A Quick Primer On Cell Tower REITs

Summary

- Cell Tower REITs are joining our coverage universe. To get investors up to speed, we’re providing a quick primer on the sector.

- These REITs demonstrate exceptional growth in revenue and AFFO per share. The sector has seen tremendous demand for years.

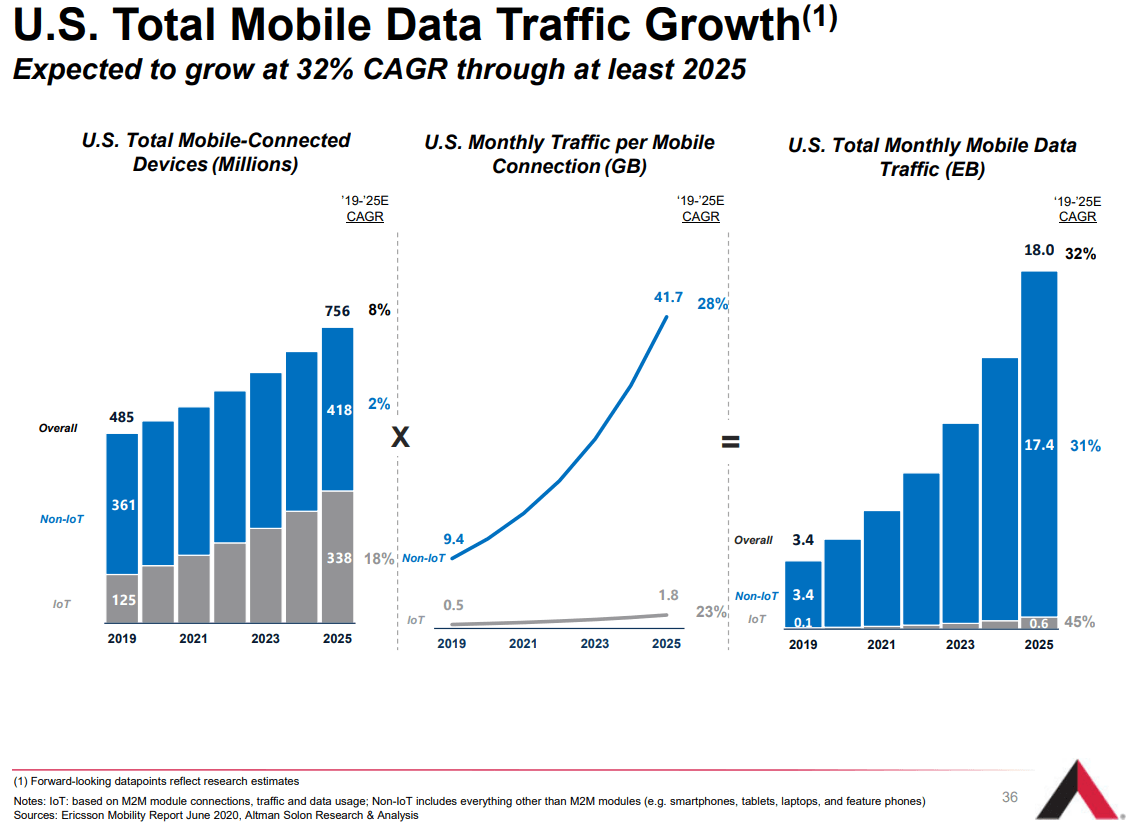

- We expect strong demand for mobile data. Expert estimates suggest a 32% average CAGR (compound annual growth rate) for the next 5 years.

- Towers are critical infrastructure to support mobile data. Wireless carriers need towers to deliver data to the end consumer.

- The tower property type demonstrates excellent fundamentals. It benefits from economies of scale and has exceptionally low capital expenditures required for maintenance.

We are thrilled to be able to expand some of our equity REIT coverage. This was something we couldn’t do before because we needed one more team member. With Hoya Capital Real Estate as part of our service and providing exceptional updates on the REIT sectors (work off of my plate), we’re able to expand coverage and include some REITs we’ve been watching over the last couple of years. Specifically, we’re interested in adding more tech REITs. Tech REITs covers two kinds of REITs:

- data center REITs

- cell tower REITs

Essentially, these are REITs that use their real estate to facilitate the transfer of data.

What We Like:

- A strong forward trajectory for demand

- Consistent revenue growth

- Huge economies of scale

- Competitive advantages over smaller operators

- Proven history of delivering growth for shareholders

In this article, we’re going to focus on the tower REITs. However, that list of things we like has been accurate for data center REITs and tower REITs.

There are three major tower REITs for consideration:

- American Tower Corporation (AMT)

- Crown Castle International (CCI)

- SBA Communications Corporation (SBAC)

We recently added AMT to coverage (and purchased shares). We plan to include CCI and SBAC as well.

Keep it Quick

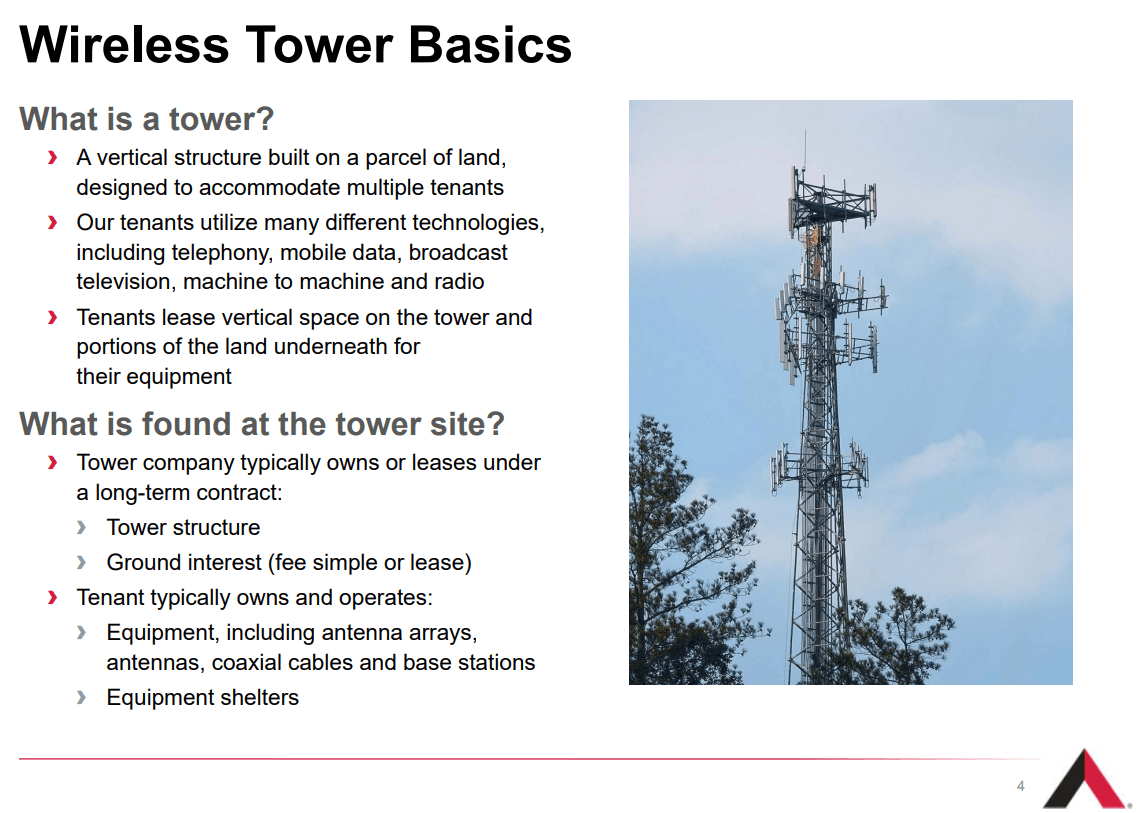

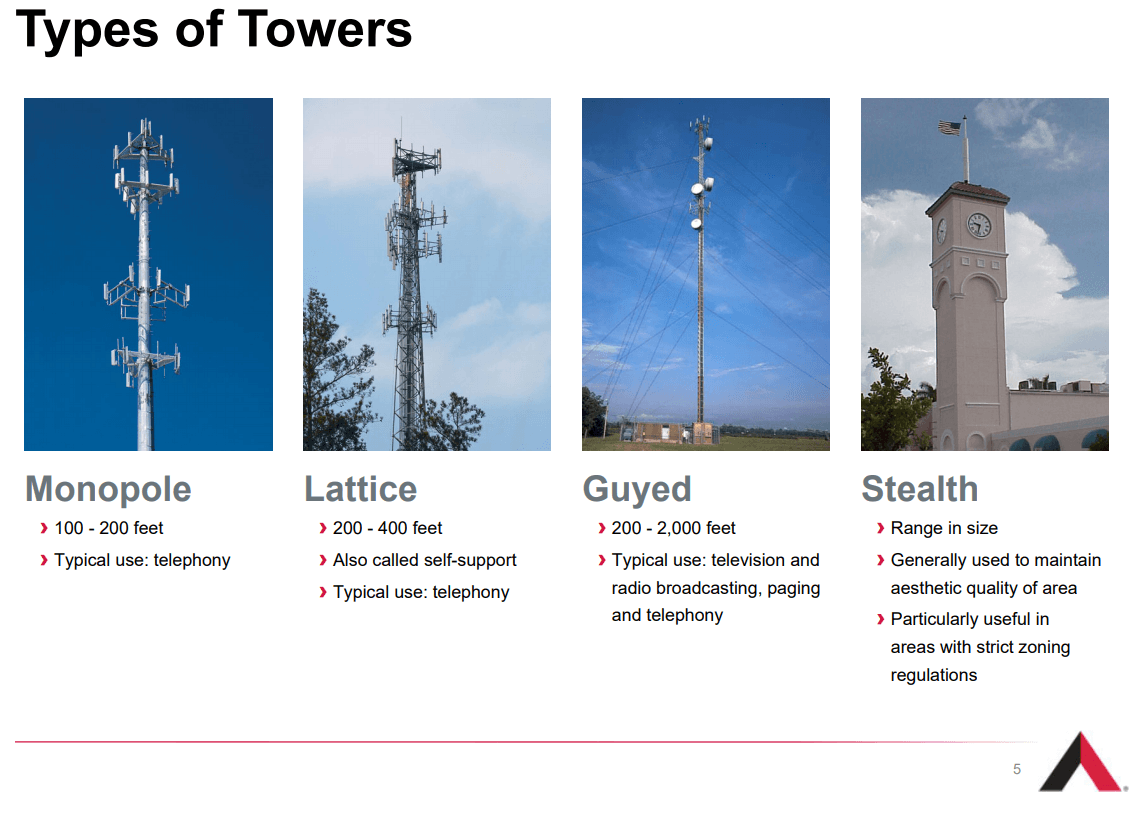

We’ll run through that list in order. However, we need to start by defining the term “cell tower”, or “tower” for short.

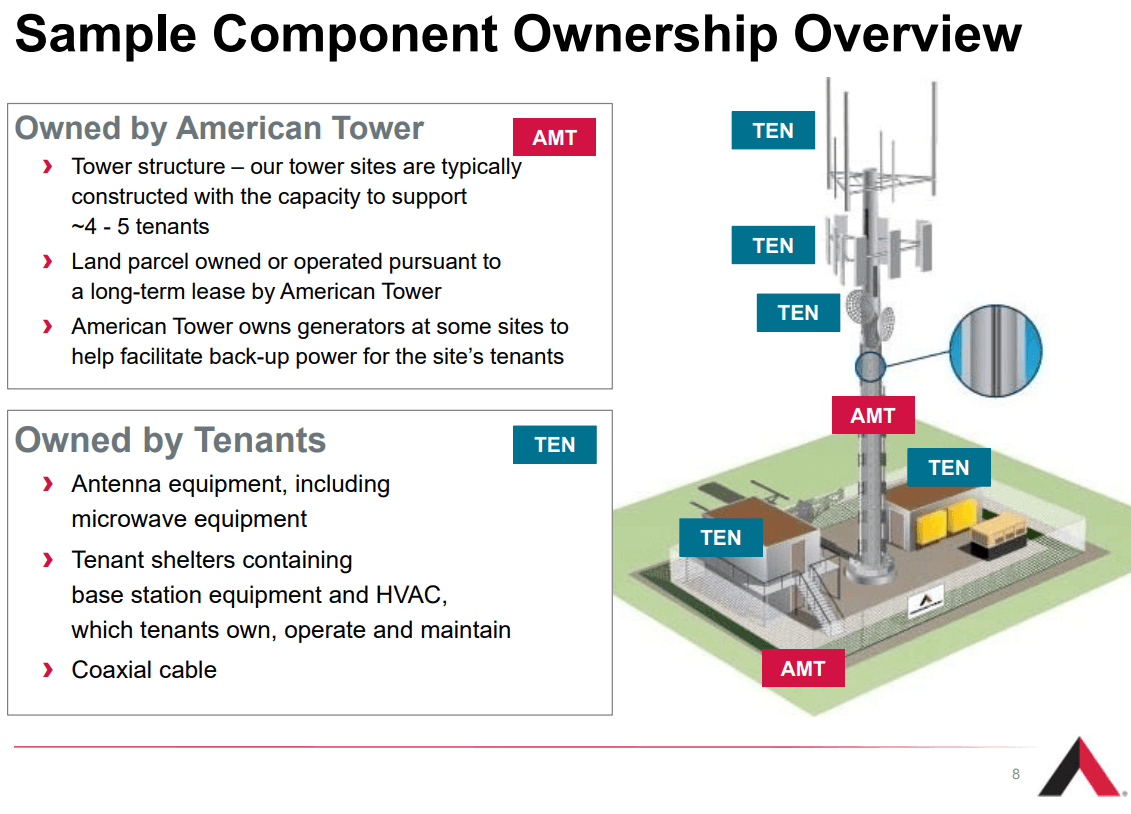

Fortunately, AMT is actively working to educate potential investors and provides us with several educational images.

Source: AMT

Source: AMT

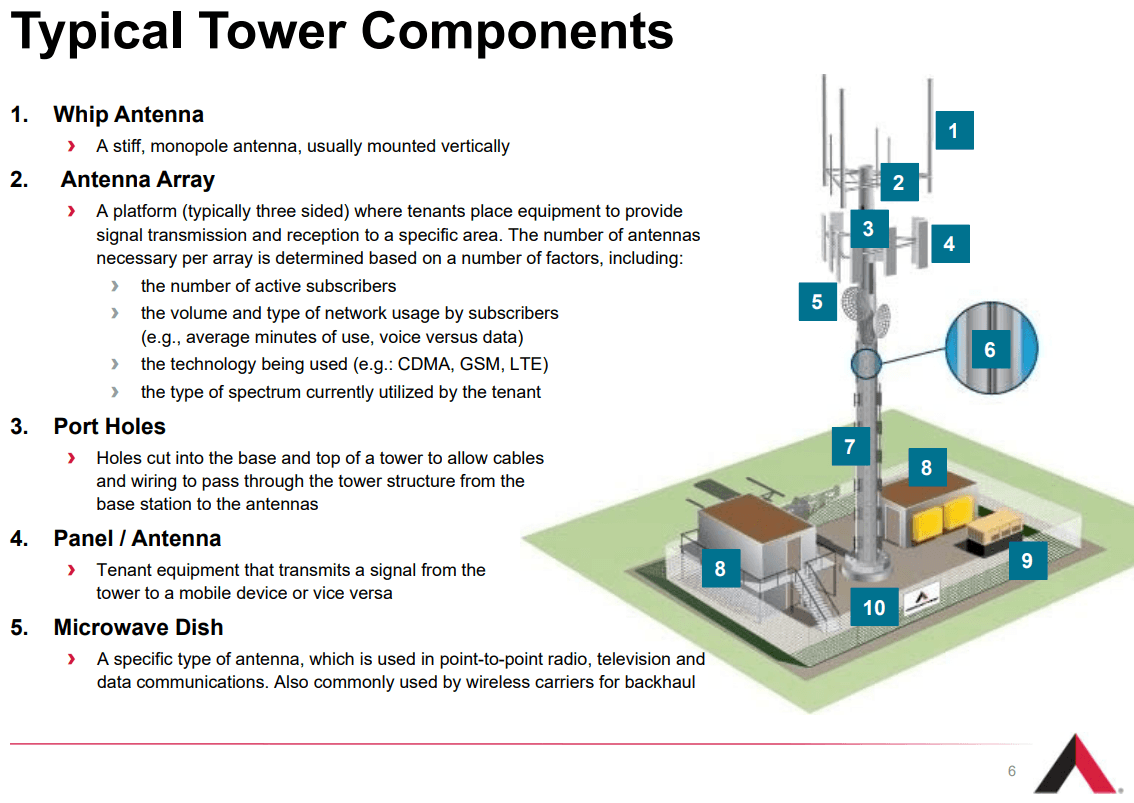

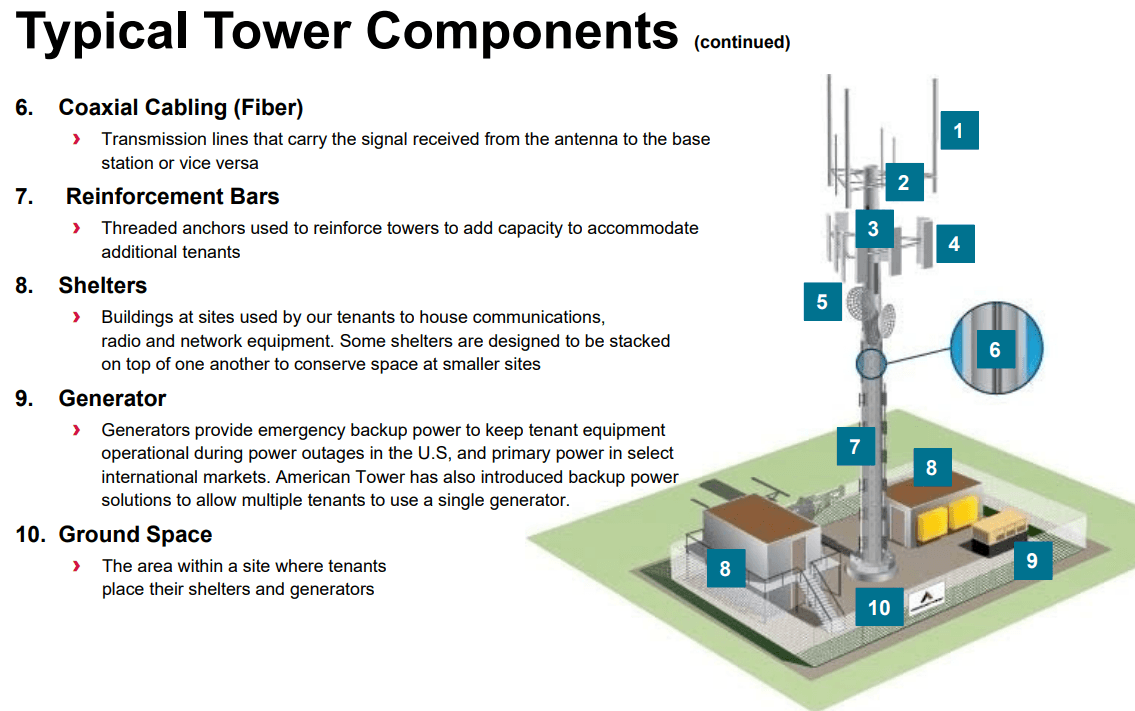

You don’t really need to know the components to follow the rest of the article, but we’re including it anyway:

Source: AMT

Strong Forward Trajectory for Demand

Simple questions:

Do you use your phone more now than you used it 5 years ago? Probably.

Dramatically more than 10 years ago? Probably.

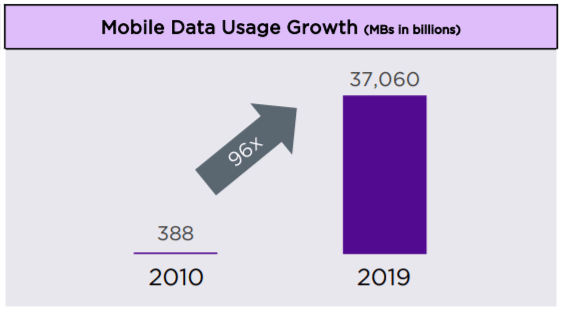

Beyond using your phone more, you may use it for much more complicated things. You may demand more data. 5 years ago, we weren’t thinking about streaming REIT presentations on-demand through our phones. This increase in data consumption has been dramatic:

Source: CCI

In the span of about a decade, mobile data consumption increased by around 100 times. By 2019 (only 9 years), it was up 96 times.

Phones have improved rapidly. Perhaps faster than any other technology over the last decade. That makes sense because the amount consumers are willing to spend on their phones has scaled dramatically higher. Those consumers expect their phones to work and a phone without a signal is far less useful. Phone screens are getting bigger, pictures have higher resolution, and video calls/messages have taken off. To put this in perspective, many of our public articles over the last few years have actually been transcripts. They are recorded as video and sent to REIT Forum Support.

Consistent Revenue Growth

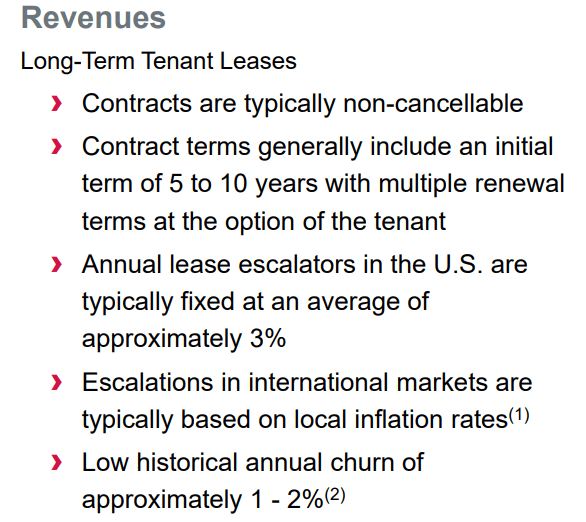

Typical contracts run 5 to 10 years and the average annual lease escalators in the United States are fixed at an average of 3%. International leases generally use local inflation rates.

Source: AMT

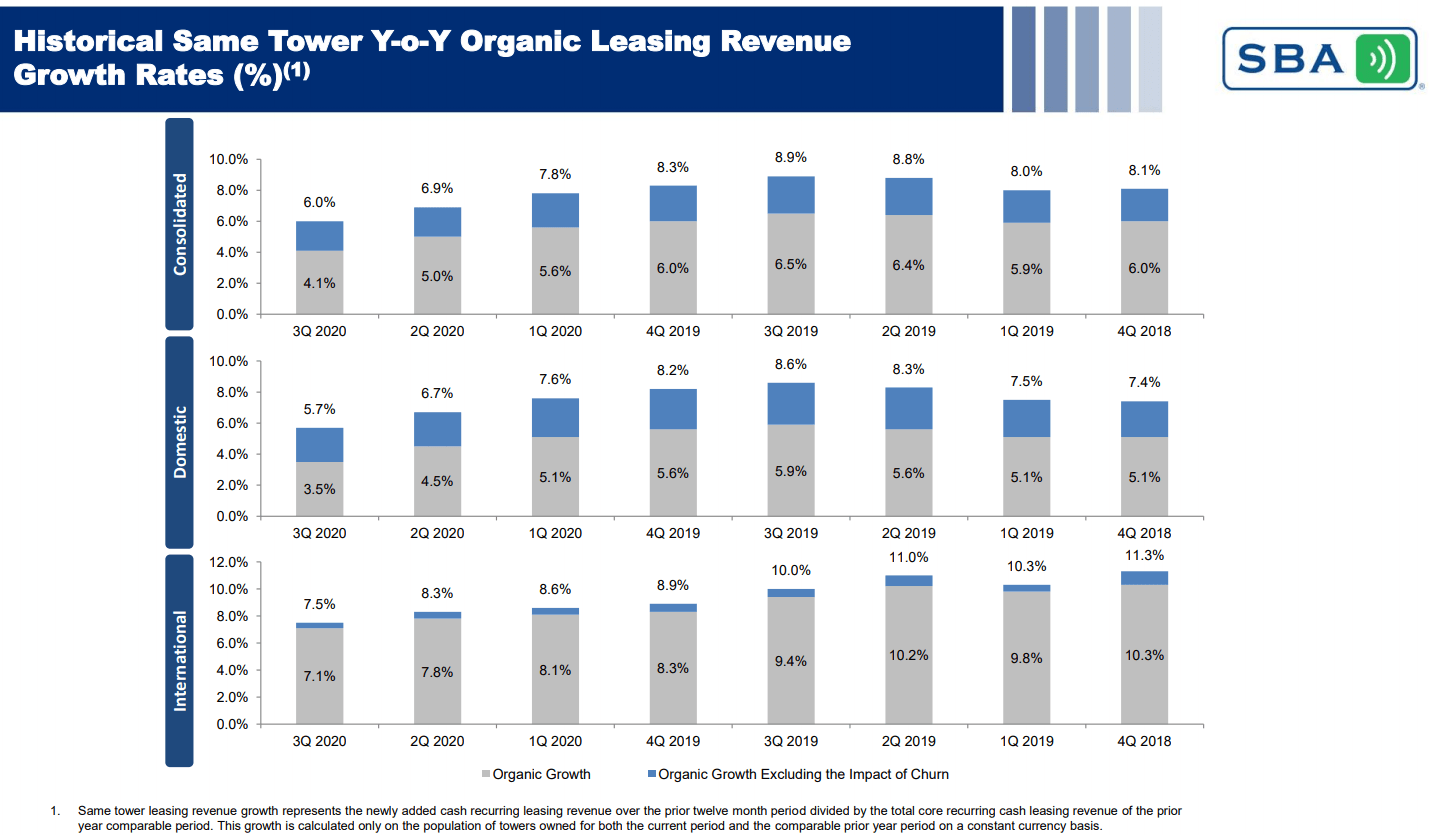

Because the landlords are able to add additional tenants to an existing site, they can grow revenue per tower at a faster rate than the annual rent escalators. This is demonstrated by SBA’s performance:

Source: SBA

Huge Economies of Scale

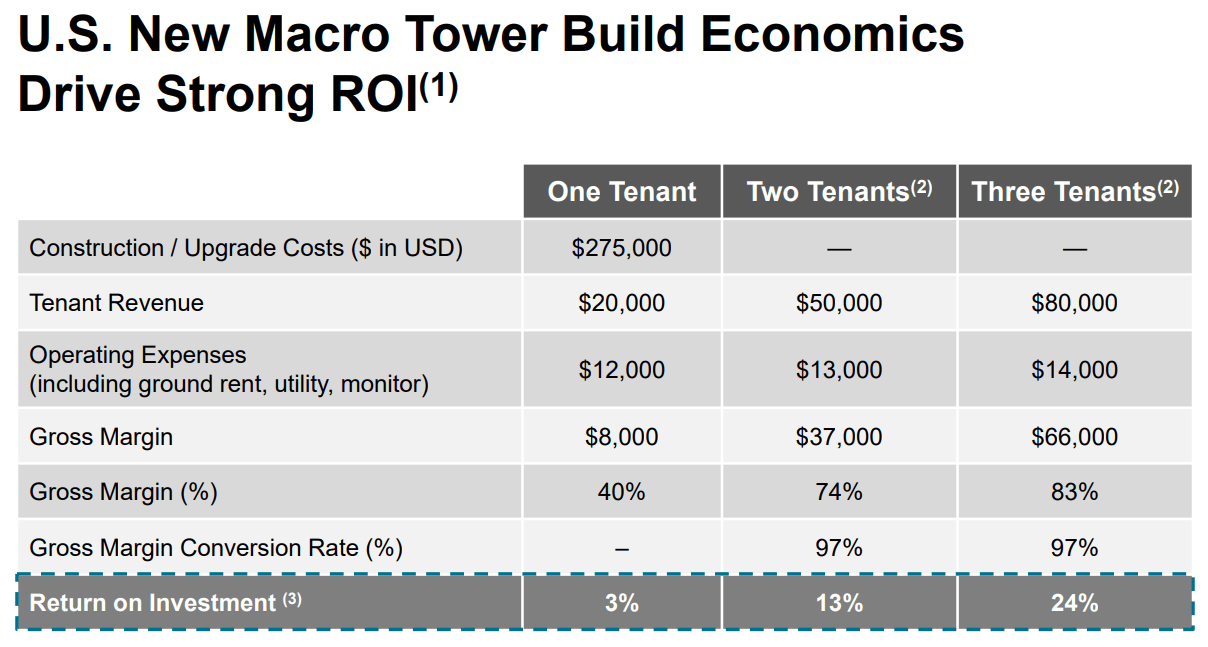

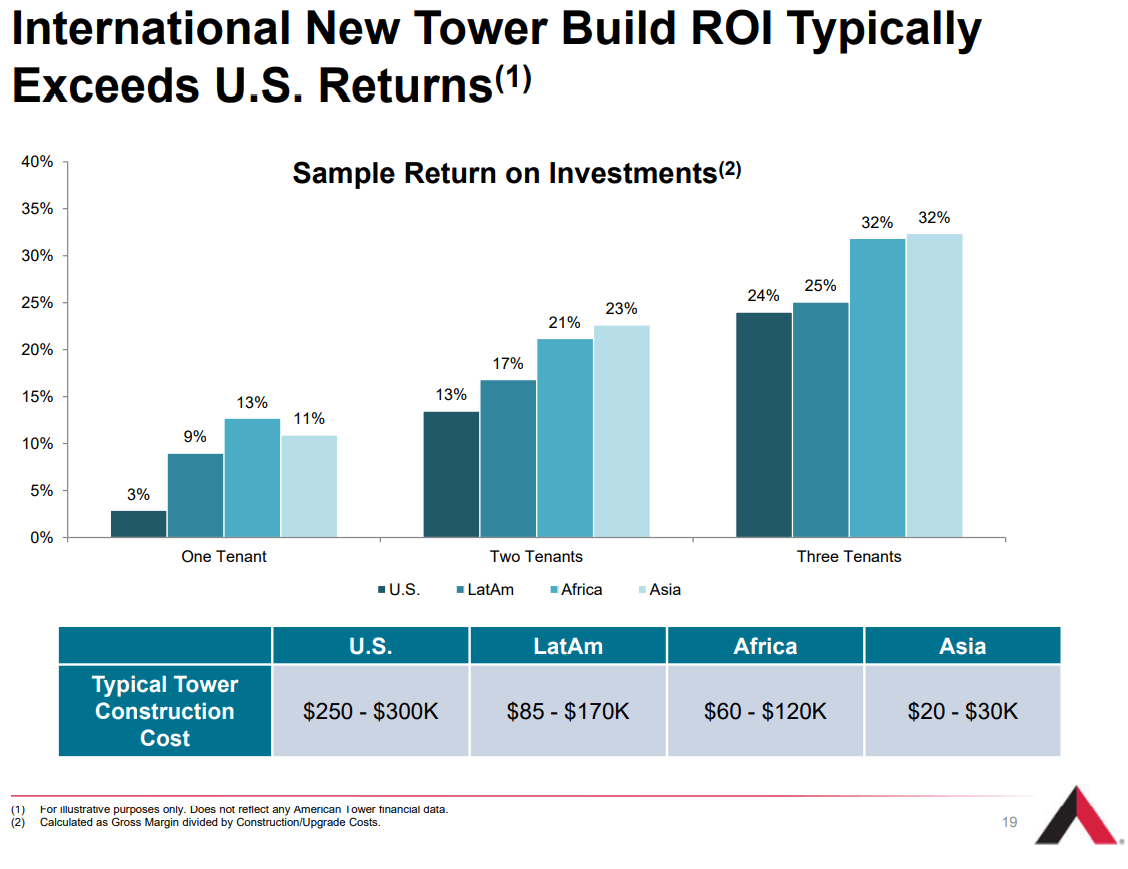

When we see healthy contract duration and significant escalators built-in, it signals strong demand driving consistent growth. However, towers are a bit unique since the landlord can lease out space on the same tower to several tenants. The following slide demonstrates the economics with a sample transaction: Source: AMT

Source: AMT

Costs hardly increase when additional tenants are signed. It may seem strange that the first tenant has lower rent, but AMT says that the anchor tenants on build-to-suit towers usually have a lower rent level. The yield on international tower assets is even higher: Source: AMT

Source: AMT

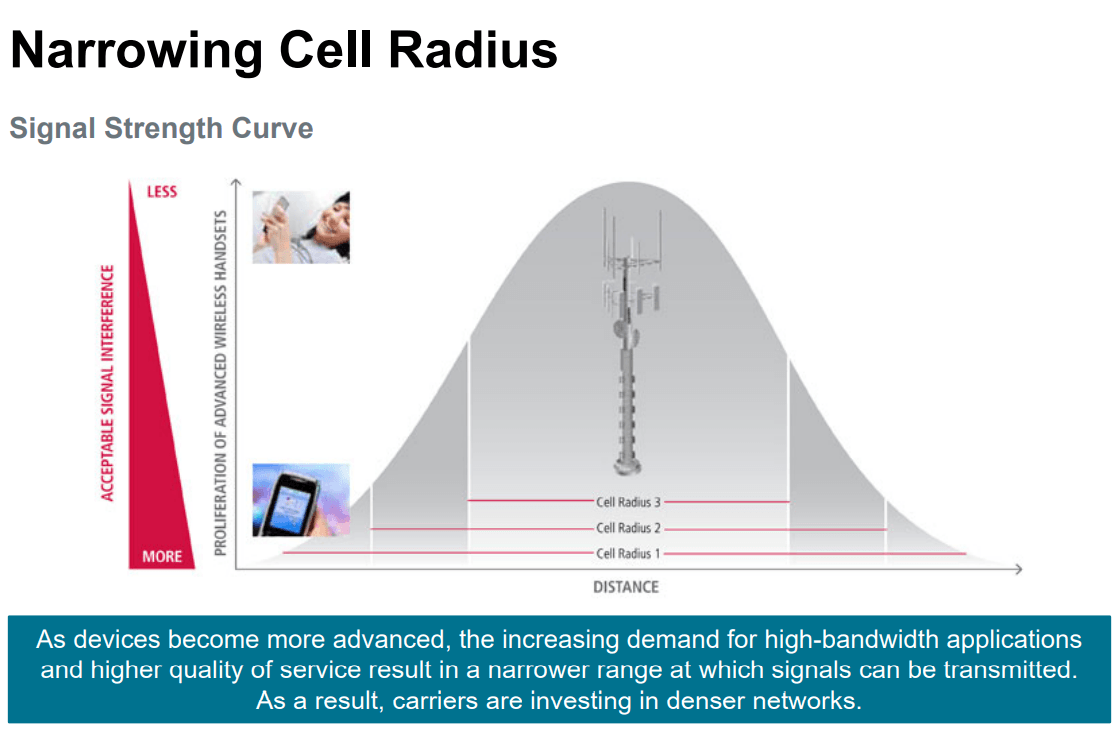

Adding additional tenants is the factor that can drive returns on any given project dramatically higher. Tenants still need to expand their networks, because they (wireless carriers) are acquiring more customers and those customers expect more data faster. To provide faster data, the carriers need even more sites because the faster connection covers a shorter distance: Source: AMT

Source: AMT

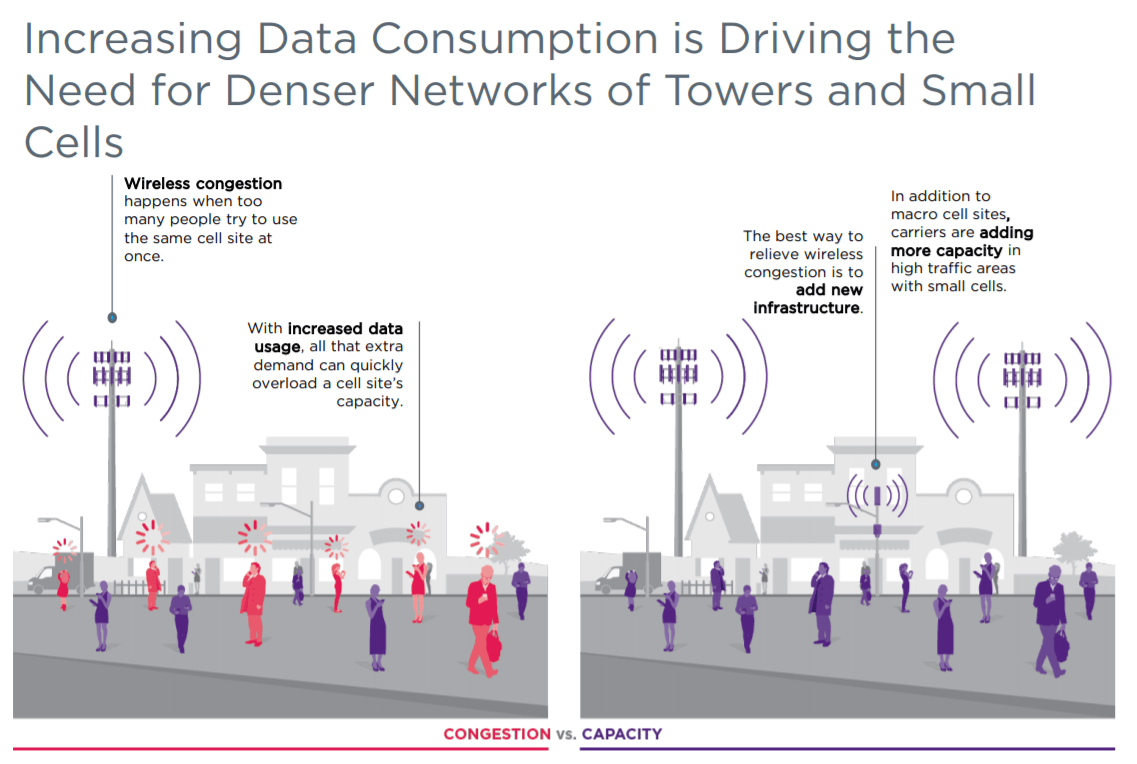

The combination of more customers and more data per customer can lead to congestion, even when a tower is available nearby: Source: CCI

Source: CCI

Competitive Advantages Over Smaller Operators

Remember that the economies of scale are dramatic. That applies in several ways. The first is that more tenants on any given tower make it dramatically more profitable. The second is that a landlord with only a few properties would be in a terrible situation if they only had one tenant on each property. Diversification is a substantial advantage in being able to build and finance more towers. The third is that a large network, which is very appealing to carriers, will generally involve some debt financing. The huge REITs can get access to dramatically cheaper debt than a smaller operator would be able to access. That leaves more of the NOI (Net Operating Income) for shareholders.

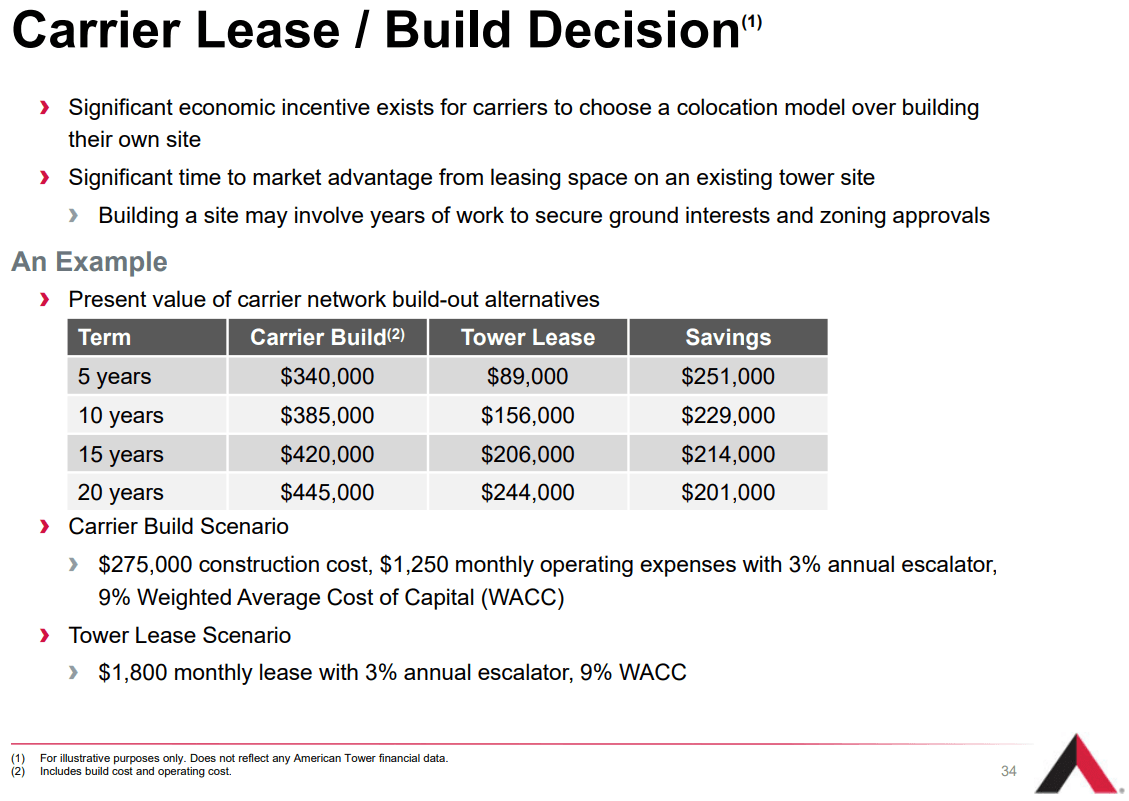

Finally, we need to point out that leasing space makes sense for the tenant as well. Remember that the original yield on a tower with only one tenant is very low. Major carriers signing leases with each other produces anti-trust issues. So that leaves tenants deciding if they should lease space or build a tower by themselves. AMT demonstrates the math: Source: AMT

Source: AMT

As an analyst, I appreciate the company applying the same 9% WACC to both scenarios. There are too many instances where a company would try to “improve” the numbers by changing the rates between scenarios. AMT demonstrated this clearly. This is precisely why the tenants want the REIT to own the assets.

Proven History of Delivering Growth for Shareholders

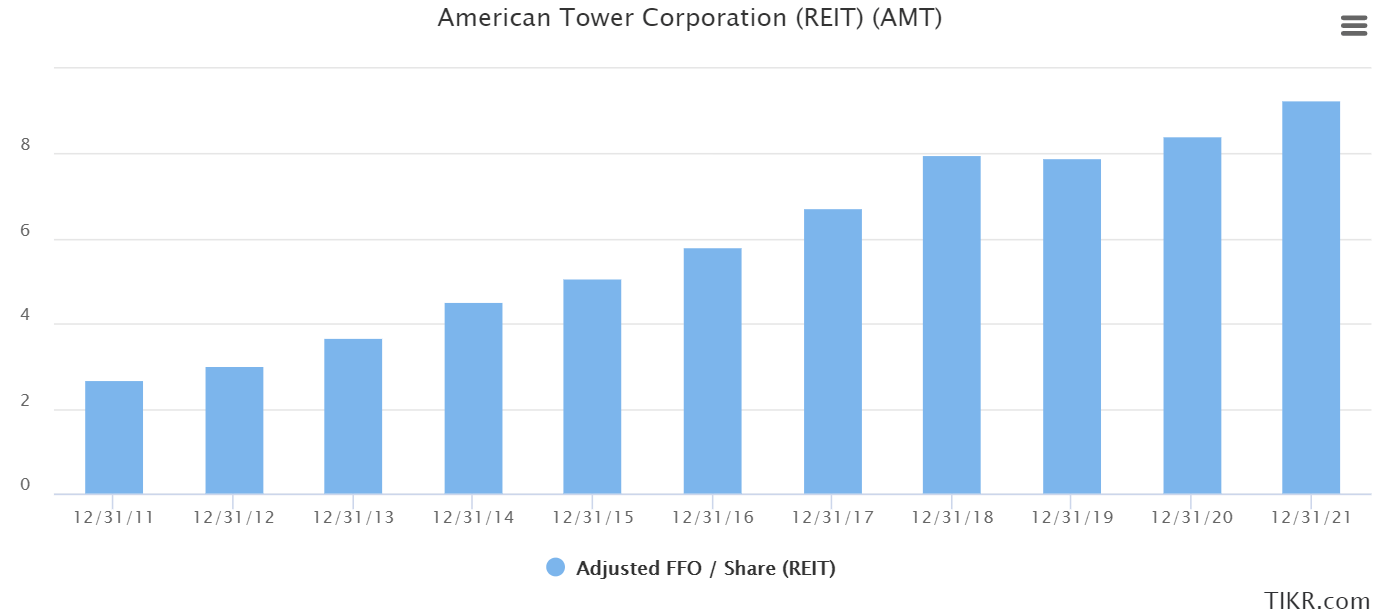

When we talk about an equity REIT delivering growth for shareholders, one of the first metric we should be looking at is the growth in AFFO per share. So we can start with evaluating that for AMT:

Clearly, AFFO per share has grown substantially. The growth rate dipped, but it is expected to recover. We would note here that there are some short-term headwinds such as the T-Mobile (TMUS) merger with Sprint. That’s not an overwhelming factor. It’s merely a headwind. Some consolidation in the international markets (such as India) also creates a bit of a short-term headwind. However, we expect it to blow over. At NAREIT, AMT’s CFO said:

Clearly, AFFO per share has grown substantially. The growth rate dipped, but it is expected to recover. We would note here that there are some short-term headwinds such as the T-Mobile (TMUS) merger with Sprint. That’s not an overwhelming factor. It’s merely a headwind. Some consolidation in the international markets (such as India) also creates a bit of a short-term headwind. However, we expect it to blow over. At NAREIT, AMT’s CFO said:

I'll now make a couple of comments on international, Ric. So in the international business, the way to think about that is our model is very similar internationally that it is in the U.S. One noticeable difference is we do expect, and we've seen the international markets on average grow a couple hundred basis points faster than the U.S. That's primarily because their technologies are a good 5 years behind us, kind of on average. It differs in certain places, maybe even longer in terms of behind us in other places like India and parts of Africa.

But we do see that extra growth there in the U.S. business, and certainly -- I mean, in the international businesses. And certainly, prior to the consolidation that we experienced in India, that's exactly what we were seeing, our international business as a whole growing faster than our U.S. business. We are looking forward to a recovery in India in terms of continuing to see the churn rates come down following the consolidation that has happened in that market. But the India market really is looking structurally very good, has 3 commercial carriers, 1 government-backed carrier. And we do see double-digit growth there. We also continue to see elevated churn, but we've seen that come down. We expect that to continue to come down. So we are on track here to recover in India. And then I think you'll see across our international business, that growth rate being a couple of hundred points ahead of what we see in the U.S. business.

Source: S&P Global Market Intelligence Transcript

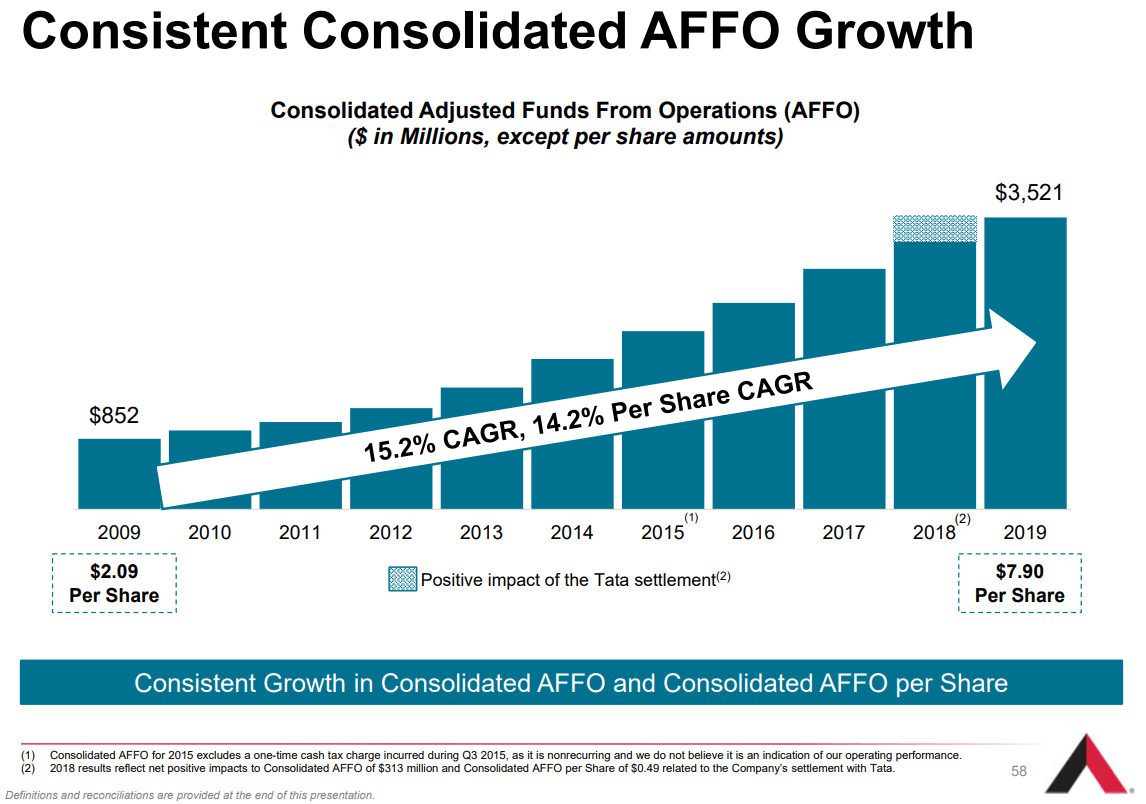

Investors may notice that the numbers appear to grow rapidly up until 2018, then dip slightly. Well, that’s a bit of an issue with “AFFO”. In this case, we want to pull another slide from AMT to demonstrate the non-recurring impact that caused 2018 results to be so far out of line:

Source: AMT

The positive impact of the Tata settlement enhanced AFFO in 2018 and caused the metric to be far less comparable between periods. We don’t expect a 14.2% growth rate to be sustained, but it doesn’t need to be. Even a much lower growth rate would still be sufficient to make any of these tower REITs a great long-term choice.

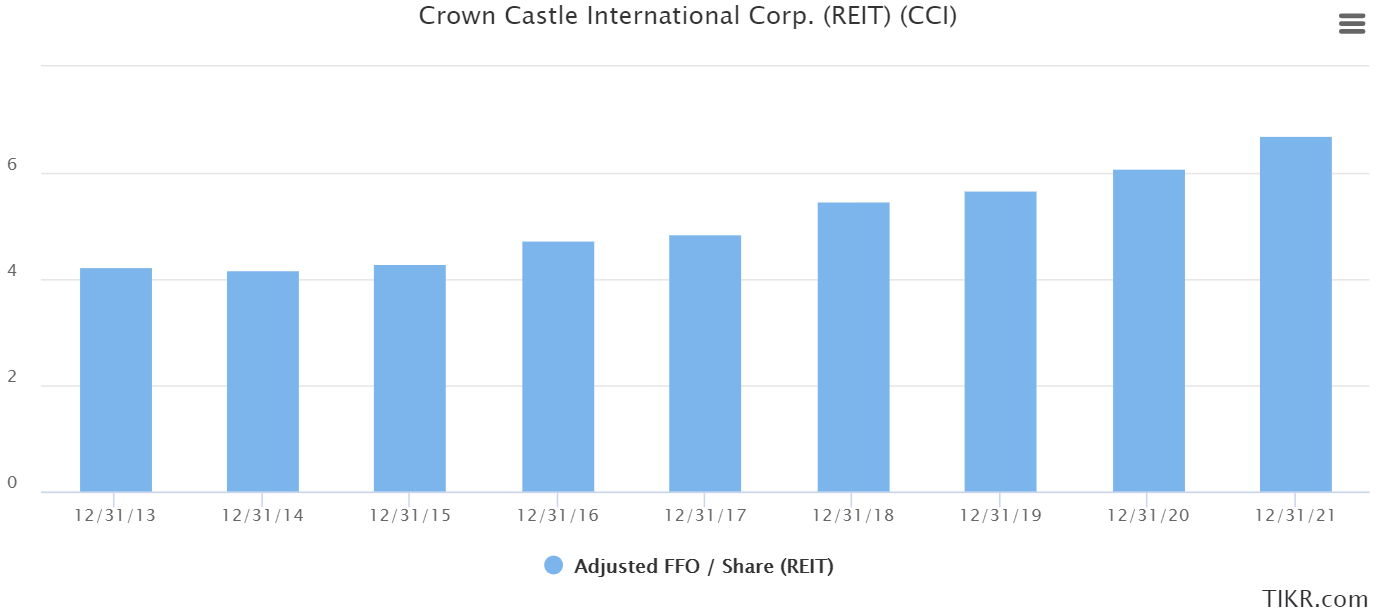

We can see that CCI was also successful in growing AFFO per share:

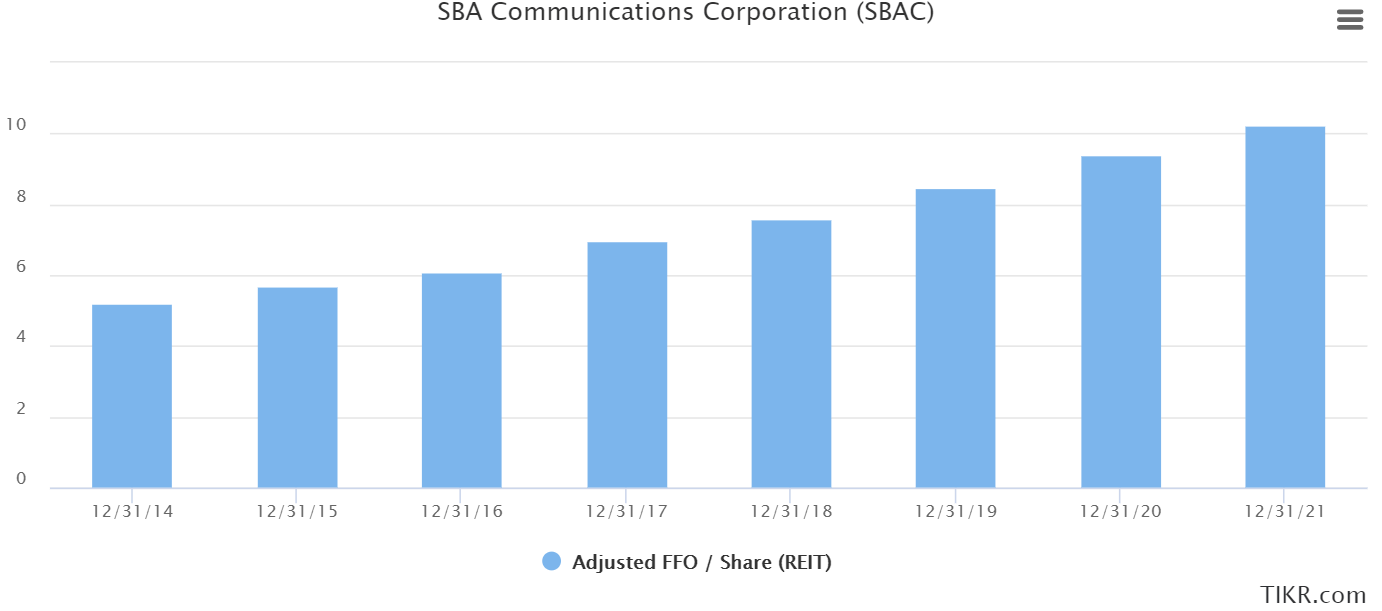

Finally, growth for SBAC was exceptional:

When we see strong growth across the three major REITs, it reflects a healthy industry with solid demand. However, as malls have demonstrated, we must also carefully consider our expectations.

Expectations

We expect demand for towers to continue because we expect consumer demand for data to continue increasing rapidly. Experts on mobile data consumption clearly support that premise: Source: AMT

Source: AMT

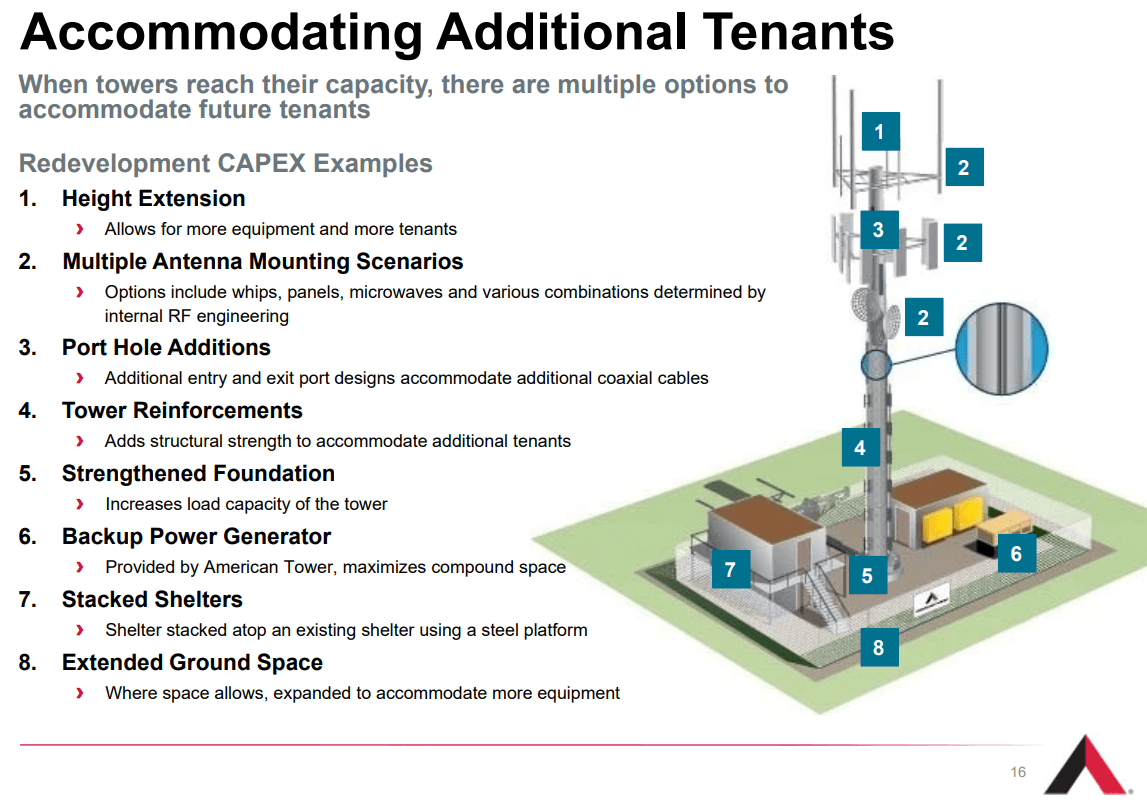

The recent projections suggest a 32% compound annual growth rate through 2025. So how can the tower REITs accommodate the growing demand? They can respond by expanding existing tower sites and building additional sites. AMT demonstrates the process for expanding an existing site to accommodate additional tenants: Source: AMT

Source: AMT

It is important to understand that AMT doesn’t really pay for everything. The tenant "gets to" own many physical assets:

Source: AMT

That’s a great business model. It takes the vast majority of the maintenance capex burden off the REITs hands. The REIT acquires the land (or rights to use it) and places their tower so tenants can rent space.

As a reminder, typical "maintenance capex" would involve projections like building a new roof or repaving a parking lot. The term refers to an expenditure (a cost) that is "capitalized". It is short for "capitalized expense". That means the cost goes onto the balance sheet as an asset, rather than flowing through the income statement as an "expense".

This is one area where amateur analysts often clam up. Many of the "sucker yield" REITs struggle with very high maintenance capex.

Another term for "maintenance capex" is "recurring capex".

Low Maintenance Capex

CCI estimates that they need to spend about 1% of revenue on maintenance capex. Some of the tools we use suggest the value might be higher, perhaps even past 2%. However, some capex will fall into a grey area where professionals can reasonably disagree about which portion is recurring. While 1% to 2% may sound like a big difference (doubling!), it just isn’t. Many other types of real estate see this burden above 10% and potentially as high as 20%. In most real estate types, 2% of revenue is easily within the margin for error on estimates. For instance, we might estimate that the value should run between 9% and 14% for a REIT in another sector. That would be a window of 5%, whereas CCI is looking at something closer to 1% to 2% in capex.

Conclusion

The tower REITs will primarily appeal to dividend-growth investors. The emphasis isn’t on getting a high yield today. Instead, investors are looking for a reasonable price (or better) on a property type with excellent long-term fundamentals and strong management in place. They should expect these REITs to often trade at high multiples of AFFO per share, but they deserve high multiples because of high growth.

For more of our research, please see The REIT Forum.

Disclosure: I am long AMT, CCI.