A Canadian REIT That Screams Buy Me

TM editors' note: This article discusses at least one penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Summary

- Today, I will introduce you to another Canadian REIT that looks promising.

- The defensive grocery-anchored model is more appealing to investors due to the growing threat of e-commerce businesses.

- Slate Retail's AFFO payout ratio is one of the lowest of all the Canadian REITs.

- Slate may not be a bad place to park capital (7.4% dividend) while the company gains scale and becomes more attractive to Mr. Market.

Last week, I wrote an article on WPT Industrial (TSX:WIR.U) (OTCQX:WPTIF), a Canadian REIT that focuses exclusively on U.S. industrial real estate. Like most Canadian REITs, WPT pays a monthly dividend (6.4%) and has more debt than most U.S. REIT counterparts (WPT's debt to GBV is 50.8%).

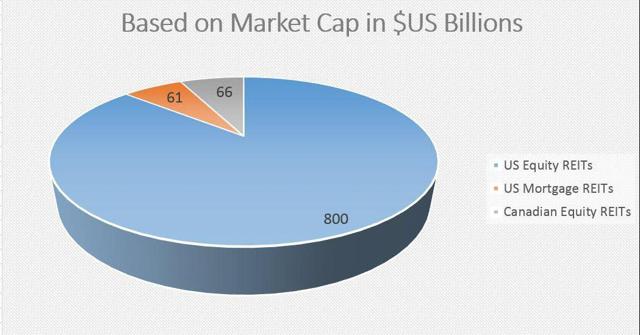

As I informed my newsletter subscribers (in the April edition), I plan to increase my research on Canadian REITs as there are around 50 companies (north of the border) and the market cap for the Canadian REIT sector is under 10% the size of the U.S. Equity REIT sector.

(click to enlarge)

While WPT has risks (noted in my previous article), I believe the REIT could be valuable for a dividend investor as the income appears safe and the shares are undervalued. Like any investment, one must weigh the risks and returns to determine if the specific security has a place setting.

Today I will introduce you to another Canadian REIT that looks promising. This company is similar to WPT Industrial as it also focuses exclusively on U.S. assets, while shares can be purchased in both Canada and the U.S.

A Pure-Play Grocery-Anchored REIT

Slate Retail REIT is listed on the Toronto Stock Exchange (SRT.UN) and shares can also be purchased in U.S. dollars (SRT.U). This Toronto-based REIT made its debut as a public company on April 22, 2014 and its formation was the combination of several existing companies: Slate U.S. Opportunity (No. 1) Realty Trust, Slate U.S. Opportunity (No. 2) Realty Trust, and U.S. Grocery Anchored Retail (1A), (1B) and (1C).

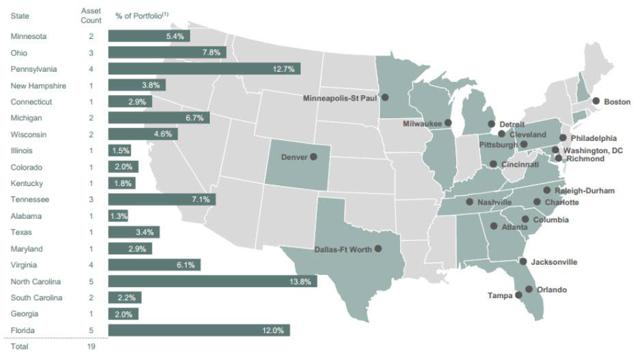

The new company is a pure-play, grocery-anchored REIT that commenced with 29 properties (across 14 U.S. states) and as of the latest quarter (Q4-14) Slate owned 41 properties in 19 states.

Slate Properties Inc., which owns a roughly 10% interest in the new REIT, will continue as the asset manager for the company and its portfolio. The properties are predominantly located on the East Coast with around 66% of leasable area located in large U.S. markets with over 1 million population.

(click to enlarge)

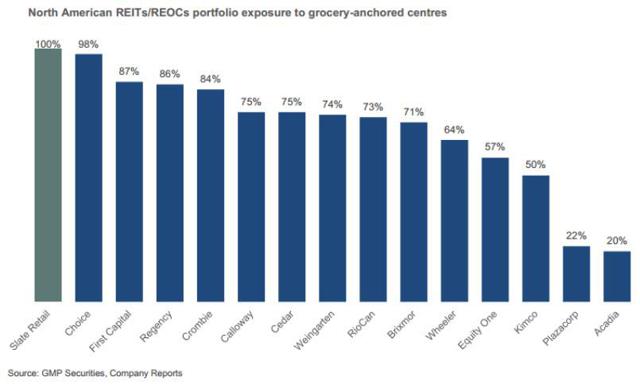

Slate ONLY invests in grocery-anchored centers and the company believes that "offers attractive characteristics in a volatile investment landscape." Several other REITs focus on grocery-anchored investments because of the non-cyclical model that defends against economic fluctuations.

Also, the defensive grocery-anchored model is more appealing to investors due to the growing threat of e-commerce businesses. Among North American peers, Slate is the only REIT with 100% grocery-anchored assets.

(click to enlarge)

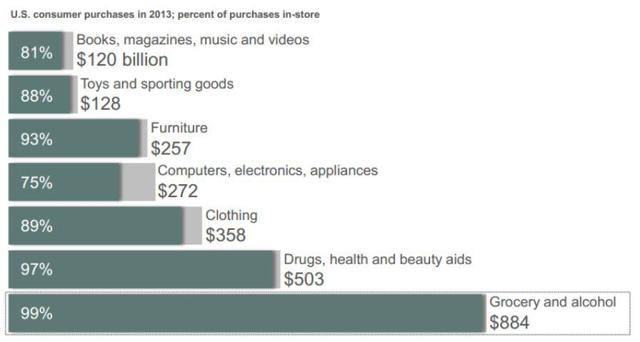

The value proposition for Slate is directly correlated to an inflation hedged strategy in which investors are betting on stable cash flow with embedded growth. Grocery retail is a defensive asset class, least threatened by the spread of e-commerce (99% of purchases remain in-store). The chart below illustrates U.S. consumer purchases in 2013 as a % of purchases in-store:

(click to enlarge)

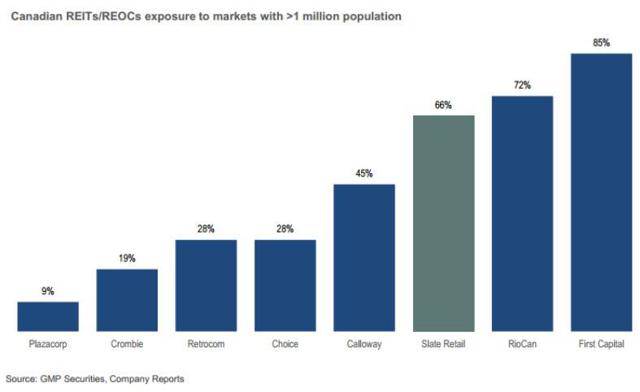

Slate also ranks high among Canadian REITs/REOCs in exposure to major urban markets.

(click to enlarge)

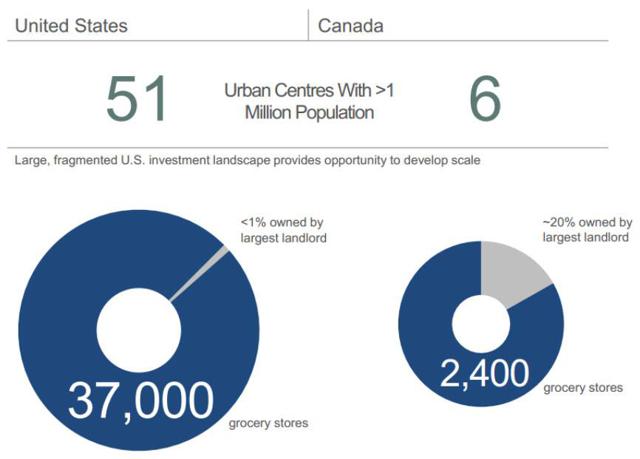

The U.S. economy is improving (that's why rates will soon be rising) and Slate has opted to focus on U.S. markets where there is significant growth. As illustrated below, the U.S. market is highly fragmented and provides a broad landscape of opportunity to develop scale.

(click to enlarge)

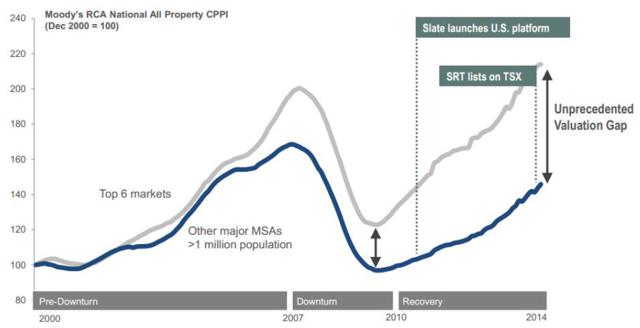

As the chart below illustrates, Slate targets high-quality assets with mis-priced characteristics. There's significant opportunity for well-financed players in non-major markets.

(click to enlarge)

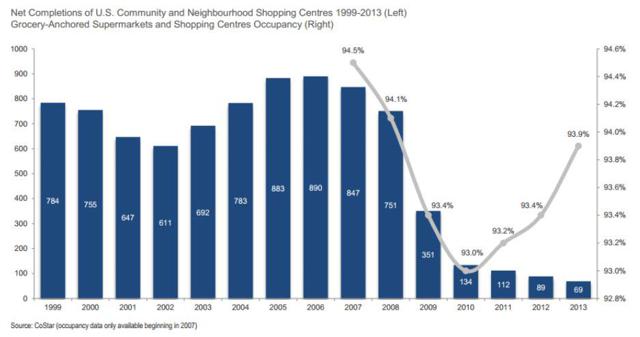

Since 2006, there has been an approximate 92% drop in the delivery of new U.S. shopping centers. (Note: I will be attending the ICSC ReCon Shopping Center conference in May interviewing many leading REIT CEOs).

(click to enlarge)

Slate's tenant base includes many leading brands such as Wal-Mart, Super Valu, Kroger, and Publix. One RISK worth noting is that Bi-Lo (operating as Bi-Lo and Winn-Dixie), Delhaize (operating as Food Lion), and Roundy's (operating as Pick'n Save) are weaker operators that generally don't command the same foot traffic as Publix and Albertsons.

As a result, a weaker store draws weaker small shop tenants that could make for higher volatility and increased tenant turnover. While I have not looked at Slate's portfolio in great detail, the characteristics of 10% exposure with Food Lion/Bi-Lo seems to be elevated and I would like to see that exposure reduced (and perhaps increased with higher quality anchors like Publix).

(click to enlarge)

Portfolio Performance

Now that we've identified Slate's investment thesis, let's take a closer look at performance. As noted (above), the grocery-anchored strategy is sound and here's how the company describes its acquisition criteria (source: latest investor presentation):

- Target properties available at a discount-to-peak and/or replacement value

- Located in large U.S. markets with sustainable/improving population and employment characteristics

- Anchored by a top grocery retailer with an established sales and profitability

- Situated in well-developed sub-markets with limited risk of new development

- Accretive to AFFO on a per unit basis

Although Slate has only been public for a few quarters, the company has been active on the acquisition front - having acquired or committed to acquire 16 properties (increasing leasable area by around 50%).

(click to enlarge)

Continue reading on Seeking Alpha.

Disclosure: The author is long O, DLR, VTR, HTA, STAG, CSG, GPT, ROIC, HCN, OHI, LXP, KIM, TCO, DOC, UDF, EXR, HST, BRX, WPC, HCP, CLDT, MPW, APTS.

more