1 million to $10 million private investor buyer pool and have spread capital into several metros. Generally, location preferences have aligned with the presence of large communities from the investor’s country of origin. The precise proportion of the $1 million to $10 million price tranche coming directly from foreign capital is difficult to estimate as investments are often conducted through a fund or U.S. intermediary.

Apartment: Private buyers were highly active in the direct acquisitions of sub$10 million apartment properties in the past 12 months. Canadian investors formed the largest contingent of cross border apartment buyers and focused on suburban complexes in markets that include Atlanta, Dallas/Fort Worth and Phoenix, a winter destination for many Canadian citizens. Canadian buyers, with their long history of U.S. commercial property ownership and familiarity with a range of markets, appear comfortable seeking potentially higher yielding assets outside of the largest primary markets.

Industrial: A large portfolio purchase by the Canada Pension Plan Investment Board accounted for most of the dollar volume in the under$10 million tranche of industrial properties directly traceable to foreign entities over the past year. The remaining purchases of industrial assets were conducted by private capital originating from Australia, Brazil and U.S. cross border trading partners Canada and Mexico. Warehouse and distribution assets in U.S. transportation and logistics hubs were the primary targets of the private capital tranche, though Latin American investors favored MiamiDade.

Office: Purchases of office properties pricing for less than $10 million that were directly attributable to foreign capital were restrained due to the greater complexity of office property ownership. During the past 12 months, private buyers originated from Canada, China, Ireland and Israel. Many of the deals in the sub$10 million tier involved suburban assets in secondary markets including Dayton, Ohio and Memphis. Niche properties, including MiamiDade office condos and a suburban Seattle medical office building, were also among the properties trading for less than $10 million.

Retail: A variety of assets and markets were targeted in sales of retail properties pricing for less than $10 million over the past year where the source of capital was identified as cross border. Some multitenant assets were sold to foreign buyers, but singletenant netleased properties were often favored due to their risk profile, passive investment characteristics and low knowledge hurdles required to own. Private foreign buyers purchasing retail assets primarily came from Australia, Canada, China and Mexico.

Hospitality: Asian Americans and American citizens born in India historically comprise a large share of ownership of limited service properties in the U.S. and foreign capital has maintained a presence in the pool of potential investors. Over the past 12 months, individual private overseas investors accounted for 69 percent of the dollar volume of hotels pricing up to $10 million directly purchased by foreign entities. Canadians were the most active group in this segment.

Sector Highlights

Apartment: Completions will climb to 285,000 units this year, likely setting the peak during this development cycle. Even as a significant amount of new stock in a limited number of metros raises some local vacancy rates, the broader effects of heightened construction on the nationwide vacancy rate will remain minimal. This year, the national vacancy rate is forecast to hit 4.2 percent, while the average rent should rise by 4.5 percent.

Hospitality: U.S. hotels maintained record levels of occupied rooms and room revenue through the first half of 2016. The annual U.S. occupancy rate will achieve its highest level on record this year, 65.8 percent. Primary measures of revenue performance will also increase.

Industrial: Demand for industrial space is growing and construction remains restrained after years of falling vacancy. In 2016, completions will decrease to 150 million square feet and the vacancy rate will decline to 5.8 percent behind net absorption of more than 200 million square feet.

Office: Sustained growth in office using employment is generating tenant expansions and the creation of new office based businesses. With restrained construction, rising space demand will fuel further tightening in the U.S. vacancy rate to 14.7 percent this year. Rents will continue to gain momentum, rising by a forecast 3.9 percent in 2016.

Retail: In U.S. retail properties remains strong despite the rapid growth of online retail. In the second quarter, the vacancy rate reached a level last seen in 2005, with the trend pointing toward additional tightening this year to 5.7 percent at year end. Much of the 46 million square feet of space slated for completion will be single tenant formats that include restaurants and other growth leading retail segments.

--------

*The EB-5 Immigrant Investor Program provides a visa to a foreign citizen who invests a minimum $500,000 into projects or businesses that create at least 10 jobs, among other thresholds and stipulations. EB-5 has become a frequently used source of capital formation for large commercial real estate developments, most often employed as mezzanine debt. The program has recently emerged as an avenue enabling Chinese families to send their children to U.S. colleges. Upon completion of the commercial project, a green card conferring permanent U.S. residency is issued and an application for U.S. citizenship can be subsequently submitted. The eventual repayment of the mezzanine debt by the developer to the EB-5 participant effectively “onshores” the capital and potentially liberates it for new investment in U.S. commercial property.