Emerging Markets Continued To Rebound Last Week

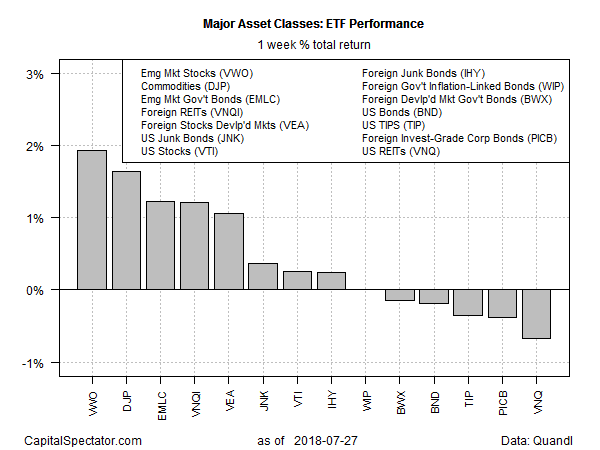

Equities and fixed-income securities in emerging markets posted solid gains last week, based on a set of exchange-traded funds. Stocks in this corner of global markets posted the highest weekly gain for the major asset classes through Friday July 27 while bonds in emerging markets delivered the third-best return.

Vanguard FTSE Emerging Markets (VWO) jumped 1.9% — the ETF’s fourth straight weekly gain, lifting the fund close to its highest level in a month. VanEck Vectors JP Morgan Emerging Markets Local Bond (EMLC) also popped, jumping 1.2% last week – the third-biggest increase for the major asset classes.

Bloomberg notes that July’s been a strong month for emerging markets, which had been fading previously. But some money managers focused on the niche say that it’s premature to assume that a sustained rally is now underway.

“We might see another correction between now and October,” advises Zsolt Papp, a client portfolio manager at JPMorgan Chase & Co.’s asset management unit. “If it is stabilization, we’re in early stages of it. There is still a tail risk that volatility will stay high.”

Meanwhile, US real estate investment trusts (REITs) posted the biggest loss for the major asset classes last week. Vanguard Real Estate (VNQ) slumped 0.7% — the ETF’s third weekly decline.

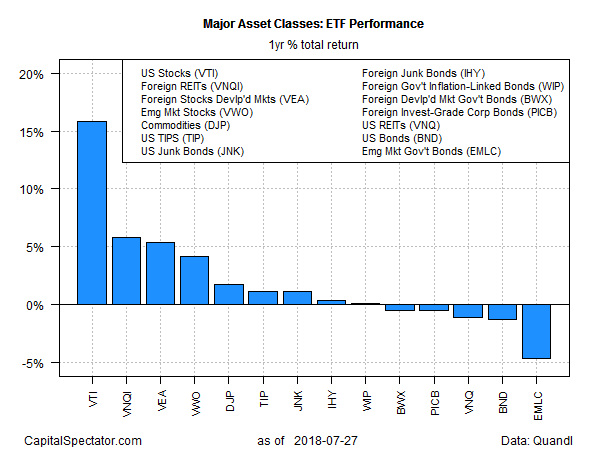

Turning to the one-year trend, US stocks continue to dominate by a wide margin. Vanguard Total Stock Market (VTI) is up a solid 16.3% on a total-return basis – far above the rest of the field. Indeed, the second-best one-year performer – foreign stocks in developed markets — are ahead by a comparatively mild 6.7% via Vanguard FTSE Developed Markets (VEA).

Despite the recent rally in emerging markets, bonds in this corner are posting the biggest one-year decline. EMLC traded down 3.8% on Friday vs. the year-earlier price after factoring in distributions.

Disclosure: None.