Buy The Dip! 5 REITs On Sale Right Now

Ever since the January high, REITs have been slowly shedding value, and some great bargains have appeared as of late. Take advantage, as now is the best time to buy shares in these five high-quality REITs that are still boosting their dividends every year.

Equity (those that own real property) REITs were one of the hot sectors in 2014. By the time REIT index values peaked in late January 2015, index values for the sector had gained over 40% since the start of 2014, plus about 3% in dividends. Since that late January peak, the REIT sector has dropped by 11.7%, as of the market close on May 6.

A market or index drop of more than 10% is the generally accepted definition of a correction. By that definition, REITs are definitely in correction territory. I write this on May 7, which closed as a nice up day for the REIT ETF I follow. Possibly this is a signal that the correction has reached a bottom. Although there should not be much of a correlation, the investing public views REITs as a bond substitute, so if interest rates are expected to increase, REIT share prices have a tendency to sell off. You can counter that viewpoint by investing in REITs that regularly increase their divided rates. A bond can’t do that.

It is an interesting phenomenon of the stock market that investors love stocks when share prices are high and buy more, but have trouble pulling the trigger to invest when prices have fallen. Now that share prices are down more than 10% from three months ago, everyone is worried about REITs. I think it would be a good time to get in on some quality real estate companies. Here are five large cap REITs from a range of property sectors that have dropped by 15% or more from their peaks earlier in the year.

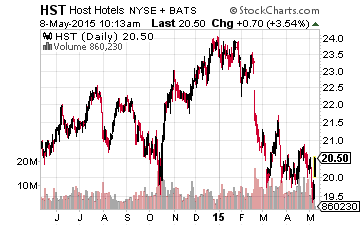

Host Hotels and Resorts Inc. (NYSE: HST) is down close to 20% from its high and yields 4%. HST has increased its dividend by over 50% in the past year. I think the lodging sector will remain one of the best growth stories in commercial real estate.

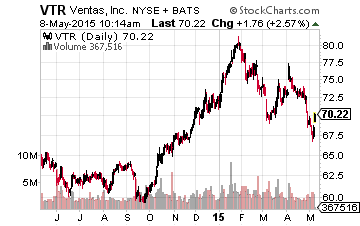

Ventas, Inc. (NYSE: VTR) and Health Care REIT, Inc. (NYSE: HCN) are the two largest healthcare property REITs and have similar 4.6% yields and high single digit growth rates. The VTR and HCN share prices are down about 16% from the highs, which means yields have moved up from less than 4%.

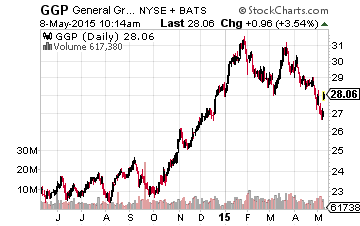

General Growth Properties Inc. (NYSE: GGP) is down about 15% and yields 2.5%. The dividend was increased by more than 20% in the last year. GGP owns and operates high quality shopping malls.

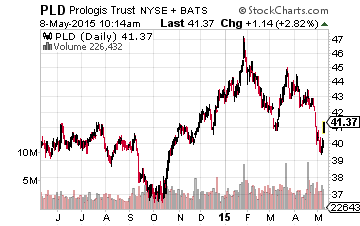

The Prologis Inc. (NYSE: PLD) share price is down 15%, pushing the yield up to 3.7%. PLD owns and leases distribution facilities in the U.S. Europe and Asia. The dividend grew by 18% over the last year.

If you like value hunting, you can find deeper share price declines and higher yields with similar growth rates among the smaller cap REITs. It takes some work, but if you have the time it is possible to find 6% yields combined with 10% or greater dividend growth.

High-yield REITs with a solid track record of increasing dividends are one of the core investments we use in my Monthly Dividend Paycheck ...

more