Five Ways To Protect Yourself From A Dividend Bubble

It’s understandable that many investors have been clamoring for the attractive dividend payments of real estate investment trusts (REITS) and utilities stocks, considering central banks around the world have been artificially holding rates so low. However, REITS, utilities stocks, and other high dividend paying corners of the market have been rallying significantly, and it may be a good idea to try and protect yourself from a potentially growing bubble. Specifically, the following charts show the recent and historical performance of REITS and utilities stocks, and there is a precedent for these sectors to experience rapid and dramatic pullbacks relative to the rest of the market. For starters, here is a breakdown of recent sector performance year to date through July 1st, and utilities and REITS are leading the way with their very big dividend payments and strong performance:

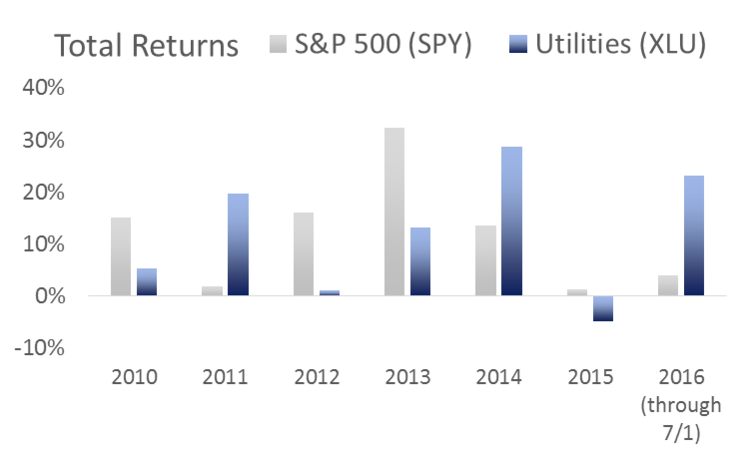

These next two charts show the recent history of REITS and utilities significantly underperforming the rest of the market in years after they’ve experience strong outperformance. For example, 2013 was not a good relative performance year for REITS and utilities, and we may be setting up for some similar underperformance in the second half of 2016 and 2017.

So if you are an income-focused investor, and you’re concerned about a pullback in the big-dividend sectors of the market, what can you do to protect yourself? For your consideration, we’ve highlighted below five ways you can protect yourself from a possible dividend stock bubble:

5. Don’t Chase Returns.

When discussing the natural progression of investments, Warren Buffett once said “first come the innovators, who see opportunities… Then come the imitators, who copy what the innovators have done… Last come the idiots…” He was referring to the concept of a market cycle, and it makes sense to pay attention. Just because many other people have purchased big dividend REITS and utilities stocks and experienced large gains doesn’t mean you should buy them too. We may be approaching the later innings of the dividend stock rally, and it’s unlikely they’ll continue to deliver the out-sized returns they have been.

4. Own Less Conventional Dividend Payers.

It’s okay to be an innovator, and look to other sectors of the market for attractive dividends. For example, we like Wells Fargo, Main Street Capital, AmeriGas, Teekay preferred units, and a variety of other financials, and you can read our full reports on these opportunities here:

3. Don’t be afraid to take capital gains.

If you need income, it’s okay to get some of it from selling your winners. Not all of your income needs to come from dividends, and other sectors of the market can provide opportunities to harvest capital gains. For many investors, capital gains are taxed at the same rate as dividends anyway.

2. Don’t be afraid to own some fixed income.

If it’s truly lower risk income that you’re after, then there’s nothing wrong with owning some high quality fixed income such as investment grade corporate bonds. Certainly they don’t offer the same big yields as they did back in the 1980’s, but they’re still less risky than stocks. And yes, their values may fluctuate with the ebbs and flows of interest rates, but if you buy and hold high quality bonds until they mature, you’ll collect steady interest payments while simultaneously protecting your wealth.

1. Diversify.

Diversification sounds boring, but it can be critically important for income-focused investors, and it’s a lesson they often forget. Rather than living or dying by one or two big dividend sectors of the market (e.g. REITS, utilities), you can structure a high quality diversified portfolio that won’t be nearly as risky. Investing your assets across the various sectors of the market, as well as across various fixed income opportunities, is a proven strategy for long-term success.

Disclosure: None.