Annaly Capital Management Is A Value Trap

Annaly Capital Management (NLY) is down significantly from its highs over the summer. However, the stock remains a value trap. The mortgage REIT is facing secular headwinds in early 2018 as Treasury yields move materially higher. Mortgage REITs are primarily valued based on price-to-book. The problem for most retail investors is that the last published book value isn’t the same as the current book value.

Declining Book Value

Given the rapid increase in Treasury yields and the corresponding decline in bond prices, most mortgage REITs are already sporting large unrealized losses in their portfolio as of February 19, 2018. The damage comes from two sources. One is that a large movement higher in rates leads to a significant decline in book value. The second is a widening of the spreads between RMBS (residential mortgage-backed securities) and their corresponding hedge portfolio.

The damage from the widening of spreads isn’t a major problem. Those spreads will gradually widen and shrink over time. However, the significant increase in rates is a major problem. The book value lost due to the rapid change in rates represents a fundamental problem for residential mREITs in a period of rising rates.

The dividend level a mortgage REIT can support is a function of their yield on assets, the net interest spread, their operating expenses, and the amount of book value available for leverage. When the book value declines, all of these other yield metrics are multiplied by a smaller equity base. That results in less net interest income per share. Eventually, the decline in net interest income per share leads to a reduction in the dividend.

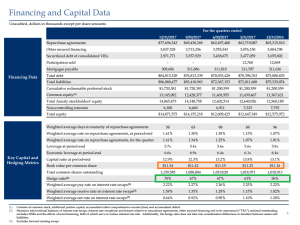

The trend in book value was previously flat, as shown in this slide from their Q4 2017 supplemental:

The orange box demonstrates the book value per common share. Investors should expect that to be down quite a bit since the end of the Q4 2017.

The green box highlights the hedge ratio. This is important because it is going to be relevant to the company’s cost of funds as the hikes in interest rates continues.

Declining Income

Investors wouldn’t know NLY’s core business was suffering. They could easily look past those issues. NLY hasn’t cut their dividend in a few years and the company’s “Core EPS” remains stable. However, that masks the underlying problem. The ability of a residential mortgage REIT to earn net interest income on a continual basis relies on their ability to fund the portfolio at a rate below the yield on assets.

The Federal Reserve has increased interest rates several times already and we are expecting 2 or 3 increases in 2018. It is possible that we could even see hikes this year.

That’s a huge problem for Annaly Capital Management because it drives their cost of funds higher. Their hedges will protect part of their cost of funds, but it isn’t possible to hedge out all duration exposure. A mortgage REIT hedging out all of their risk would end up hedging out all of their returns as well. The question is how well investors get paid for the risk they do take.

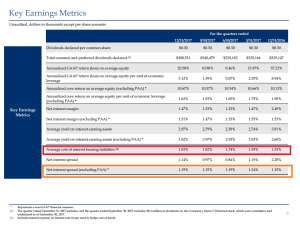

The relevant earnings metrics can be seen in the slide below, from the same presentation:

I’ve added the red box to highlight the cost of funds. Investors should expect this to continue climbing over the next several quarters. I’ve also put an orange box around the net interest spread excluding PAA. Investors should expect this to gradually decline over the next year unless NLY either modifies their hedging strategy or reallocates more of their portfolio into a different sector.

How Well are Investors Paid?

Currently, NLY’s dividend yield is materially higher than what they can reasonably expect to earn on book value in this environment. Consequently, a chunk of the current dividend is effectively a return of capital rather than a return on capital.

A better option in this scenario would be to look at the preferred shares for Annaly Capital Management.

While Annaly’s common stock dividend isn’t sustainable, the preferred shares are covered several times over. The yield on the preferred shares isn’t bad, about 7% to 7.7% depending on which series of preferred stock. The F series and G series both carry floating rates when call protection ends, so investors who expect further rate hikes may find them preferable.

I am currently long NLY-F and actively trade in the preferred shares of mortgage REITs to capitalize on relative mispricing between preferred shares. I have no position in the common stock and do ...

more