Fake News Means These High-Yield Stocks Just Got Cheaper

The financial news media has been pushing the retail apocalypse belief for the last several years. It comes from the closing of numerous North American brick-and-mortar retail stores. The theory is that online retailing will take over most retail sales and that real estate retailing will continue into a death spiral.

Malls and shopping centers will become ghost towns of worthless real estate. The news reporting makes it seem like the collapse of bricks-and-mortar retailing is well underway. You may be surprised to learn, this is not the case, and traditional retailers are fighting back, and in many cases, winning.

Despite “losing” to online retailers for more than a decade, in 2019, online sales make up just 10% of total retail. Yes, 10%! The most optimistic forecasts have online getting up to 15% after another half-decade. Brick and mortar retailing will keep the majority of the spending dollars in the U.S.. More importantly, retailing companies are fighting back. One big push is for what is called experiential stores. This is from Storefront Magazine:

“As consumers choose to invest in experiences rather than products, retailers need to respond to meet the needs of their customers. Customers don’t want just to walk in and buy your product and leave because they could do this in the comfort of their own home. But by creating a more immersive retail experience, retailers can drive people towards their stores and ensure they leave not just with your products but also memories.”

It will be hard to pick out which retail companies will succeed with their experience-based sales effort. I am not even going to try. One way to invest in this trend is to own the real estate investment trusts (REITs) that help retailers promote their experiential approaches to giving customers memorable shopping trips.

With a REIT, you get a landlord that collects rent checks. If a single store or chain doesn’t make it in this competitive retail world, there are new companies popping up all the time that want to give customers a great experience and sell their hopefully awesome products.

Here are three REITs with a focus on working with experientially focused retailers.

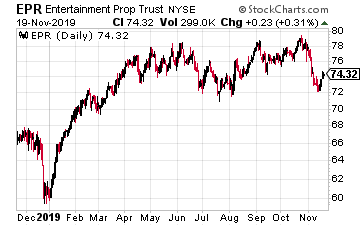

EPR Properties (EPR) is a REIT that is 100% focused on experience-based real estate. The company’s entertainment division owns 176 megaplex theaters, seven retail entertainment centers, which include an additional eight theaters and 12 family entertainment centers.

The recreation division owns 12 ski areas, 23 attractions, 35 golf entertainment (TopGolf) complexes, and 13 “other” recreation properties.

For the younger set, EPR owns a total of 138 charter, private, and early childhood education facilities. EPR has increased its monthly dividend for ten straight years.

The current yield is 6.1%.

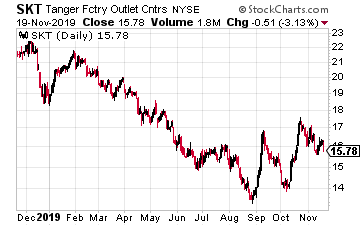

Tanger Factory Outlet Centers (SKT) exclusively owns and operates outlet centers. It is the only pure-play outlet REIT. For retailers, outlets are one of the most profitable sales channels.

Rents are lower, and the outlets allow retailers to try out new experience-based sales tactics and strategies. Outlets are an integral part of the omnichannel retail strategy. This is when a retailer sells through both its online sales channels and through brick-and-mortar locations.

Tanger also has its own TangerClub, which gives members rewards and perks. The SKT dividend has been increased every year since the 1993 IPO.

Shares currently yield 8.7%.

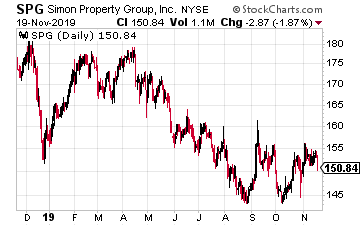

Simon Property Group (SPG) owns premium shopping centers and outlet malls. It has a large international portfolio. The total portfolio consists of 234 properties. This is the largest REIT by market cap in the entire REIT sector.

Simon is very active in helping its tenant retailers who want to build experience-based sales efforts. Simon calls it its Consumer-Facing Entertainment and Lifestyle Platform.

Investments have been made by Simon Ventures in Foursquare, Bustle Digital Group, FabFitFun, Grailed, Le Tote, Bird, Brud, Verishop, and other next-generation innovators in tech, media, and retail.

For investors, the SPG dividend has been increased 22 times in the last nine years.

The current yield is 5.4%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more