A Real-Life Example Of Dividend Value Investing Paying Off Big

I love it when companies or shares get cheap in relation to the underlying business’s actual value. I often tell the story of Aircastle, Ltd. During the last financial crisis, at the 2009 stock market bottom, Aircastle traded for less than $3.00 per share. In that same year, the company generated more than $4.00 per share in free cash flow and paid something like $0.60 per share in dividends. In early 2020, Aircastle was acquired for $32.00 per share.

The lesson here is that if you understand the fundamentals of a company, you have the knowledge to jump in when shares get “stupid cheap” and you can reap fantastic profits when the market gets its act back together.

Recently, large-cap shopping mall REIT, Simon Property Group (SPG) showed how the company’s deep knowledge of retailing allowed it to make some very profitable investments in companies investors had written off.

Even before the pandemic, some retailers faced challenges as more and more retail sales moved to online channels. Bankruptcy declarations from brick and mortar retail companies were bad news for Simon Property and its shopping malls, so the company chose to take its fate into its own hands and bought struggling retailers. At first glance, buying failing retail companies could appear like a desperate move to keep vendors occupying malls. I will show shortly that is not the case.

During 2020, Simon Property, sometimes with a partner, acquired Forever 21, Lucky Brands, Brooks Brothers, and JCPenney. These acquisitions kept a lot of stores open that might have closed due to the pandemic.

However, you will be surprised at how well Simon fared from these retailers’ business results.

During the 2020 fourth-quarter earnings conference call, CEO David Simon noted that Simon Property Group had a net investment of about $330 million into these brands, adding that for 2021, the brands would generate a total EBITDA of $260 million. That’s right: in one year, Simon will earn $260 million on a total investment of $330 million. The math works out to a 79% return on investment in the first year.

I expect the total EBITDA will continue to grow as the pandemic subsides and more shoppers return to the mall. The REIT will also receive contracted lease payments from the retailers. But even if shoppers are slow to return to brick-and-mortar shopping, CEO Simon noted that the brands generate $3.5 billion in digital sales.

Over the next decade, Simon Property Group will reap returns that are many multiples of the capital it invested in rescuing the name brands. Simon saw value where others just saw failing retail businesses.

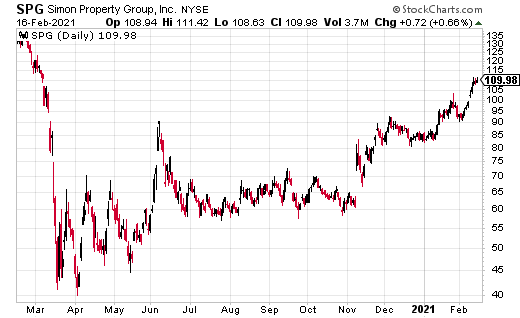

Simon Property Group has been a portfolio stock in my dividend growth-focused service for three years. While it was tough to watch the company’s share price in 2020, I know my subscribers will benefit from the excellent management of this premier REIT.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more