EXR: Can The Storage REIT Surmount The Intensifying Headwinds Going Forward?

The Extra Space Storage REIT (EXR) has delivered strong returns over the past decade, though over the past year its total return was comparatively mediocre at 20.67%. It has enjoyed strong Net Operating Income (NOI) margins and Funds From Operations (FFO) growth as people’s needs to rent storage space continues to trend higher. However, this solid demand is being confronted by a rising supply of storage choices, which puts into question whether EXR can continue to deliver strong returns going ahead. Despite rising competitive pressures, EXR has various strengths to play and overcome these headwinds.

Industry Dynamics

Before we dig into EXR, let us assess some industry dynamics and catalysts.

Industry Dynamics

The self-storage industry is highly fragmented market, with the top 10 operators controlling about 15.2% of the US market. Out of all the storage REITS operating in the US, only six are traded publicly.

The majority of the customer base is made up of residential customers (70%), while the other 30% comprises of students, military and businesses.

Non-commercial demand is highly composed of millennials, which make up about a third of this division. The fact that the younger generation constitutes such a large portion of demand is bullish for the industry over the long-term, as demand from this generation should be sustainable as long as they continue to incorporate self-storage facilities in their way of living as they go through different phases of their lives over the coming decades.

Homeownership Trends

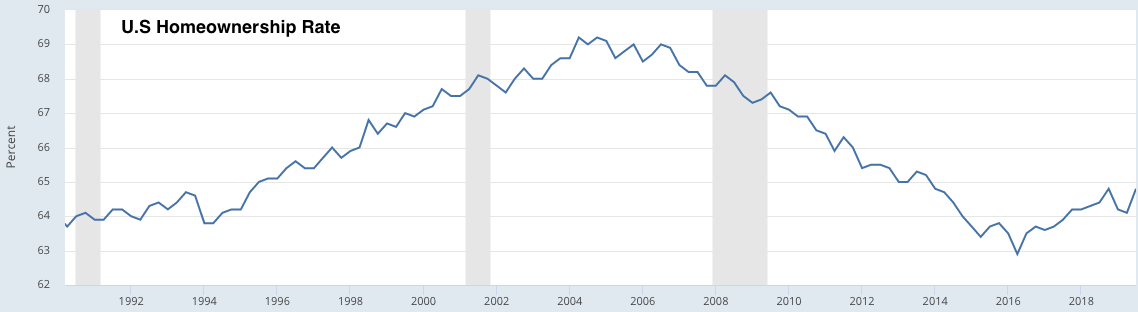

The chart below reflects the trend in homeownership rates since the 1990s. The descend in homeownership between Q2 2004 and Q2 2016 has played significant role in driving the demand for self-storage facilities, as renters are more likely to use such services as opposed to homeowners.

Source: Federal Reserve Economic Data

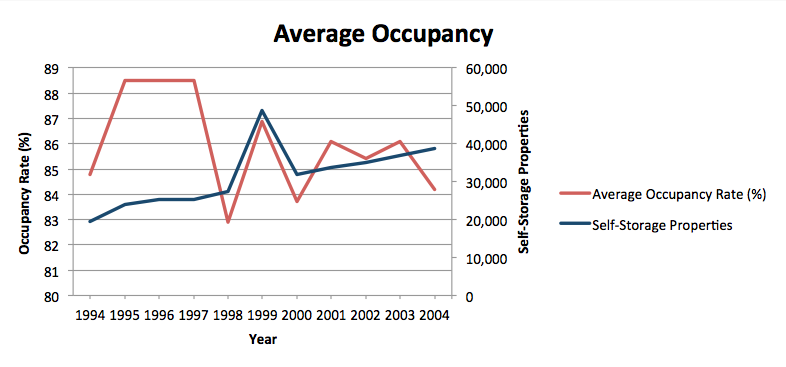

Though the home ownership rate has begun to trend upwards again since Q2 2016. If this trend continues, it could weaken demand for self-storage services going forward, and thus undermine the performance of REITs such as EXR. However, the chart reveals that America also witnessed a strong uptrend in home ownership rates between 1994 and 2004. While the average occupancy rate of self-storage facilities experienced some ups and downs during this period, overall it remained relatively solid, as shown in the chart below. In fact, this strength in occupancy rates was witnessed despite the number of self-storage properties almost doubling during these 10 years. Therefore, rising home ownership rates does not necessarily translate to a deteriorating demand for self-storage facilities, given a solid occupancy rate of 84.2% at the peak of the home ownership rate in 2004.

Data Source: The Almanac

In fact, while the industry has been enjoying above 80% occupancy rates for many years, these self-storage REITs would still be profitable even if the occupancy rate fell to as low as 50% (or even lower). This is due to low capex and general & administrative expenses, resulting in higher Net Operating Income margins. However, these favorable industry characteristics have encouraged a development boom, and this increase in supply is a threat to fundamentals going ahead.

Rising competition

The low barriers to entry and attractive margins led to a massive wave of self-storage development in the middle of the last decade. The number of self-storage properties grew from 38,800 in 2004 to 51,475 properties in 2014 (the latest year for which data was available), which marks a 32.67% growth in supply.

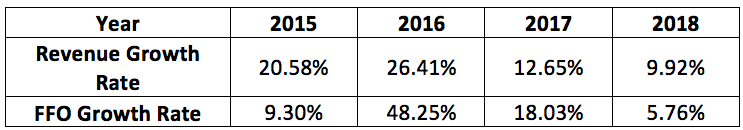

Due to mounting supply and rising competition, EXR’s growth rates have become less exciting. The table below reveals EXR’s annual growth rates for Sales Revenue and Funds From Operations since 2015.

Data Source: Wall Street Journal

Both growth rates have slowed over the past few years amid a growing supply of self-storage facilities across the nation, giving consumers more choice and thus undermining the pricing power of the storage REITs.

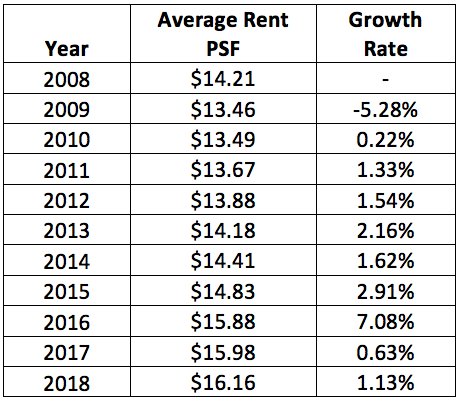

The table below details the average rent Per Square Foot (PSF) charged by EXR since 2008, and the corresponding growth rates in pricing for each year.

Data Source: EXR Annual Reports

The growth in average rent charged by EXR has certainly slowed recently. However, the company has still been able to continue hiking its prices despite the rise in supply and competition. While supply has grown, demand has also continued to grow over the years, as self-storage services become more and more popular.

Furthermore, given the low levels of barriers to entry, EXR has built an alternative moat through extending its brand an expertise to private self-storage providers, which is known has third-party management. More specifically, it involves charging private storage operators for allowing them to use Extra Space Storage’s brand value and technological platform to grow their sales, and these charges are usually collected in the form of a percentage of private operators’ revenues. While other public REITs are also well positioned to leverage such strengths, EXR has been a market leader in third-party management services, with 630 managed stores, according to its latest 10-Q report. Third-party management is a high-margin business line for EXR, thereby helping to expand its profit margins. Furthermore, it allows the company to expand its “geographic footprint” and “reduce operating costs through economies of scale”, thereby further widening its profit margins. These types of strategic relations with private operators also open the gate for future acquisitions in the event that such opportunities arise going forward, making it well positioned to sustain and grow its market share amid rising competition.

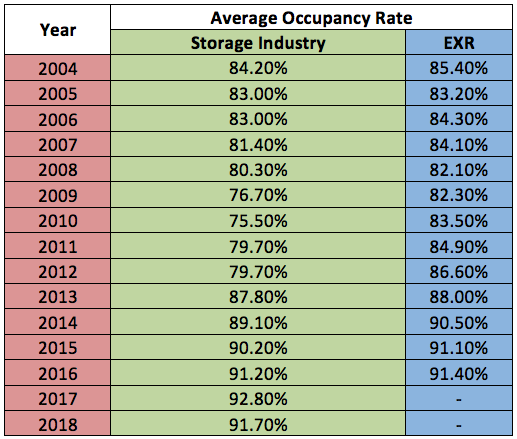

Hence, EXR’s brand power, technological superiority and extendable services have allowed the company to be able to continue growing its revenues despite rising competitive pressures. In fact, the firm has also sustained solid occupancy rates up till 2016 (the latest year for which the company has shared occupancy rates in annual reports). The table below provides the average occupancy rates for both the storage industry and EXR.

Data Source: EXR Annual Reports

Despite the absence of annual occupancy rates from EXR for 2017 and 2018, the data available is sufficient to reveal that the rising supply of storage facilities has had a negligible impact on occupancy rates for the industry’s operators. The growing supply has been absorbed by continuously growing demand for self-storage services. Moreover, regardless of the increased supply, occupancy rates at EXR have remained solid above 90% up till 2016 (the latest annual figure available). Given the robust occupancy rates for the overall industry, it would be reasonable to infer that the occupancy rates for EXR will have remained solid after 2016 as well, and will continue to remain solid going ahead given EXR’s strong competitive positioning.

Notice how even through the economically challenging times following the financial crisis, occupancy rates never fell below 82% for EXR, and 75% for the overall industry. The storage industry is clearly not very economically sensitive, enhancing its appeal as an investment choice through turbulent times.

Fundamentals

According to the latest report from Hoya Capital Real Estate, storage REITs are trading at a 10% premium to their Net Asset Value (NAV). While this sector is certainly richly valued, it is not as expensive as Manufactured Home, Industrial, and Cell Tower REITs, which trade at 20%+ premiums to NAV.

Nevertheless, premiums to NAV should actually be considered as a positive outlook for the industry, affirming that investors believe in the future growth potential for storage REITs, even after the run it has had over the past decade and rising competition.

Furthermore, trading at a premium to NAV also opens up the opportunity for the public storage companies to raise more capital through issuing more units in their REITs. Hence this enhances their financial strength and ability to pursue their external growth strategies ahead.

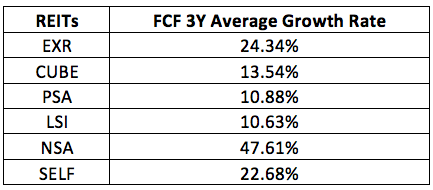

Amid moderating revenue and FFO growth rates due to rising competition, acquisitions will need to be the main source of FFO growth over the coming years. Hence the fact that they are trading at premiums to NAVs means lower cost of equity capital to engage in such expansion activities. The table below provides the 3Y average growth rate in Free Cash Flow (FCF) for all the U.S. publicly traded storage REITs.

Data Source: Wall Street Journal

EXR offers one of the best FCF growth rates in the industry, positioning it well for pursuing future external growth opportunities, and thereby boosting FFO growth going forward. Though competition will be stiff as competitors also witness healthy cash flow growth.

Bearish factors

Debt & Credit Rating

While EXR has been experiencing one of the strongest FCF growth, its cash flows alone will be insufficient to pursue its future growth plans. In fact, they won’t even be enough to repay its existing debt.

In its latest 10-K report, the company stated:

We may borrow under our Credit Lines or borrow new funds to finance these future stores. Additionally, we do not anticipate that our internally generated cash flow will be adequate to repay our existing indebtedness upon maturity and, therefore, we expect to repay our indebtedness through re-financings and equity and/or debt offerings. Further, we may need to borrow funds in order to make cash distributions to maintain our qualification as a REIT or to make our expected distributions.

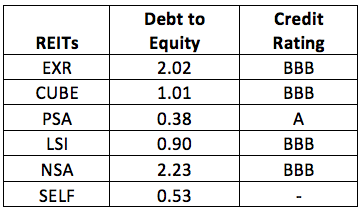

This undermines their financial strength and competitive positioning. The table below details the Debt-to-Equity ratios of the storage REITs, along with their credit ratings.

Data Sources: Wall Street Journal, Standard & Poor’s

EXR already has the second-highest Debt to Equity ratio at 2.02, and like most of the industry has a BBB credit rating- the lowest investment-grade rating possible. As a result, it is highly sensitive to tighter credit market conditions amid any bearish investor sentiment, such as the period witnessed in December 2018. Difficulties in raising capital to repay maturing debt and pursue external growth opportunities would weigh heavily on the stock, and could make it vulnerable to losing its investment-grade rating as well, putting further pressure on stock performance as the company’s cost of capital rises. Conversely, Public Storage (PSA) has the lowest Debt to Equity ratio at 0.38, and the highest credit rating out of the public storage REITs, putting it in a stronger financial position than EXR to engage in acquisitions.

Nevertheless, EXR offers one of the most powerful brand values in the industry. Furthermore, as discussed earlier, the storage industry is not very economically sensitive. In fact, EXR maintained an occupancy rate of more than 82% even following the financial crisis. Hence, this provides a level of stability in rental income and FFO, underscoring its ability to stay financially afloat even during turbulent times. In the event that EXR was in fact downgraded to a junk rating, it should have an easier time raising capital than other junk-rated companies due to its lack of economic sensitivity and relative stability in income-generation, thereby limiting the rise in cost of capital and other financial implications. Therefore, any dip in the stock price in such scenarios should be considered a buying opportunity, especially if it trades at a discount to NAV, because its strong brand value, external growth opportunities and strengths like income stability will mean that investors will be quick to jump into the stock and it wouldn’t be long before EXR, along with the rest of the industry, starts trading at a premium to NAV again.

Interest rate sensitivity

While the storage industry REIT is not very economically sensitive, it is indeed interest rate sensitive. While US interest rates are likely to stay lower for longer, it is the movements in the 10yr that strongly impacts REITs performance. REITs are considered bond proxies, popularly considered an alternative to the low-yielding government bonds. Consequently, lower/declining yields leads to greater demand for the higher-yielding REITs, pushing their prices higher.

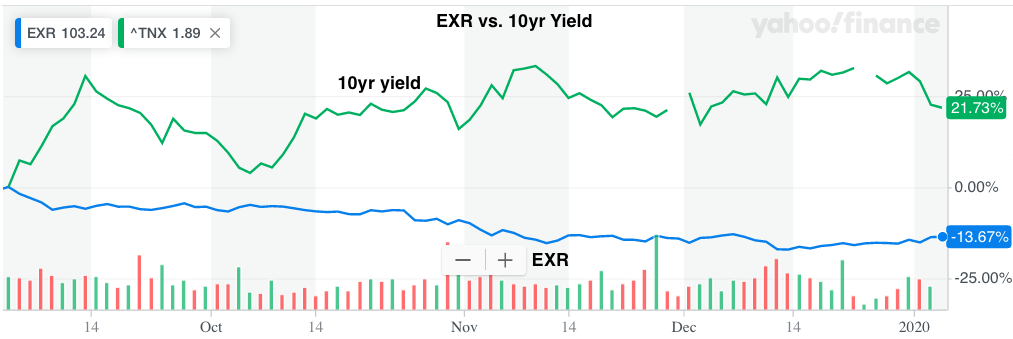

Improvements in the future economic outlook and/or expectations of the return of inflation would induce the 10yr to rise amid expectations of higher rates in the future, which would put pressure on storage REITs. Hence, ironically self-storage stock performance appears to be more vulnerable to improving economic sentiment than deteriorating sentiment. This has been particularly evident in the second half of last year, as the chart below reflects the strong divergence between the 10yr yield and EXR stock price since September 2019.

Source: Yahoo Finance

Since EXR’s inception in 2004, it has had a notably strong negative correlation with the 10yr yield, with a Pearson’s R correlation coefficient of -0.61. This negative correlation has become even stronger lately, given that during 2019 the correlation coefficient was -0.91, implying a nearly perfect negative correlation.

Over the past decade, the decline in the 10yr yield amid unprecedented monetary policy stimulus following the financial crisis has played a significant role in driving the prices of REITs higher, including the extraordinary total returns offered by EXR. Unless negative yields become a reality in the U.S. as well, we are unlikely to witness a decline in the 10yr yield to the magnitude witnessed over the past several decades. This in turn reduces the likelihood of experiencing such incredible returns again from here, unless the correlation between the 10yr yield and EXR stock price weakens.

The negative correlation between the 10yr yield and REITs is not unusual. Nevertheless, the strongly negative correlation between EXR and the 10yr yield undermines its appeal as an investment vehicle, as essentially it becomes an indirect bullish bet on Treasuries, which are already in bubble territory.

While during periods of economic uncertainty this negative correlation bodes well for EXR, investors should beware of scenarios in which we witness an uptrend in the 10yr yield, due to perhaps improving economic outlooks and rising inflation projections. If a pullback in EXR’s stock price amid a rising 10yr yield leads to the REIT trading at a notable discount to NAV, it should be considered a buying opportunity given the company’s strengths and growth potential, especially if its negative correlation with the 10yr yield weakens and more emphasis is given to the company’s strong fundamentals among investors.

Rising competition

The low barriers to entry for the industry has allowed for increased development of new storage facilities across the nation. Going forward, increasing competition could lead to price wars to lure customers. While EXR has deep pockets and superior technology to fend off competition, such price competitions could hurt margins and undermine stock performance for certain periods of time. However, the sticky nature of storage rentals and EXR’s strong brand value will likely limit the threats from new competitors. The company’s efforts in offering third-party management services, by leveraging its brand and technological capabilities, has been a great approach to countering the rising supply of storage facilities, and in fact helping the company expand its profit margins. As discussed earlier, EXR’s annual reports reveal how the company has been able to continue raising the Per Square Foot rent while maintaining solid occupancy rates. Therefore, despite rising competition, EXR remains a solid investment vehicle to gain exposure to the booming self-storage industry.

Bottom Line

Following the solid returns delivered by EXR and the storage industry overall during the 2010s, investors are keen to explore whether such returns can be replicated going forward. Amid a growing supply of storage facilities and consequently rising competition, such solid returns will be challenging to repeat. Nevertheless, regardless of the low barriers to entry, EXR has made remarkable strides towards building a moat through its third-party management services, by leveraging its powerful brand value and technological capabilities, and setting up a pipeline for future acquisitions.

Income stability, strong FCF growth and its premiums to NAV should allow the company to continue raising capital with relative ease despite one of the highest Debt to Equity ratios in the industry and a BBB credit rating. Any potential tightening in credit market conditions would likely induce a notable pullback in the stock, though any scenario where it is trading at a discount to NAV should be considered a buying opportunity given its strong growth potential.

Disclosure: I currently hold no positions in any of the securities mentioned in this article.