6 REITs Boosting Dividends In October

I maintain a database of about 140 REITs to track yields and dividend growth rates. I take this information and then search out those REITs that have histories of paying dividends and have increased their FFO enough to support a dividend increase. Out of the 140 I track, these six have the best chances of seeing dividend increases in the coming month.

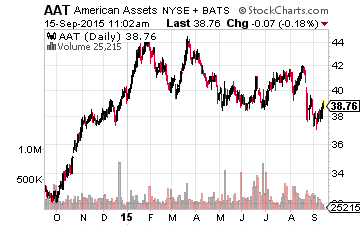

American Assets Trust, Inc (NYSE:AAT) has a $1.7 billion market cap and the company owns a mixed portfolio of retail, office, and multi-family properties. Company headquarters are in San Diego. The portfolio focuses on high-barrier-to-entry markets in Southern California, Northern California, Oregon, Washington, and Hawaii. AAT launched with a January 2011 IPO. The dividend has been increased by about 5% each of the last two years with the announcement coming at the end of October or in the first few days of November. Second quarter FFO per share was up 13% compared to a year earlier. The current dividend rate is 53% of management’s 2015 FFO guidance. AAT yields 2.4%.

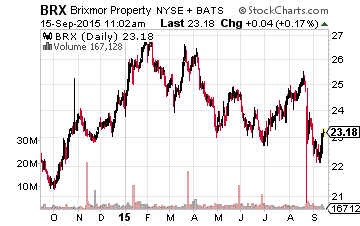

Brixmor Property Group Inc (NYSE:BRX) is a $6.9 billion market cap company that owns grocery store anchored community and neighborhood shopping centers. BRX came to market with an October 2013 IPO. After one year, the company increased its dividend rate by 12.5%. The new dividend rate was announced at the end of October last year for a January dividend payment. BRX currently yields 3.9% with a 47% payout ratio of the FFO for the last four quarters.

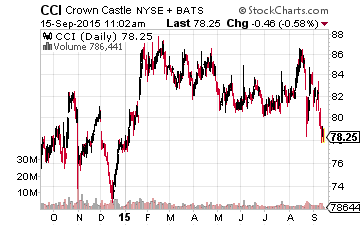

Crown Castle International Corp (NYSE:CCI) owns and leases out cell phone towers. The company has a current market cap of $26 billion. The company converted to REIT status effective January 1, 2014. In late October last year, a new dividend rate was announced with a 134% increase over the previous dividend amount. The October announcement is for the dividend paid at the end of December. The current dividend rate is 77% of 2015 AFFO guidance, which is forecast to be 6% higher than the AFFO per share generated in 2014. A dividend increase of 5% to 6% seems to be in the cards. CCI currently yields 4.2%.

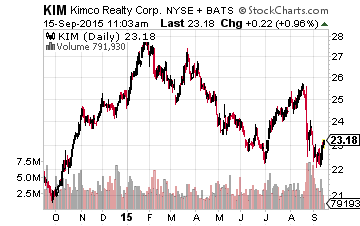

Kimco Realty Corp (NYSE:KIM) owns and operates neighborhood and community shopping centers and has a $9.5 billion market cap. The company claims that its 1991 IPO initiated the modern REIT era. Coming out of the 2007 – 2008 financial crises and recession, Kimco has increased its dividend every year since 2010 with an 8.4% compound annual growth rate. The coming dividend to be paid in January is announced near the end of October. The current dividend is 60% of trailing FFO per share. KIM currently yields 4.2%

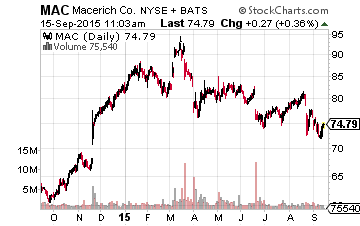

Macerich Co (NYSE:MAC) is an $11.75 billion market cap REIT engaged in the acquisition, ownership, development, redevelopment, management, and leasing of regional and community/power shopping centers. Coming out of the last recession, MAC has increased its dividend every year since 2010. Last year, the dividend was bumped up by 4.8%. The new dividend rate is announced on about October 23 or 24 to be paid the first week of December. MAC currently yields 3.5%.

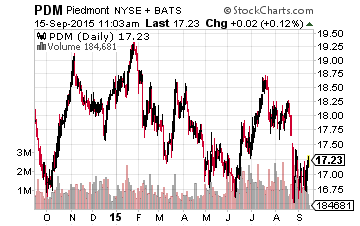

Piedmont Office Realty Trust, Inc.(NYSE:PDM) is a $2.6 billion market value REIT that acquires, owns, and manages Class A office buildings. On October 29, 2014, the company announced its first dividend increase in its seven-year history as a public company. Be aware that the dividend was reduced by 36% at the beginning of 2012. The dividend rate was increased by 5% last year and the new dividend was paid the week before Christmas. The current dividend rate is 52.5% of 2015 core FFO per share guidance per share. The guidance represents an 8% increase in FFO for 2015 over 2014. PDM yields 4.9%.

These REITs have the potential for share price gains when the new dividend rates are announced. The information provided here gives you some basics to start your own research. Make sure you take a closer look at any of the covered companies before buying shares.

You could collect an average of $3,268 in extra monthly cash with a new dividend payout system for income investors. And ...

more