Dividend Aristocrats In Focus: Essex Property Trust

Essex Property Trust (ESS) isn’t necessarily a household name when it comes to brands, but the real estate investment trust, or REIT, has produced very impressive growth in the past two decades. The trust has managed to produce a soaring share price and rapidly increasing dividends since its IPO in 1994, and today is worth just over $20 billion.

Last year marked the 25th consecutive year Essex boosted its dividend payment, making it one of seven stocks that are new to the prestigious Dividend Aristocrats, a group of S&P 500 stocks with at least 25 consecutive years of dividend increases.

That list is now up to 64 companies that have proven to investors they can pay – and increase – their dividends in any economic climate. That characteristic is unusual for REITs, so Essex has set itself apart from the herd.

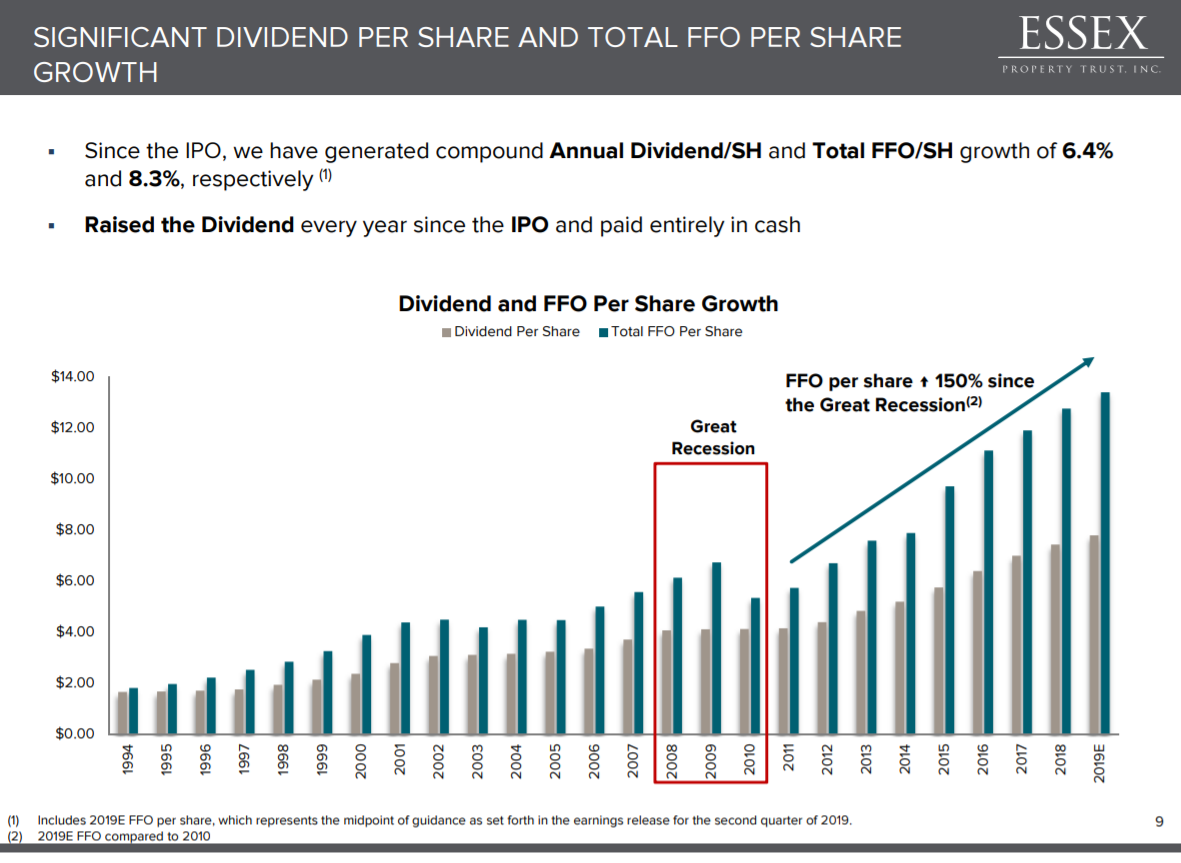

Essex struggled during the Great Recession of 2008-2009, which took a sizable toll on its funds-from-operations. However, since the bottom in 2010, FFO has risen by a compound annual growth rate of 11.5%. This has afforded Essex a higher share price, as well as the ability to continue to raise its payout.

Unfortunately, this excellence has been recognized by the market, and Essex shares look somewhat overvalued today. The stock’s dividend yield isn’t overly attractive either, coming in at just 2.5%.

With the valuation and dividend essentially offsetting each other, as well as a modest 4% annual FFO-per-share growth projected, we think this Dividend Aristocrat needs a pullback before it is worth considering.

Business Overview

Essex is a Real Estate Investment Trust, or REIT. It started out in 1971 as a small real estate company, and eventually went public in 1994. At that time, Essex had grown to 16 multifamily communities as a fully integrated REIT that acquires, develops, redevelops, and manages multifamily apartment communities located in supply-constrained markets.

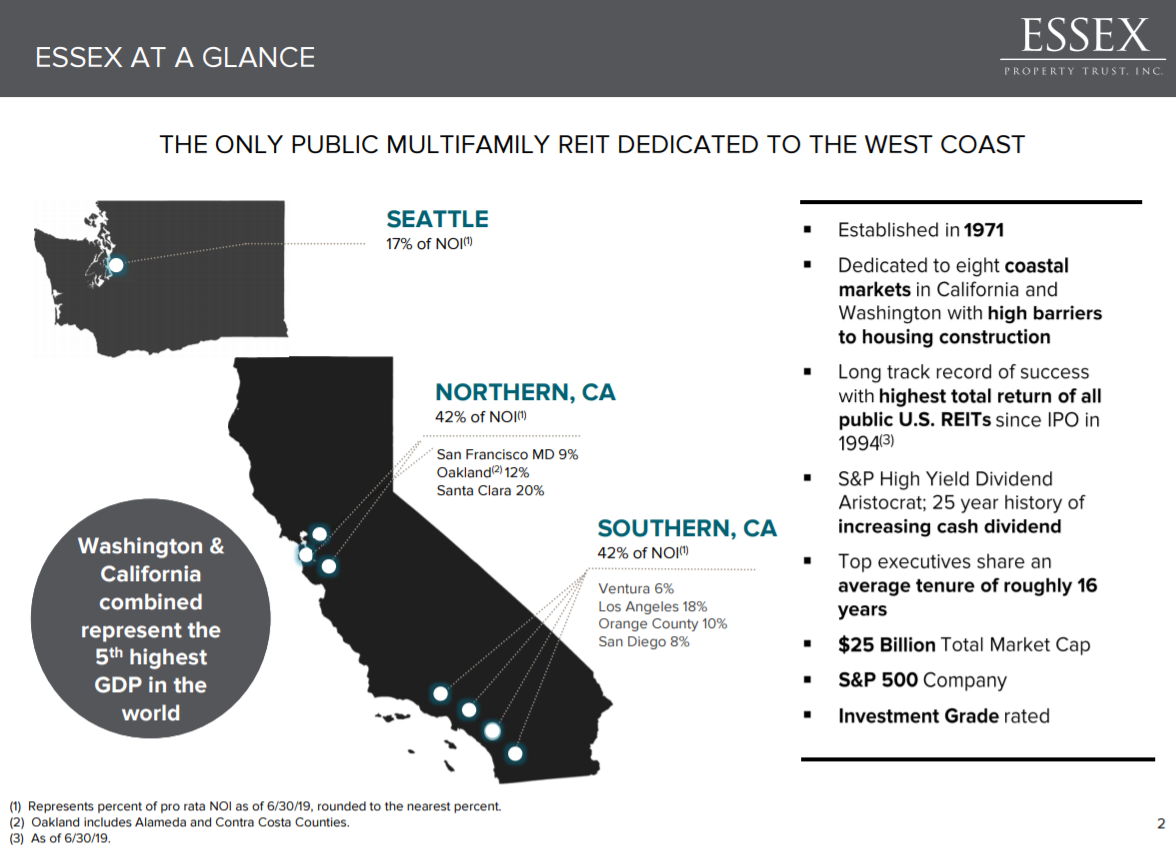

Today, Essex is concentrated on the West Coast of the U.S., including cities like Seattle and San Francisco.

(Click on image to enlarge)

Source: Investor Presentation, page 2

Essex is present in Washington and California, two states with high population concentrations and housing shortages, particularly in desirable seaside cities. The trust is only present in eight markets, but it has identified the best ones with high barriers to new supply, which is key for pricing strength and occupancy over the long-term.

Essex is less diversified than investors would typically look for, but its track record is unmatched in the world of REITs. Indeed, according to the company it has produced the highest total return of all public US REITs since it went public in 1994.

The trust reported Q4 and full-year earnings on January 29th, and results showed strong growth once again. Core FFO-per-share was up 8.2% year-over-year in Q4 and 6.4% for the entire year. The trust achieved same-property revenue and net operating income, or NOI, growth of 4.0% and 5.5%, respectively, against the fourth quarter of 2018. Same-property revenue and NOI are organic growth measures REITs use to assess the performance of their portfolio, in the same way a retailer reports same-store sales.

For the full-year, realized same-property revenue and NOI growth came to 3.4% and 3.9%, respectively, both of which were towards the top end of the trust’s prior guidance. In total, full-year core FFO-per-share rose 6.4% to $13.38, slightly missing our estimate of $13.55, but a strong performance nonetheless.

Essex acquired two more apartment communities during the fourth quarter for a total consideration of $172.1 million. For the full-year, Essex acquired or otherwise invested in eight communities for a total consideration of $856.4 million, which was in excess of its guidance range for 2019. Essex has never been shy about acquiring growth when the deal is attractive, and it spent nearly $900 million last year to that end. Essex funded these purchase in part by divesting its interest in one community during Q4 for $311 million.

Finally, in January of 2020, Essex acquired its joint venture partner’s 45% interest in a land parcel and six communities with more than 2,000 combined units for $1 billion. The company has guided for core FFO-per-share of $13.74 to $14.14 for 2020. At the midpoint, FFO would reach $13.94 per share and would represent ~4% annual growth over 2019 FFO.

Growth Prospects

We see Essex producing 4% annual FFO-per-share growth in the coming years, consistent with growth that was produced for the past two years, as well as guidance for 2020. Essex has reached the point where it is a huge player in the markets where it is present, so growth could be more difficult to come by.

However, we see some catalysts as driving further improvement in FFO over time.

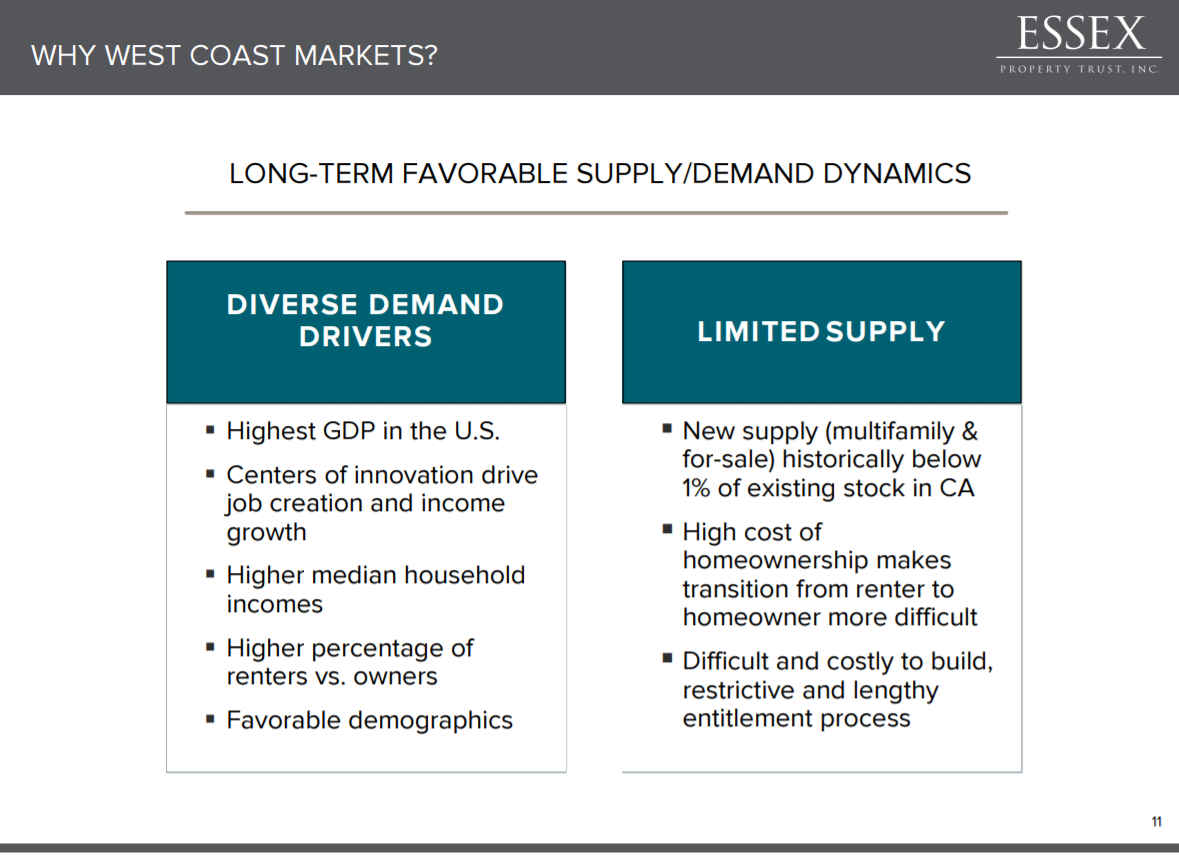

(Click on image to enlarge)

Source: Investor Presentation, page 11

Essex concentrates on the markets on the West Coast because of favorable long-term rental prospects. That area has very high economic productivity and strong rates of job growth, both of which fuel demand for housing supply. In addition, single-family residences are very expensive in these markets, making renting more attractive.

These markets have a strong demand for rental units, but also limited new supply as undeveloped land is limited, and construction is lengthy and expensive.

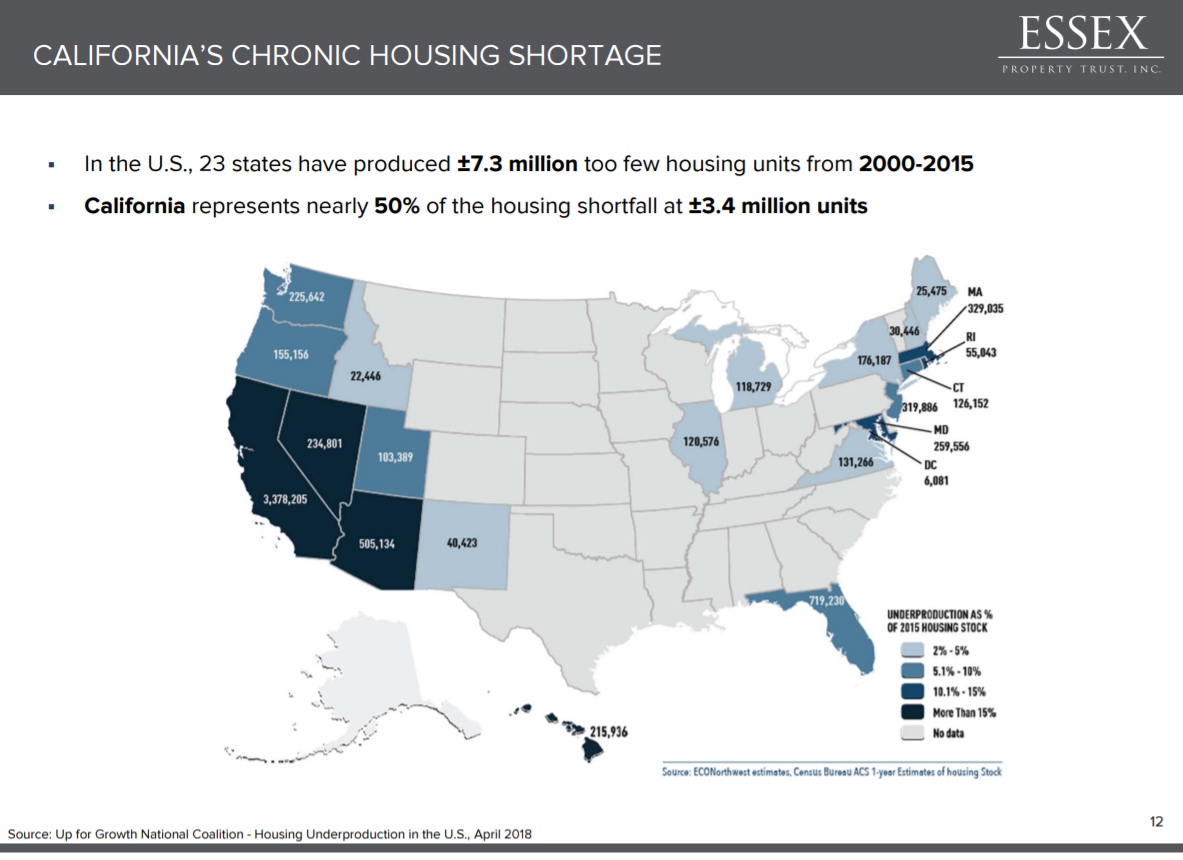

(Click on image to enlarge)

Source: Investor Presentation, page 12

Indeed, as this map shows, Essex is present in two markets with chronic housing shortage problems, which drives demand for its rental units over time. We think this tailwind will be modest but steady, adding to the trust’s FFO-per-share in the years to come via higher same-property revenue and NOI growth.

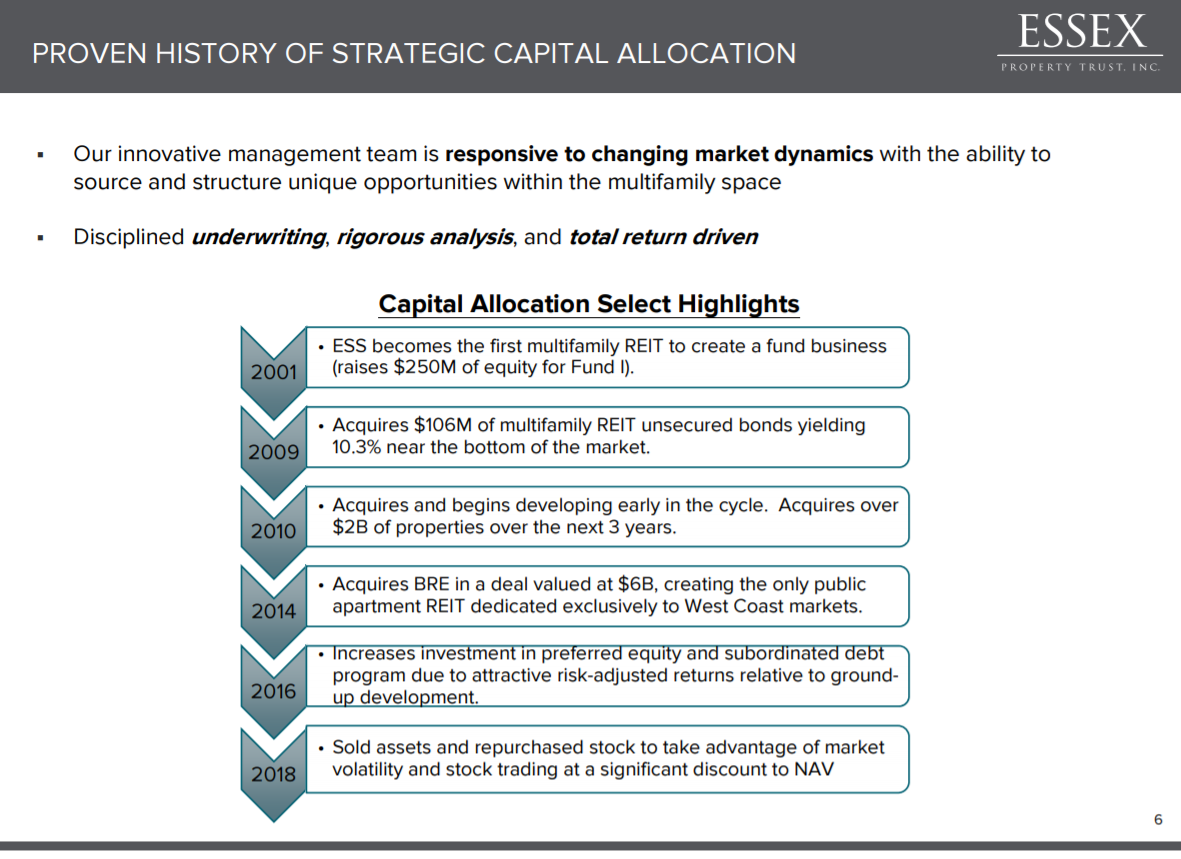

In addition, Essex has never been afraid to acquire or invest in future growth, as we can see below.

(Click on image to enlarge)

Source: Investor Presentation, page 6

Essex has a history of investing in properties in a variety of ways, but also in financial instruments like bonds and preferred stocks. Essex has, over time, invested its capital in the way it saw fit, irrespective of the method. We think this sets Essex up well for the long-term, as it has produced strong results for the past 25 years.

Competitive Advantages & Recession Performance

Competitive advantages are difficult to come by for a REIT, given that so many competitors employ essentially identical business models. However, Essex has scale and size unlike other apartment REITs and a management team that is highly skilled in terms of creating shareholder value through a variety of methods.

Interestingly, Essex performed very well during and after the Great Recession:

- 2007 FFO-per-share: $5.57

- 2008 FFO-per-share: $6.14

- 2009 FFO-per-share: $6.74

- 2010 FFO-per-share: $5.02

This speaks to the resilience of the markets where it is present, as 2010 was the only year in the past decade where FFO-per-share declined. We see this recession resilience as highly-favorable and adds to the attractiveness of the stock.

Valuation & Expected Returns

We believe total returns for Essex – given all the factors above – should be somewhere in the area of 4% annually. The stock’s dividend yield of 2.5% should be almost entirely offset by a similarly-sized headwind from the elevated valuation.

At the midpoint of 2020 FFO-per-share guidance, Essex is trading for a multiple of 22.4. We see fair value at 20 times FFO-per-share, which introduces a 2.2% potential headwind to annual total returns. We see fair value for the stock at $279, which is about 11% below the current price of $313. As such, Essex is overvalued at present.

If we combine the unfavorable valuation, current dividend yield, and 4% forecast FFO-per-share growth, we have total projected annual returns to shareholders of just 4.2%.

(Click on image to enlarge)

Source: Investor Presentation, page 9

Essex has paid increasing dividends for 25 consecutive years, and its average increase since 1994 is in excess of 6%. For obvious reasons, dividend growth investors likely find this to be an attractive quality, and we expect Essex will continue to raise the payout in the mid-single-digits for the foreseeable future.

Unfortunately, this alone is not enough to warrant a buy recommendation, as we are cautious on the valuation and growth prospects.

Final Thoughts

Essex has undoubtedly been a world-class REIT since it went public and began paying dividends a quarter-century ago. The trust has very favorable long-term demographics working in its favor, and a management team that is keen to unlock shareholder value. We think Essex will produce moderate long-term growth and continue to increase its dividend each year.

However, the yield of just 2.5% is low for a REIT, and with shares being overvalued in our view, the stock’s total returns are expected to be modest. Therefore, value and income investors should wait for a price closer to fair value before buying shares. That said, the stock is appropriate for those investors looking for dividend safety and steady dividend growth over time.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more