A Steady 7% From 3 Stocks For Investors Who Don’t Want Drama

In the universe of higher yield stock investing, often no news is good news. Income stock investors want to own shares that pay steady dividends from companies that can be counted on to earn enough to cover the dividends quarter after quarter.

Stock market drama usually leads to share price volatility, which is something that makes dividend investors uncomfortable. As a result, often the best dividend stocks don’t make much news in the financial news, which makes it harder for investors to find them.

One group that gets little press but pays steady dividends and attractive yields are the small cadre group of commercial mortgage finance real estate investment trusts (REITs).

REITs are divided into two broad categories. Equity REITs own commercial properties. They earn revenue from rent or lease payments. Finance REITs originate or own portfolios of real estate secured loans. The residential focused REITs usually own highly leveraged portfolios of mortgage-backed securities (MBS).

Commercial finance REITs typically originate loans on commercial properties and hold them in their own portfolios. Commercial finance REITs contrast starkly compared to the more popular residential MBS owning REITs. They are less leveraged, financially more conservative, and have better dividend track records.

Commercial finance REITs are lower risk and historically have been more stable dividend payers. Commercial mortgages are typically done with variable interest rates, and commercial REITs match their loans with variable debt. They lock in the interest rate spreads, no matter which way interest rates move. These REITs also use a lot less leverage than their residential MBS owning cousins.

If you are looking for 7% to 8% yields where you can count on the dividends for years to come, consider commercial finance REITs. Here are three that I’ve been following for years to get you started.

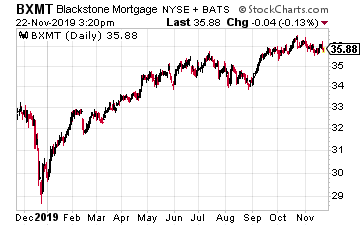

Blackstone Mortgage Trust, Inc. (BXMT) is a pure commercial mortgage lender. The REIT receives high-quality mortgage lending leads from its sponsor, The Blackstone Group L.P. (BX).

As of its 2019 third-quarter earnings, BXMT had a $16.4 billion portfolio of senior mortgage loans.

In the quarter, the company originated $3.7 billion of new senior loans and received about $3 billion of principal paybacks. 94% of the portfolio is floating rate.

The loans were at 62% loan to the value of the underlying properties. Leverage is 2.8 times debt to equity.

The stock currently yields 6.8%.

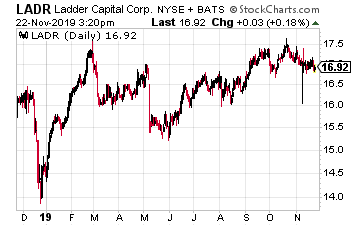

Ladder Capital Corp (LADR) uses a three-prong approach to its investment portfolio. The three legs are commercial mortgage loans, with a current $3.4 billion portfolio of floating and fixed-rate loans, commercial real estate equity investments, valued at $981 million, and commercial MBS bonds, worth $1.9 billion.

The business plan is that the three groups cycle to more or less attractive through the commercial real estate cycle, each being more attractive at different phases of the cycle.

Leverage is a comfortable 2.6 times.

Since it paid its first dividend for Q1 2015, Ladder has steadily increased the quarterly payout at an average 5% annual growth rate.

The shares currently yield 8.0%.

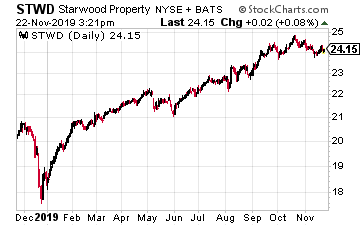

Starwood Property Trust, Inc. (STWD) is one of the largest commercial lenders of any business type – including banks. The company currently has an $8.0 billion loan portfolio with a 65% loan to value.

Since launching in 2009, the company has deployed over $40 billion in loans and investments with zero realized losses.

In recent years, Starwood has acquired the largest commercial mortgage special servicer. This acquisition has led to growth in CMBS origination and investments.

The company also owns a $2.7 billion equity commercial property portfolio that generates 9% to 12% cash on cash returns. Recently Starwood has invested in non-agency residential MBS.

The $1.2 billion RMBS portfolio has a 68% loan to value. Management constantly looks for investment opportunities both in and out of the commercial mortgage business.

STWD current yields 7.9%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more