4 Stocks To Buy For A Lifetime Of Increasing Dividends

As a cash flow and income focused stock investor, I really don’t get the market valuation of Amazon.com, Inc. (NASDAQ: AMZN). The stock trades at close to 500 times earnings per share and has always had an extremely high share value compared to its net income. However, Amazon has become and continues to grow as a major force in retail sales.

I personally would not buy into the sky-high valuation that Amazon trades at, but I do want to participate in the market dominance of the business and earn a return through auxiliary investments. I have dug around and found a few options where investors can participate in the Amazon story and earn an attractive dividend income stream without overpaying.

I think we are all familiar with what Amazon does. It is the online marketer of a tremendous variety of products. The sales of those products require a robust Internet website and back end electronic services to process orders. The company then needs warehouses and shipping facilities to make sure the ordered items get quickly delivered to the buyers. Part of the issue with profitability at Amazon is the continued capital spending required to build the infrastructure needed to support an ever growing stream of orders and sales. Another growth offering is Amazon Web Services (AWS), which has become the largest public cloud solutions provider.

Income focused investors can participate in the Amazon story through real estate investment trusts (REITs) that provide facilities and services to Amazon or that help other companies work with the Amazon systems. Data center REITs own facilities where companies can either install their own data storage and communication platforms or they can have those services included in their lease agreements. This REIT subsector has been a hot place to invest compared to the entire group of stock market sectors and subsectors. The data center REITs can host AWS cloud service computers and they also provide global inter-connectivity for the companies that use AWS for their cloud storage needs. Two REITs have focused their offerings to support Amazon Web Services.

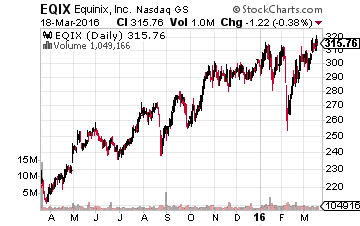

Equinix Inc (NASDAQ: EQIX) with a $22 billion market cap is one of the largest data center companies with 145 facilities located across the globe. In mid-2015, Equinix converted to REIT status, so investors should start to see more emphasis on dividends and dividend growth. In February 2016, the company increased its quarterly dividend by 3.6%. In its 2016 guidance, Equinix forecasts that adjusted funds from operations (AFFO) will grow by 17% in 2016. Since AFFO is the cash flow out of which companies pay dividends, investor can expect mid-teens payout growth going forward. EQIX currently yields 2.2%.

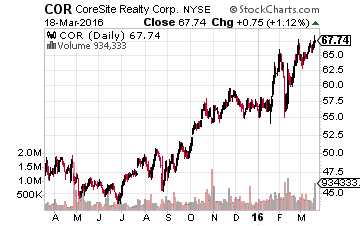

CoreSite Realty Corp (NYSE: COR) is a smaller, $3.2 billion market cap data center REIT that offers AWS Direct Connect service to its customers. CoreSite went public in 2010 and has grown its dividend by an average of 45% per year. The dividend rate was increased by 27% in December 2015. Management’s 2016 guidance has FFO growing by at least 20% this year. COR yields 3.2%.

It is obvious that Amazon needs a tremendous amount of warehouse space. In those facilities the company stores its own inventories, inventories of third-party sellers on Amazon and completes its order fulfillment services. While Amazon currently owns the majority of its warehouse and fulfillment centers, the company also leases space from a few industrial property sector REITs.

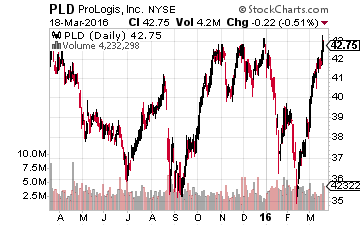

Prologis Inc. (NYSE: PLD) with a $22 billion market value is the largest industrial REIT. The company focuses on providing facilities for logistics services. In a recent presentation it was noted that e-commerce fulfillment services require three times the square footage compared to traditional storage and shipment of retail goods. E-commerce sales are forecast to double in the next five years. While it represents a small percentage of Prologis total revenues’s, Amazon is the REIT’s largest customer. Prologis has steadily grown core FFO per share and its dividend by an average 10% per year for the last five years. PLD yields 3.9%.

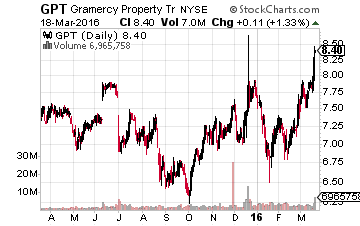

Gramercy Property Trust (NYSE: GPT) is a $3.5 billion diversified REIT that owns industrial, office, and specialty real estate assets. Amazon is Gramercy’s largest client in its industrial property portfolio, which is about one-third of the total asset portfolio. In late 2015, Gramercy completed a merger with a similar sized REIT. Now larger, the company is selling and buying properties to generate a more stable growth profile. Look for the dividend to start to grow later in 2015 or early 2016. GPT yields 5.3%.

The industrial REITs offer possible upside if Amazon decides to monetize some of its owned warehouse assets. Owning warehouses is not the most efficient use of capital for an e-commerce company like Amazon. It would be a big positive for the REITs listed above if Amazon wanted to sell a warehouse… or 50.

Disclosure: There are currently over twenty of these stocks to choose from in my more